Europe’s Telecom Trifecta: 3 Cash-Flow Giants Setting Up for Breakouts As Wall Street Sleeps

With U.S. markets closed for Thanksgiving, these under-the-radar European telecom stocks are building some of the cleanest risk/reward setups

Introduction

Every day, most investors look at what’s moving the most in the U.S. market. Big tech headlines. AI narratives. Earnings reactions. Index flows.

But when U.S. markets go quiet, whether it’s a holiday, low-volume session, or late-stage market cycle, the real opportunity often shifts somewhere less crowded.

Europe is one of those places.

European telecom stocks sit in a part of the market that rarely gets attention: essential infrastructure businesses that throw off real cash, operate in regulated environments, and quietly benefit from exponential growth in data consumption.

They’re not story stocks, nor are they hype trades. These guys are more like cash-flow machines.

And right now, the three largest European telecom companies sit at very different stages of their cycle, offering three very different types of opportunity. We’re talking about Deutsche Telekom, Orange, and Vodafone.

Here’s how they compare, and where the best risk/reward sits today.

Deutsche Telekom DTE 0.00%↑ (Market Cap EUR 133 B)

Deutsche Telekom is a global telecom operator with deep exposure to the U.S. economy through its majority ownership stake in T-Mobile US.

That exposure has massively transformed the business. Where most European telecoms struggle with slow domestic growth, Deutsche Telekom benefits from faster-growing American wireless markets, scale advantages, and strong brand positioning.

The business itself is built on essential infrastructure: mobile networks, broadband, fiber deployment, and enterprise networking services. This creates a mix of defensive stability and international growth.

Deutsche Telekom trades more like a hybrid stock, part European defensive, part U.S. growth proxy.

Dividend yield: 3.6%

Orange ORA 0.00%↑ (Market Cap EUR 37 B)

Orange is far more than just France’s former state telecom operator. It’s one of the most deeply embedded infrastructure businesses across Europe, with expanding operations in Africa and the Middle East.

The company controls critical fixed-line, mobile, fiber, and enterprise infrastructure, making it closely tied to national digital strategies and government-backed connectivity priorities.

One of Orange’s biggest strengths is network quality and regulatory positioning. It often operates in less cut-throat competitive environments than consumer tech companies, which gives it stable pricing, predictable margins, and long-term infrastructure spending visibility.

It’s not a high-growth stock, but it doesn’t need to be. It’s built to survive and generate dividends.

Orange is a steady infrastructure compounder with low drama and reliable execution.

Dividend yield: 5.3%

Vodafone VOD 0.00%↑ (Market Cap GBP 22 B)

Vodafone spent years as a struggling legacy telecom business. That has changed.

Over the last few years, Vodafone has aggressively simplified its structure, sold non-core assets, reduced complexity, and focused on core network quality and operational discipline.

This strategic reset is beginning to show in both price action and fundamentals.

Unlike Deutsche Telekom and Orange, Vodafone is now behaving like a turnaround and momentum story. After breaking a multi-year downtrend, the stock has started to attract technical traders and longer-term investors at the same time.

The company is positioned to benefit from network modernization, enterprise connectivity, and rising data demand, while operating in markets that are slowly becoming more rational in terms of competition.

Vodafone is now a recovery and momentum play, not just a utility stock.

Dividend yield: 4.2%

Fundamental Analysis

Deutsche Telekom (DTE): Scale and cash machine at a discount.

Scale and growth: Roughly €121bn TTM revenue with low single-digit growth – a classic, mature incumbent rather than a high flyer.

Profitability: TTM operating margin ~25% and FCF margin ~24%, which is unusually high for telecoms, helped by scale and integrated infrastructure.

Balance sheet: Debt / total capital ~47%, a solid but not extreme level for an infrastructure-heavy telco.

Shareholder returns: About 3.6% dividend yield with strong FCF coverage, leaving room for capex and buybacks.

Valuation vs peers:

Trades on roughly 11x trailing P/E (vs peer average of 13.4x) and ~13.6x forward P/E.

EV/EBITDA ~6.9x, in line with global telco majors.

