ASML Holding NV (ASML) Semiconductor Sovereign: Roadmap to New Highs

Why fundamentals and Fibonacci are flashing green.

ASML Holding NV, the sole supplier of next-gen EUV lithography, sits at the heart of the global semiconductor boom. With a fortress balance sheet, 25% net margins, and unrivaled pricing power, its fundamentals are bulletproof. Yet even the strongest business needs the right price to buy—and that’s where technicals come in.

Key Takeaways

Fundamentals: Stellar top-line & margin growth, world-class cash flow, net cash position.

Technicals: A corrective pullback into key fibs & moving averages; watch €672 & €697 zones.

Plan: Accumulate near €672/653; add on €697; targets €740→€783→€850.

This analysis pulls together ASML’s rock-solid financials, real-time price action, and market context—helping you navigate your next entry or top-slice with confidence.

A factory’s output is only as good as its machines – and ASML builds the world’s most advanced.

Fundamental Analysis

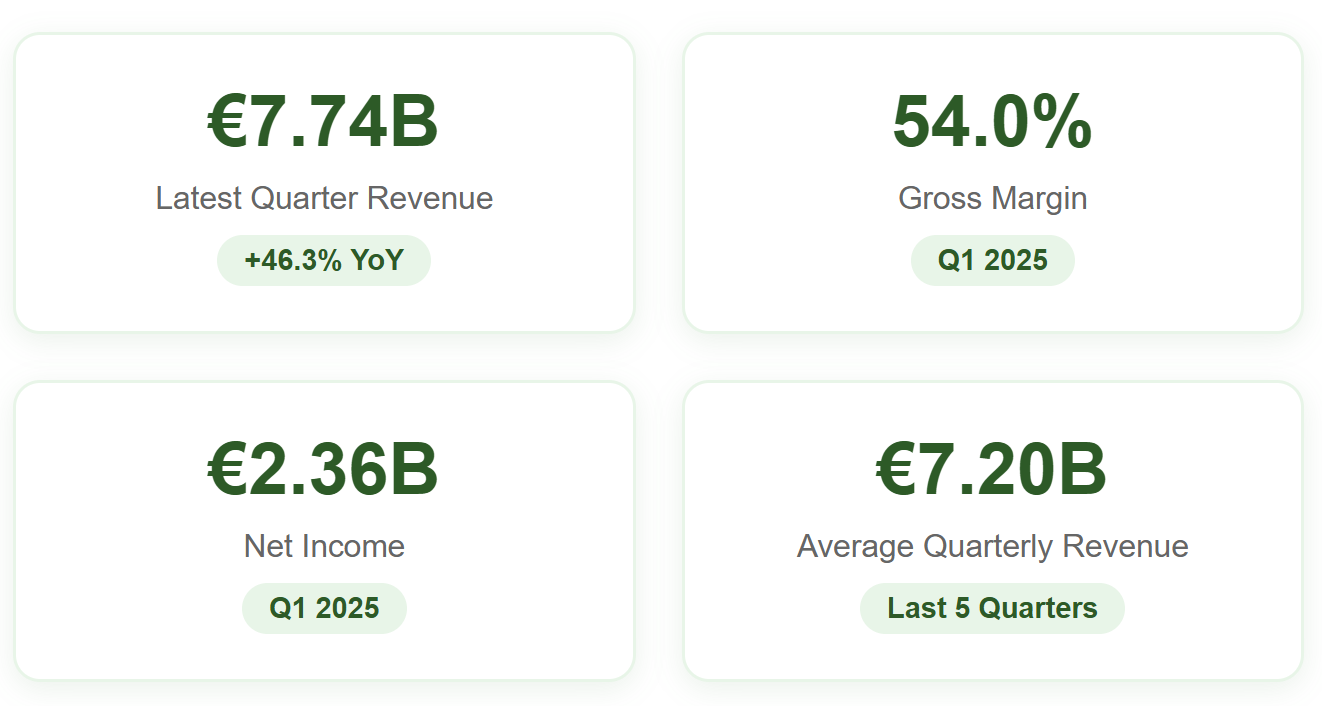

Revenue & Growth

2024 Sales: €28.0 B (+15% YoY)

Analyst Forecasts: Consensus sees revenues of €32 B by 2026 (≈12% CAGR). Growth fueled by next-gen EUV system deliveries and robust service revenues.

