CoreWeave vs Nebius: Building the Brains of AI

CRWV & NBIS: Two infrastructure builders, one market reset

In the race to power artificial intelligence, compute is the new gold. Data centers are the mines, and companies like CoreWeave (CRWV) and Nebius (NBIS) are the miners, wiring together GPUs, power, and cooling at a pace that leaves most peers behind.

The past two weeks, though, reminded investors that even the strongest AI narratives can hit a wall. CoreWeave has dropped 38.8% in 14 days. Nebius has fallen 30% in nine. Both reported earnings that beat expectations, yet the market didn’t care.

That disconnect tells us something deeper: we’ve entered a phase where execution, cash flow, and delivery timelines matter more than headlines.

Let’s break it down.

Key Takeaways

The AI infrastructure boom isn’t slowing, but capital is getting more selective.

Both companies beat EPS estimates, yet their stocks sold off hard, signaling investor focus on liquidity, margins, and capex digestion.

CoreWeave shows scale, profitability at the EBITDA level, and a huge backlog, but carries heavy debt and negative free cash flow.

Nebius has smaller revenue and wider losses, yet runs a cleaner balance sheet with net cash and long-term hyperscaler contracts.

Technically, both charts remain in corrective phases, short-term oversold, but no confirmed reversal yet.

Pipelines, Environment, and Growth Drivers

AI infrastructure demand remains strong and visible. Training large models, expanding inference workloads, and serving enterprise AI tools require enormous GPU clusters.

Both companies are positioned in the middle of that wave.

CoreWeave’s backlog now exceeds $55 billion, doubling quarter-over-quarter, anchored by long-term contracts with names like OpenAI. These aren’t speculative deals; they’re consumption agreements that will convert into revenue as new capacity comes online.

Nebius recently secured a $17–19 billion compute deal with Microsoft and another $3 billion multiyear contract with Meta. Together, those two relationships provide multi-year visibility, a rare commodity in a cyclical industry.

The limiting factor isn’t demand. It’s capacity: power, GPUs, and data-center delivery. Both companies face the same bottlenecks, power interconnects, transformer lead times, and permitting timelines.

Macroeconomically, rates are stabilizing, but financing remains expensive. With 10-year yields hovering near 4.5–4.7%, highly levered operators (like CoreWeave) are more exposed to debt-service costs, while net-cash players (like Nebius) have flexibility to expand without near-term refinancing pressure.

