CHAPTER 1: The Ocean Beneath the Charts

Imagine the market is an ocean.

Every price move is a wave. Traders get swept up, dragged under, or - if they know what to look for - ride it like a pro.

That’s the promise of Elliott Wave Theory.

It’s not about guessing every tick. It’s about spotting the structure beneath the chaos.

Impulse. Correction. Emotion. Psychology.

These waves repeat - over and over - because human behavior repeats.

NOTE ON DIRECTION: Bull or Bear?

Before we dive into wave types, here’s something most beginners miss:

Waves don’t always move up.

Elliott Wave describes trend structure- regardless of direction.

In a bull market, the 5-wave impulse is up, and the 3-wave correction is down.

In a bear market, the 5-wave impulse is down, and the 3-wave correction is up.

Same structure. Flipped psychology.

We’ll walk through both.

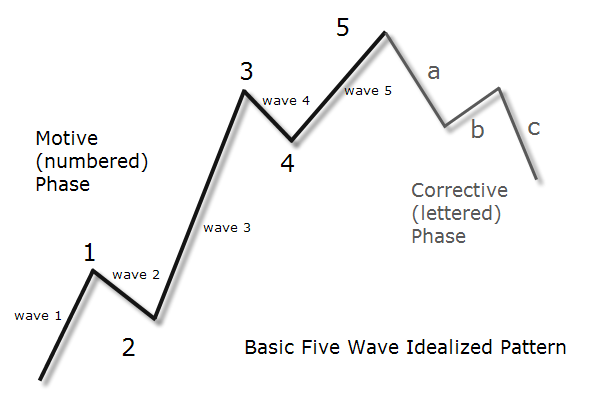

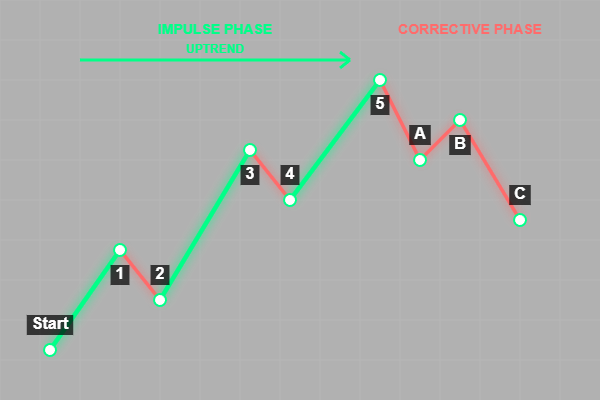

CHAPTER 2: The Impulse – 5 Waves of Emotion

The impulse is the core move—5 waves with the dominant trend.

In a Bull Market, it looks like this:

Wave 1 – The Spark

Smart money moves in. The market rises, quietly. Most traders ignore it.Wave 2 – The Doubt

Pullback. “Another fakeout,” they say. But price doesn’t break down.Wave 3 – The Explosion

Momentum surges. Fundamentals “improve.” Everyone jumps in.Wave 4 – The Pause

Choppy. Sideways. Traders get nervous. Weak hands exit.Wave 5 – The Euphoria

“This will never stop.” Volume fades. RSI diverges. But price pushes one last time.

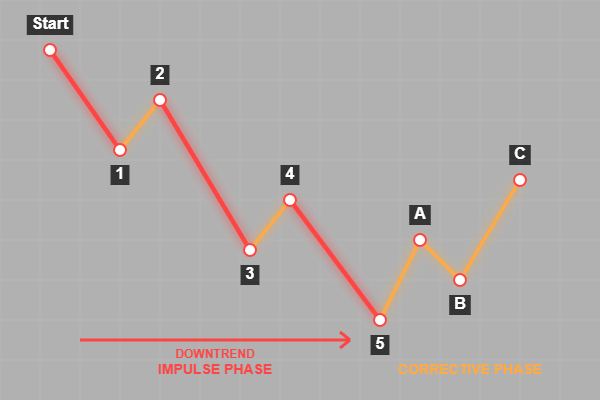

In a Bear Market, it’s the same emotions—in reverse:

Wave 1 – The Crack

Selling begins. Smart money exits. Few notice.Wave 2 – The Bounce

Hope returns. “That was the bottom.” It’s not.Wave 3 – The Panic

Broad selling. Bad news hits. Fundamentals now match price.Wave 4 – The Sucker's Rally

A sharp bounce. People want to believe. They get trapped again.Wave 5 – The Washout

Capitulation. Despair. No buyers left. Oversold… but no one cares.

CHAPTER 3: The Correction – 3 Waves of Psychology

After every 5-wave impulse, the market needs to breathe out. This is the A-B-C correction.

In Bull Markets (correction moves down):

Wave A – First hit. “Buy the dip” works… but it’s weaker.

Wave B – Bounce. “New highs coming!” But internals are weak.

Wave C – Drop. Pain. Stops hit. Then… stabilization.

In Bear Markets (correction moves up):

Wave A – The bounce. “The worst is over.”

Wave B – Pullback. Confusion. Still bearish sentiment.

Wave C – A sharp rally. Feels like recovery… but it’s just a breather.

CHAPTER 4: Fractals – Waves Within Waves

Elliott Waves are fractal.

Every wave you see contains smaller waves inside it. Zoom out, and you’ll find that same pattern repeating on larger timeframes.

A Wave 3 may contain 5 smaller waves.

That Wave 3 might itself be part of a larger Wave 1 on the weekly chart.

This is where Elliott becomes powerful - but also messy.

Example: Bitcoin 5 year chart

CHAPTER 5: Tools of the Wave Rider

Waves aren’t magic - they’re probabilistic. To trade them effectively, combine them with:

Fibonacci:

Wave 3 often extends 161.8% of Wave 1.

Wave 2 often retraces ~61.8%.RSI/MACD:

Use to confirm momentum in Wave 3.

Divergence? Could mark Wave 5 or C tops/bottoms.EMAs:

Wave 1 often breaks through the 21/55 EMAs.

EMA flips confirm trend transitions.

Use these tools to validate - not force - your wave count.

CHAPTER 6: Why It Works

Elliott Wave works not because price moves in waves…

…but because people move in cycles.

Fear → Hope → Greed → Complacency → Fear again.

The waves are just footprints of mass psychology.

They aren’t perfect. But they repeat - because we repeat.

CHAPTER 7: From Theory to Practice

Don’t get lost labeling every subwave.

Start simple:

Is the trend up or down?

Are you in an impulse or a correction?

Where’s the momentum?

Study past charts. Practice counts. Track them forward. Refine.

Takeaway

Elliott Wave won’t turn you into a psychic. But it will give you a map.

A way to anticipate structure. To spot the traps. To know when to push - and when to stay patient.

Because when you read the waves,

you stop fighting the market - and start riding it.