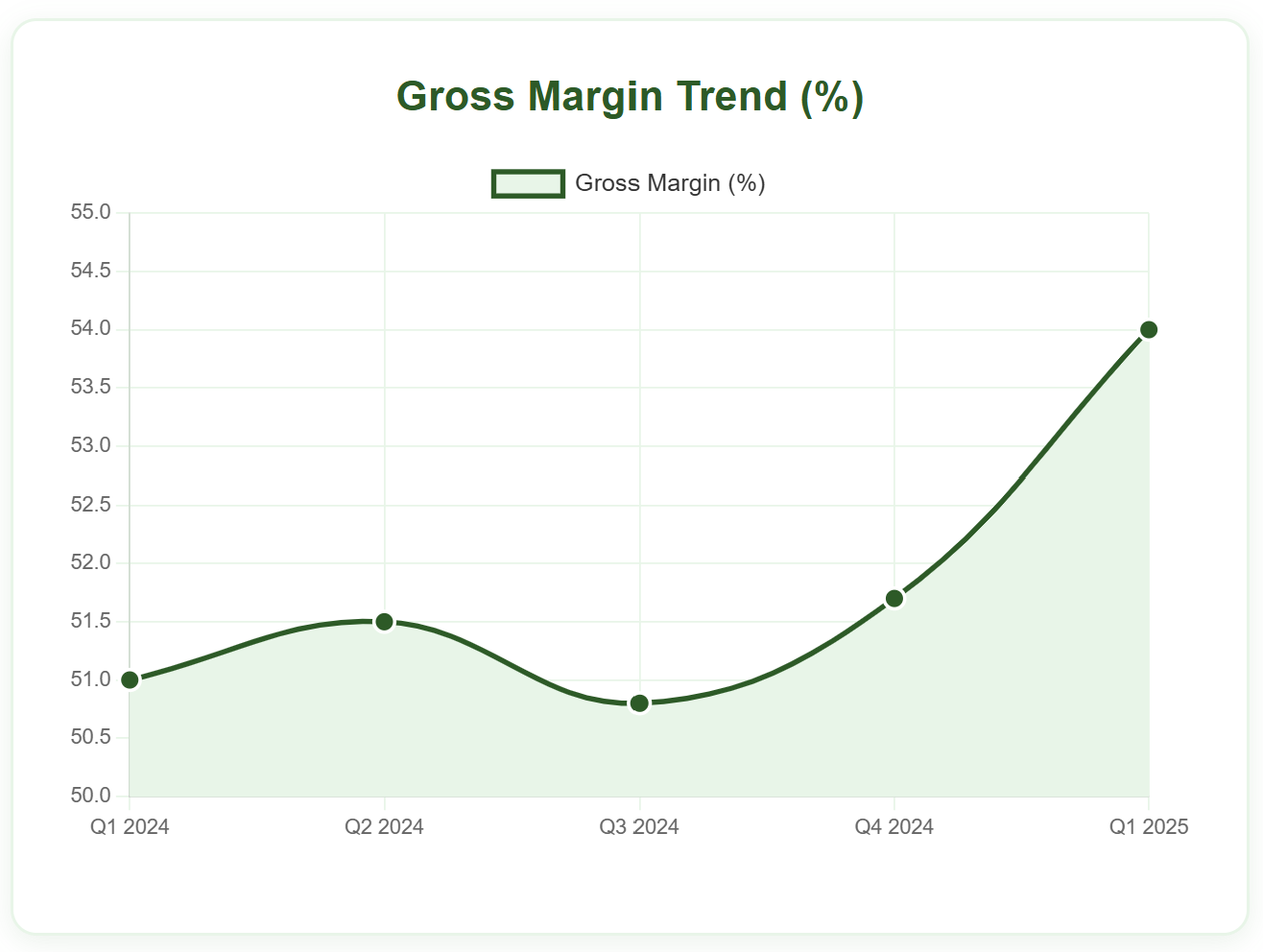

Profitability

Gross Margin: ~55%

Operating Margin: ≈30%

Net Margin: ~25%

ASML consistently outperforms peers on margin, thanks to technological leadership and high-value service agreements.