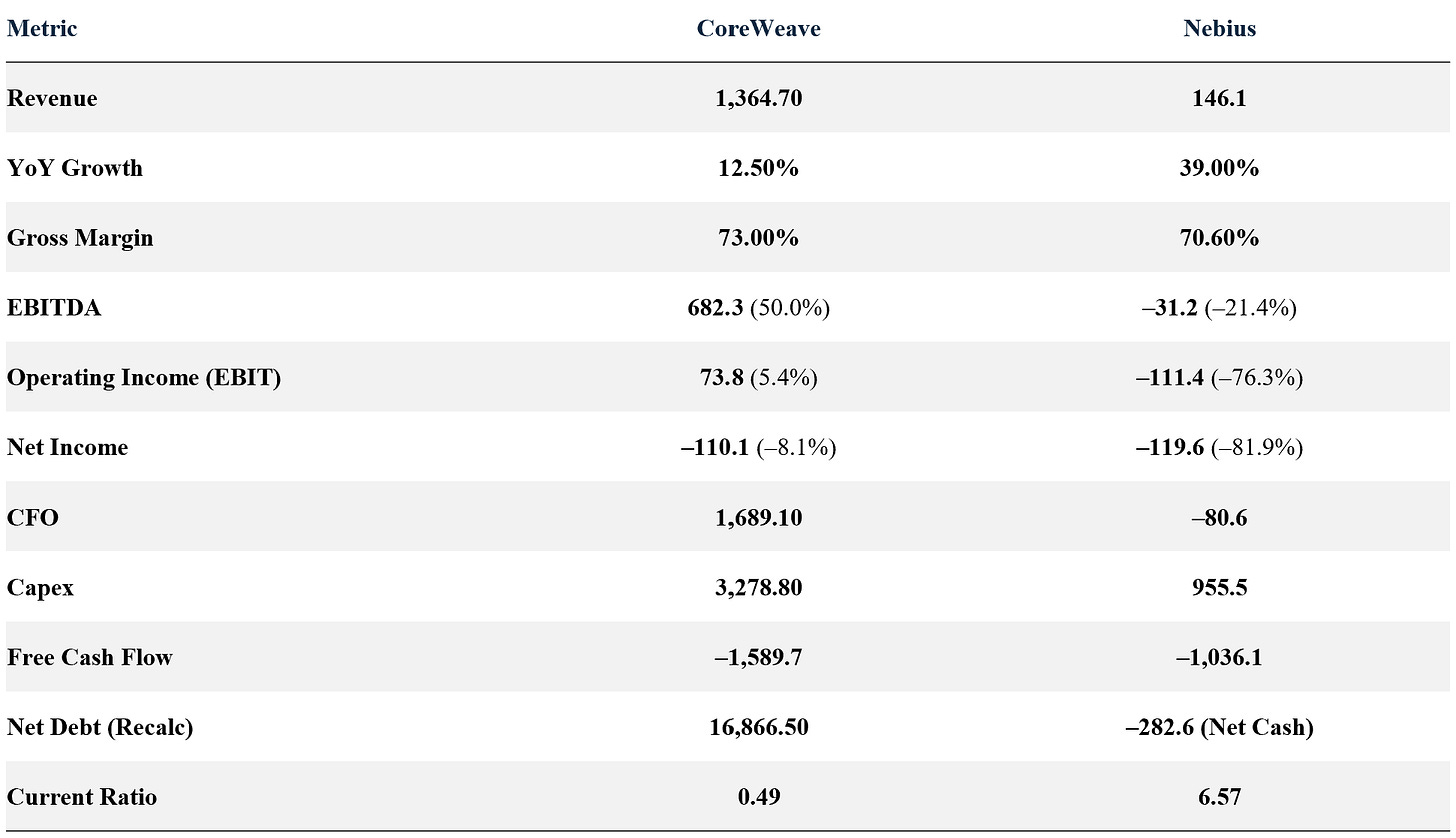

Fundamental Analysis

CoreWeave’s scale gives it enviable gross and EBITDA margins, but it’s burning cash at a fast clip to build capacity. Debt is heavy, liquidity thin, and timing of free-cash-flow inflection will determine valuation.

Nebius is smaller and less efficient today, but its liquidity cushion and net-cash position give it breathing room to execute its massive hyperscaler contracts. It’s still in the investment phase; negative EBITDA is the cost of capacity ramp.

Post-earnings reality

On Nov 10, CoreWeave beat EPS by 79% and revenue by 6%, yet the stock dropped nearly 40%. The market’s message: growth is priced in, balance-sheet leverage and guidance matter more now.

On Nov 11, Nebius beat EPS by 28% but missed revenue by 5.8%. Investors punished the top-line miss even though margins improved. In a capacity-build business, revenue acceleration is what validates the model.

