E-Commerce Power Trio: AMZN, MELI, SHOP Who’s Best Positioned Into Earnings and the Holiday Quarter

Macro cross-winds, platform moats, and momentum: a side-by-side of fundamentals, key levels, and a simple trade plan

Digital commerce is no longer a single business model. It blends retail marketplaces, payments, logistics, advertising, and cloud infrastructure. That matters for investors because revenue quality, margin drivers, and cyclicality differ across Amazon AMZN 0.00%↑, MercadoLibre MELI 0.00%↑, and Shopify SHOP 0.00%↑. With earnings clustered around Oct 29–Nov 4 and the holiday quarter ahead, this is a timely check on what truly moves these stocks, what the numbers look like today, and where price is likely to react next.

Pipelines & environment

Industry: Internet & Direct Marketing Retail / Application Software, with embedded fintech and ads.

Demand drivers: consumer spending, mobile penetration, checkout conversion, seller tools, and ad monetization.

Cost drivers: logistics and fulfillment efficiency, compute/storage costs, last-mile density, and payment funding costs.

Competitive moats: network effects on buyers/sellers, proprietary fulfillment networks, ad platforms, and payments ecosystems.

Macro:

Rates and the dollar: higher real rates compress multiples and slow discretionary spend; a stronger USD pressures LatAm translations for MELI.

Labor and fuel: fulfillment and last-mile costs track wage inflation and diesel; easing supports margins.

AI and infra cycle: AWS reinvestment and ad tech improvements drive Amazon mix; capex intensity is high but returns are durable.

Seasonality: Q4 holiday uplift helps all three; inventory discipline and promotions set the margin tone.

Fundamental analysis

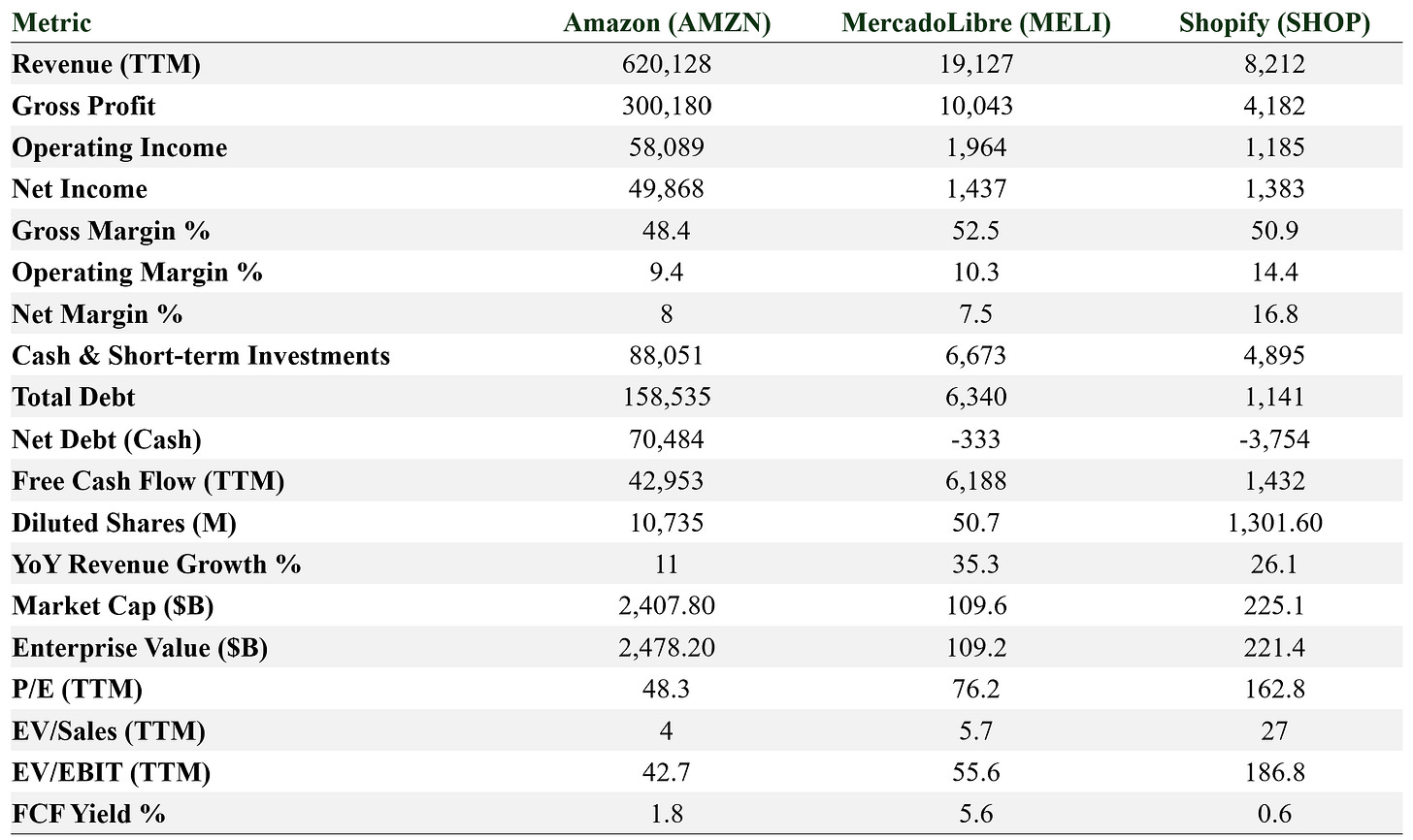

Key TTM fundamentals (USD millions, except ratios and shares)