Fair value estimates hover around €34.2 vs ~€27.7 spot, implying roughly +24% upside.

Big, cash-rich, moderately levered incumbent, priced like a boring bond proxy but with real upside to intrinsic value.

Orange (ORA): Higher yield, solid operations, less cheap.

Scale and growth: About €40bn TTM revenue, growing at low single digits with fairly steady topline.

Profitability: TTM operating margin ~10% and FCF margin ~8% – decent but clearly below Deutsche Telekom on efficiency.

Balance sheet: Debt / total capital ~51%, a bit more geared than DTE but still reasonable for the sector.

Shareholder returns: Around 5.3% dividend yield, making it the top income play in this trio.

Valuation vs peers:

On the expensive side on earnings: ~41x trailing P/E, reflecting one-offs / depressed earnings, with a forward P/E ~17.8x, closer to peer average.

P/B ~1.3x and P/S ~0.9x, so not expensive on asset/sales metrics.

EV/EBITDA ~5.9x, slightly cheaper than DTE on cash-flow multiples.

Fair value estimates hover around ~€15.2 vs ~€14.1 spot, suggesting single-digit upside (~8%).

Healthy incumbent with good cash generation and a strong dividend. Not cheap on earnings, but attractive for yield-focused investors.

Vodafone (VOD): Turnaround story with strong FCF.

Scale and growth: Around €33bn TTM revenue with mid single-digit growth recently - better topline momentum than its reputation suggests.

Profitability:

TTM operating income is slightly negative.

But FCF margin is very strong (~26%), thanks to heavy non-cash charges and the typical telco capex cycle. This is a cash story more than an accounting EPS story.

Balance sheet: Debt / total capital ~65%, clearly the most leveraged of the three. That’s the main risk here.

Shareholder returns: Dividend yield around 4.2–4.3%, so solid income, but with more perceived risk than Orange.

Valuation vs peers:

TTM P/E is negative (loss-making on reported numbers), but forward P/E ~13.4x, so the market is already pricing a recovery.

P/B ~0.5x and P/S ~0.65x, much lower than Orange, giving it classic value optics.

EV/EBITDA ~6.9x, very similar to Deutsche Telekom.

Fair value estimates are slightly below the current price.

Classic turnaround: cheap on book and sales, good FCF, but higher leverage and messy earnings. More cyclical, more moving parts, more execution risk.

Technical Analysis

Deutsche Telekom (DTE)

Trend: Long-term uptrend, short-to-medium term still in recovery after a deep correction.

Structure: Forming a base around €27–28 after completing a multi-month A–B–C corrective phase.

Momentum:

RSI is rebuilding from oversold toward neutral, early recovery signal.

MACD is flattening, means selling pressure is fading.

Key Levels:

Support: €27.0–26.8

Resistance: €29.0–30.0

Main takeaway:

DTE looks like it is stabilizing after a long correction. Above €27, the bias slowly shifts bullish, but it is still a build, not a breakout stock.

Orange (ORA)

Trend: Higher-timeframe structure remains bullish.

Structure: Consolidating near highs after a strong impulsive advance.

Momentum:

RSI cooled from overbought to neutral, healthy reset.

MACD moving sideways, meaning it’s in a digestion phase, not breakdown.

Key Levels:

Support: €13.9 - 13.8

Resistance: €14.3 - 14.5

Main takeaway:

Orange is in bullish consolidation. If it breaks above resistance, it likely enters the next leg higher. Until then, it remains a controlled, technical grind.

Vodafone (VOD)

Trend: Strongest trend of the three, with a clear long-term uptrend.

Structure: Classic bull flag just below major resistance after breaking a multi-year downtrend.

Momentum:

RSI stays in bullish territory

MACD remains positive on higher timeframes

Key Levels:

Support: 90 - 92

Resistance: 95 - 96

Main takeaway:

Vodafone has the cleanest bullish technical structure. If resistance breaks, probability favors a fast push toward the 100+ zone.

Technical Conclusion

Vodafone shows the strongest technical trend, Orange is consolidating in a bullish structure, and Deutsche Telekom is still in the base-building phase. Technically, Vodafone offers the clearest upside momentum, Orange offers controlled upside potential, and Deutsche Telekom offers a longer-term recovery setup rather than immediate breakout potential.