Technical Analysis

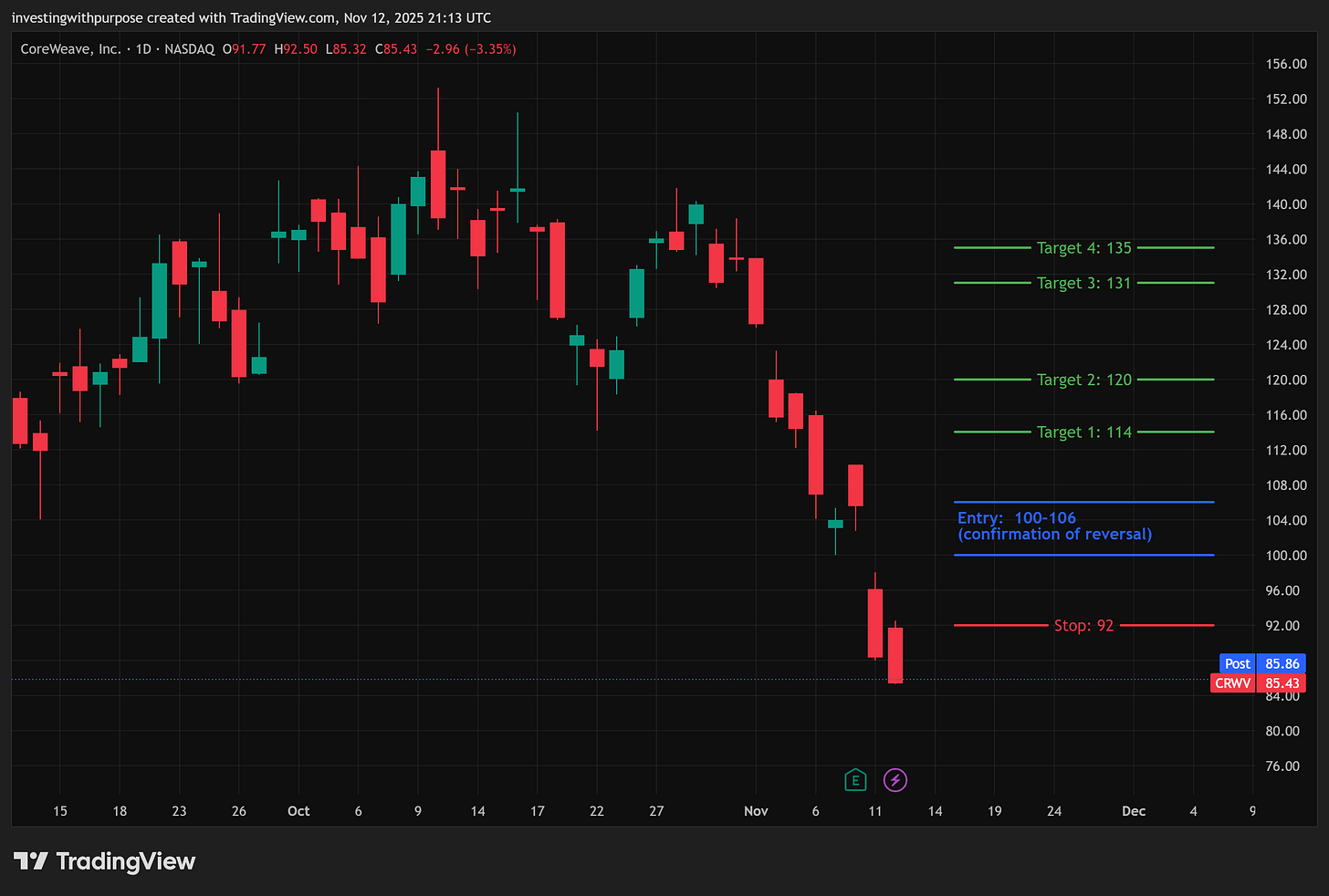

CoreWeave (CRWV)

Trend: Clear downtrend. The daily chart shows price far below the Ichimoku cloud and the 20/50/100/200 EMAs. Momentum remains bearish with no crossover confirmation yet.

Momentum: RSI is deeply oversold (below 30). MACD remains negative with widening distance between signal lines, momentum favors continuation rather than reversal.

Structure: The breakdown through $97 invalidated the prior base. The next key Fibonacci extension aligns near $69, with resistance at $106, $114–120, and $131–135.

Read: Oversold, but still falling. Any bounce is tactical until a daily close above the 20-EMA reestablishes control.

Nebius (NBIS)

Trend: Still in correction after a large run-up. Price is testing the 100–200 EMA band, a typical zone for trend resets.

Momentum: RSI in the upper-30s, approaching oversold but not extreme. MACD near a potential crossover, hinting at slowing downside.

Structure: Key support sits around $84, deeper support near $70 if pressure continues. Resistance layers near $104–110, then $120–126, followed by $130–135.

Read: Down but not broken. Watch for a higher low to confirm stabilization.

Sector & Macro Lens

Both names sit inside the broader AI infrastructure ecosystem, where growth depends on capital intensity, power access, and semiconductor supply.

Industry pulse:

Data-center capex among hyperscalers remains strong. AWS, Microsoft, and Google each guided to higher infrastructure spend into 2026.

GPU supply constraints remain through mid-2026, benefiting operators who already secured allocations.

Electricity costs have become a competitive factor, with states offering incentives for clean-energy data-center development.

Macro: If inflation continues to ease and rates stabilize, funding costs for these capital-heavy builds will fall, a key tailwind.

Trade Plan

CoreWeave (CRWV)

Entry: On a daily close above 100–106 (confirmation of reversal)

Stop: 92

Targets: 114, 120, 131–135

Note: Still in a downtrend; keep size small until it reclaims the 20-EMA. Avoid knife-catching below 97.

Nebius (NBIS)

Entry: Accumulate on dips into 90–96 or on breakout above 104

Stop: 83.5

Targets: 110, 120–126, 130–135

Note: Healthier balance sheet and support near 84. Watch for higher low before adding size.

Risk rule: Limit exposure to 1–2% of capital per trade. Take partial profits at first target, trail stops once price closes above the 20-EMA.

Bottom Line

AI infrastructure remains a secular growth story, but the market has shifted from storytelling to scrutiny. CoreWeave and Nebius are both builders of the digital backbone, yet they sit at opposite ends of the balance-sheet spectrum, one scaled but levered, the other smaller but cash-rich.

Their recent selloffs aren’t contradictions to the AI thesis; they’re reminders that in every capital cycle, there’s a digestion phase. If you believe in the long arc of compute demand, these corrections are where patience gets tested, and rewarded only when discipline meets timing.

Stay data-driven. Respect the trend. And remember: in markets like this, survival is a strategy.

This content is for informational and educational purposes only. It’s not financial advice or a recommendation to buy or sell any security.

Hey, great read as always. It's wild how the market's reaction feels a bit like my Pliates instructor saying 'form over flash' even when you nail a difficult pose. You're totally right that the focus is shifting to fundamentals, thouhg – seems like even with AI, long-term balance beats short-term hype every time.

solid analysis