Amazon (AMZN):

Scale efficiency and mix improvement are doing the heavy lifting. Ads and AWS now account for most of the incremental margin, with North America retail turning positive again. While valuation has crept up, Amazon’s reinvestment capacity and steady FCF ramp justify a long-duration premium.

MercadoLibre (MELI):

Still the cleanest high-growth compounder in emerging markets. Revenue up 35%, cash generation strong, and net leverage essentially nil. Payment margins and credit performance remain key watch points. Valuation isn’t cheap, but FCF yield north of 5% provides real support if LatAm macro stabilizes.

Shopify (SHOP):

The most asset-light of the three, and also the most richly valued. Operating leverage is impressive, margins are expanding faster than peers, but non-operating swings inflate GAAP net income. It’s a pure software growth story again post-fulfillment divestiture. Any stumble in revenue momentum could compress the multiple hard.

Relative take:

Amazon wins on scale and diversification.

MercadoLibre wins on organic growth and cash efficiency.

Shopify wins on margin acceleration and brand optionality, but at a steep valuation.

Technical analysis

Levels and indicators pulled from multi-timeframe setups.

AMZN

Daily Fib retrace shows support near 216 to 221 and intermediate resistance 236 to 246.

Extension targets line up at 251 to 257 (1.272–1.618 zone) and 264 above that if momentum persists.

Weekly trend intact; RSI mid-50s climbing, MACD curling up. Daily Ichimoku shows price working around the cloud base with a path to clear if it holds 221.

Read: constructive uptrend resumption as long as 215 to 221 holds on pullbacks.

MELI

Weekly retrace touched the 0.618 area near 2,076 and bounced; daily retrace shows 2,133 to 2,221 as first resistance band.

Momentum gauges on the 4-hour are hot; Stoch RSI in the 90s suggests near-term cooling is possible before a larger move.

Structural support 2,020 to 2,075; a daily close over 2,221 opens 2,367 to 2,493.

Read: higher-low attempt off major support; respect the volatility and FX sensitivity.

SHOP

Daily and 4-hour show a strong trend. Price reclaimed 0.786 at 150 and pushed to new local highs near 173.

Next measured moves: 175 to 176, then 184 and 194 on Fib extensions if momentum persists.

Pullback support 163 to 155; weekly trend remains up with MACD positive.

Read: leadership tone, but extended into earnings; expect fast moves both ways.

A simple trade approach that’s risk averse and strategic

Position sizing and risk

Use a max 2% portfolio risk per position. Convert that to shares by placing stops a bit below logical invalidation levels and sizing down.

Scale in with two entries: first at or just above support, second on confirmation over resistance or after a controlled pullback.

Entries, stops, and targets

AMZN:

Entry zone 221 to 224. Add on a clean break and hold above 236.

Invalidation below 215 on a daily close.

Targets 236, 245 to 251, then 257 to 264.

MELI:

Entry on dips toward 2,090 to 2,120, or on strength through 2,221 with volume.

Invalidation below 2,020.

Targets 2,267 to 2,367, then 2,493.

SHOP:

Momentum entry 171 to 173 with tight risk; add if it bases above 176.

Invalidation below 163 on a daily close.

Targets 184, then 194.

Earnings protocol

Into prints: either reduce size to half, or hedge with short-dated collars if available. For unsophisticated readers, the simplest rule is to cut position size by half before earnings and rebuy on trend confirmation after the report.

Use bracket orders around key levels and avoid chasing post-print gaps.

Time horizon

Swing framework over 2 to 10 weeks, aligned with the holiday quarter and January effect.

Bottom line

If you want balanced upside with improving earnings power, AMZN is the anchor. For higher growth with more volatility and FX risk, MELI is the satellite. For momentum with a premium multiple, SHOP works, but risk management is mandatory into earnings. Keep sizes sensible, respect the levels, and let the trend do the heavy lifting through the holiday quarter.

This content is for informational and educational purposes only. It is not financial advice or a recommendation to buy or sell any security.

Tags: Best e-commerce stocks to buy 2025, Amazon vs Shopify vs MercadoLibre, Q4 earnings preview Amazon Shopify MercadoLibre, valuation comparison e-commerce companies, how to trade earnings season safely, swing trading e-commerce stocks, macro trends in digital retail, growth vs value in online retail