Trade Plans (Medium-Term Setups)

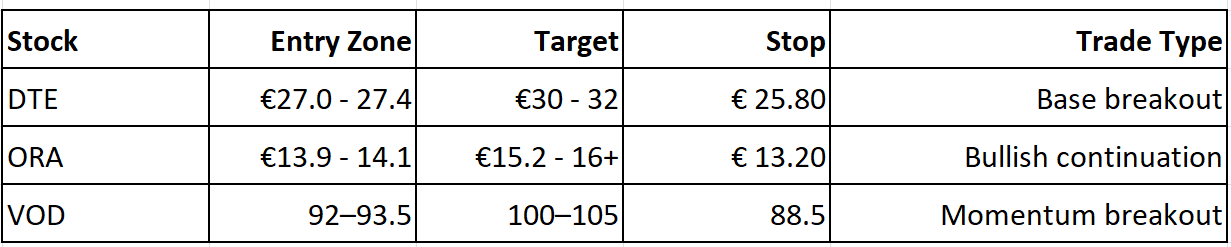

Deutsche Telekom (DTE)

Bias: Recovery / base breakout play

Entry zone: €27.00 - €27.40

Primary target: €30.00

Stretch target: €32.00

Stop-loss: €25.80

Risk/Reward logic:

Buying near base support with upside toward the top of the range and prior resistance.

Rationale:

This is a patience trade. Not explosive, but offers steady upside if the basing structure holds.

Orange (ORA)

Bias: Bullish continuation

Entry zone: €13.90 - €14.10

Primary target: €15.20

Stretch target: €16.00+

Stop-loss: €13.20

Risk/Reward logic:

Entry near consolidation support with breakout potential above resistance.

Rationale:

This is a structure trade. Buy the range, sell into breakout strength.

Vodafone (VOD)

Bias: Momentum breakout

Entry zone: 92.00 - 93.50

Primary target: 100.00

Stretch target: 105.00+

Stop-loss: 88.50

Risk/Reward logic:

Trading a bullish flag structure after a powerful trend shift.

Rationale:

This is a momentum trade. Strongest upside profile if resistance breaks.

Recommended Trade Focus

If you want the cleanest setup with the strongest technical structure, Vodafone stands out as the best focus name. Orange offers a solid secondary setup, while Deutsche Telekom is better suited for slower, longer basing-style trades rather than aggressive upside plays. DTE does remain the most attractive long-term portfolio holder, unless you’re going for a safe dividend play, in which case Orange is your move.

Conclusion

Europe’s telecom sector trades on infrastructure, cash flow, and positioning. That’s exactly why the opportunity is building here.

Deutsche Telekom offers the safety anchor: scale, U.S. exposure, and asymmetric upside as the stock rebuilds from a long correction. Orange delivers the income engine: stable operations, strong regulatory positioning, and one of the most reliable dividend profiles in European large caps. Vodafone brings the torque: a true technical breakout structure wrapped in a fundamental turnaround story.

If you want stability, DTE works.

If you want yield, Orange makes sense.

If you want upside momentum, Vodafone is the trade.

But the bigger picture is simple: Europe telecom infrastructure players are some of the largest in the world, and these three names are right at the center of that massive industry.

Disclaimer: This content is for educational and informational purposes only. It is not investment advice, a recommendation to buy or sell securities, or a promotion of any investment opinion.

See the latest from IWP:

Tags: European telecom stocks, Deutsche Telekom stock, Orange stock analysis, Vodafone stock forecast, European dividend stocks, Telco sector breakout, Infrastructure stocks Europe, High dividend European stocks, Undervalued European stocks, Global telecom investing

Good call on framing these three as different jobs within the same sector rather than just lumping them together. So DTE is the anchor, Orange is the income play, and Vodafone works as the torque, right? Anyway, I learned about Vodafone’s leverge and execution risk. Thanks.

Love this perspective; it makes me wonder how the regulated environements mentioned might actually interplay with the exponential data growth for these European telecom giants.