Balance Sheet & Cash Flow

Net Cash: +€4 B (no net debt)

Current Ratio: 2.2x

FCF (2024): €7 B (+20% YoY)

CapEx: €4 B, focused on R&D and fab expansion.

Pristine liquidity and free cash flow cushion dividend increases (yield ~1.2%) and share buybacks.

Valuation

P/E (’25 est): ~25x

EV/EBITDA: ~18x

PEG: ≈1.6

Premium valuation justified by oligopoly status in EUV lithography and secular chip-making tailwinds.

Catalysts & Risks

Catalysts:

Rising EUV adoption in logic & memory nodes.

Growing service/upgrade revenue streams.

Chinese equipment backlog unwind.

Risks:

Geopolitical export controls.

Cyclicality in cap-ex spending.

Tech shifts to alternative lithography (still years away).

Fundamental Conclusion:

ASML remains a cornerstone semiconductor equipment franchise—combining durable revenue growth, stellar margins, robust cash flow, and a fortress balance sheet. Its valuation premium is well-earned, given its near-monopoly in EUV.

Buying value is only half the battle, knowing when price aligns is key.

Technical Analysis

Daily Chart Highlights

Recent Range: €520 → 710 (April–June)

Fibonacci Retracement (May→June):

0% (swing low): €671.8

38.2%: €697.9

50%: €706.0

61.8%: €714.1

78.6%: €725.6

Key Moving Averages:

50-DMA: 645 (green)

100-DMA: 653 (blue)

200-DMA: 671 (red)

Current Price (Jun 29): €682.5

Price Action:

Rejected at ~78.6% fib near €726.

Now consolidating just above 200-DMA (€671) and daily 0% swing low.

2-Hour Chart Fine-Tuning

2-Hour Fib (Jun high→late-Jun low):

23.6%: €680.6

38.2%: €686.3

50%: €691.8

Intraday Edge:

A push above €686–687 unlocks €691–699.

A drop below €680 opens the door to €672.

Pivot & Extension Zones

Bull Targets:

1. €697 (38.2% daily)

2. €714 (61.8%)

3. €740 (full retrace)

4. €783 (1.618 ext.)

5. €850 (2.618 ext.)

Bearish Triggers:

Break €672: retest 100-DMA (€653) → 50-DMA (€645) → 1.618 fib ext. (~€596).

Technical Conclusion:

ASML is in a corrective phase after a powerful rally. A firm hold above €672 (200-DMA/swing low) favors a resumption of the uptrend. A break below that flips the short-term bias bearish.

Stack on weakness, trim on strength.

Our Investment Plan

Long-Term Investment (3-12 months):

Buy Zones: €672–€653 (200/100-DMA confluence).

Add: on reclaim of €697–€706.

Stops: below €645 (50-DMA).

Targets:

€740 (swing high)

€783 (1.618 extension)

€850 (2.618)

Short-Term Trade (2-6 weeks, 2-Hour Chart):

Entry: €682–686.

Stop: €672.

T1: €697.

T2: €706.

Trade Approach Brief

Long-term buy zone: €672–653; stop < 645; targets 740, 783, 850.

Swing trade: entry €682–686; stop 672; targets 697, 706.

Buy quality on weakness, and let the business’ strength carry you higher.

The Bottom Line

ASML sits at the epicenter of the semiconductor revolution, with unrivaled EUV technology, robust secular growth, and rock-solid cash flows, its fundamentals provide a rare margin of safety. Technically, the recent pullback into the €672–€653 zone offers an attractive entry point; a successful hold here, followed by a reclaim of €697–€706, sets the stage for a multi-leg rally toward €740 and beyond. Conversely, a decisive break below €672 would warrant caution, pointing toward deeper retracements.

In short, buying ASML on weakness, around key moving averages and Fibonacci supports, combines the power of a world-class franchise with disciplined risk management. Whether you’re a long-term investor hunting for asymmetric upside or a swing trader seeking tactical entries, ASML’s blend of fundamental resilience and clear technical thresholds makes it one of the most compelling opportunities in semiconductors today.

In the semiconductor arms race, owning the lithography leader at the right price could be your best play on the next leg up.