Freelancing: How to Thrive With Inconsistent Income

A practical system for managing unpredictable income and building long-term stability in the freelance and gig economy.

TL;DR

Managing money in the gig economy requires a structured, step-by-step approach that protects you from income swings and reduces stress. First, separate business and personal accounts so every payment has a clear entry point before it reaches your spending money. Next, smooth your pay by averaging past income and paying yourself that amount each month, building a buffer during good months to cover slow periods. Set aside a fixed percentage for taxes and self-funded benefits from every payment, and organize spending into priority buckets so essentials are always covered before lifestyle extras. Finally, manage the mental side by creating predictable paydays, planning for slow seasons, and investing in your skills. Following this system turns unpredictable earnings into a stable, sustainable financial foundation.

The rise of freelancing, side hustles, and contract work has reshaped the way millions of people earn a living. Flexibility, autonomy, and the ability to choose your projects are big positives. The downside is volatility. One month your bank account is flush, the next you are wondering how to cover rent.

The traditional paycheck-to-paycheck approach simply does not work in this environment. If your income swings from month to month, you need a financial system designed to handle unpredictability. Think of it as building a wallet that can breathe with your income cycles.

Step 1: Separate Work and Life

The first move is to create two distinct accounts: one for receiving all work-related income and another for personal spending. This is not just an organizational trick, it is a mental boundary. Your business account becomes the staging area where all payments arrive. From there, you decide how much “salary” to transfer to your personal account.

This separation prevents the trap of spending everything the moment it comes in. It also makes tax tracking simpler, and if you expand your business, the structure is already in place.

Step 2: Smooth Out Your Pay

If you let your lifestyle rise and fall with your income, you will live in constant financial whiplash. The solution is income smoothing: look back at the last 6 to 12 months, calculate your average monthly income, and treat that figure as your monthly spending budget.

For example, if your monthly earnings ranged from $3,000 to $6,000 dollars but averaged $4,200, you pay yourself that amount every month. Good months will leave a surplus in your business account. That surplus becomes a buffer to cover leaner months. Over time, your buffer should grow to cover several months of living expenses without stress.

Step 3: Build a Tax and Benefits Reserve

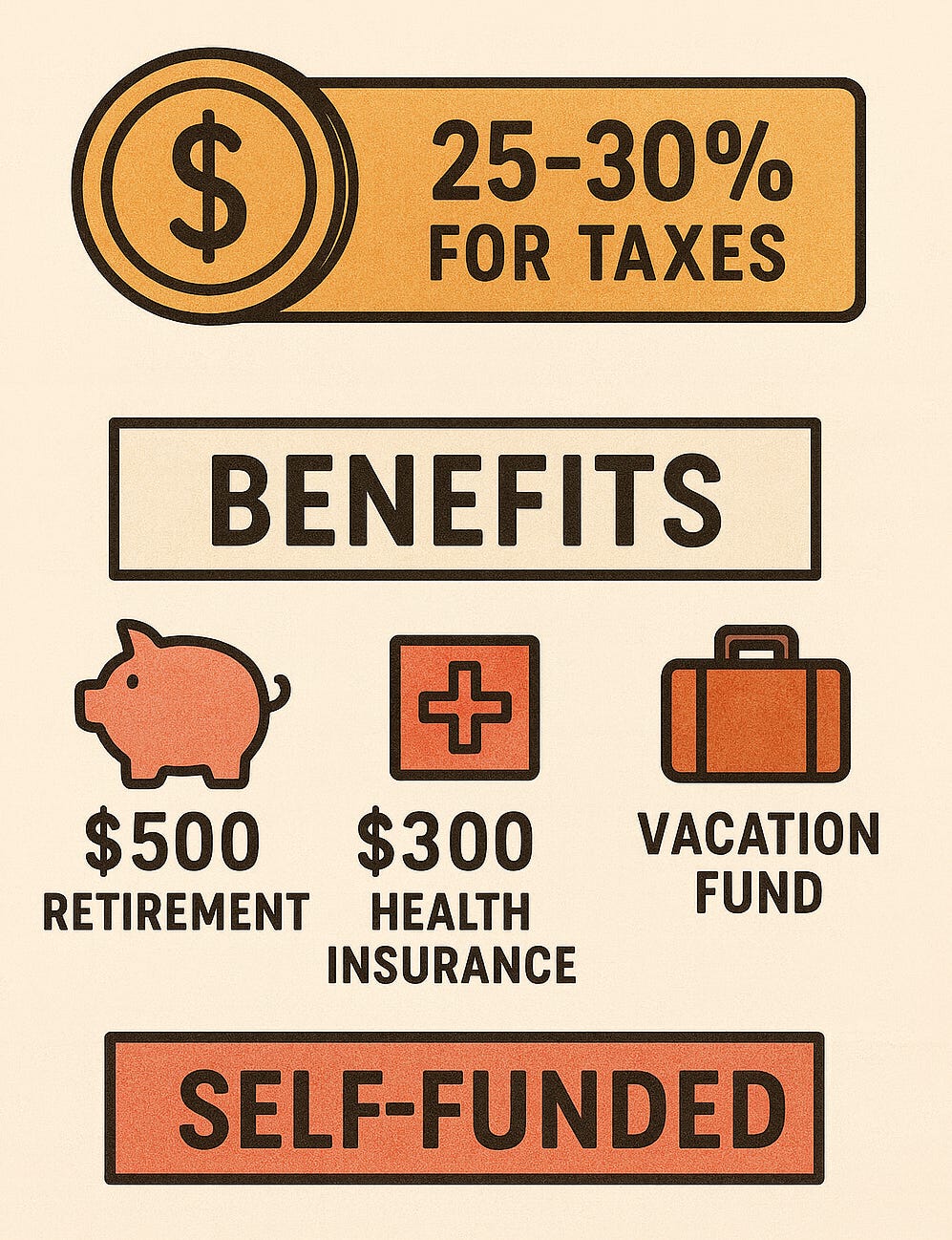

Traditional employees have taxes withheld and benefits provided automatically. Freelance workers do not. This means you must set aside a portion of every payment the moment it arrives. A good starting rule is 25-30% for taxes, adjusting based on your location and deductions.

Benefits like health insurance, retirement contributions, and even paid time off must be self-funded. Treat them as non-negotiable expenses. For example, each month you might allocate $500 to retirement, $300 to health insurance premiums, and $100 toward a vacation fund. This way, your lifestyle is sustainable, not just survivable.

Step 4: Budget With Priority Buckets

A fixed budget works poorly when income is variable. Instead, use a “priority bucket” system. Rank your expenses from essential to optional, and fund them in order each month.

Bucket 1: Essentials (housing, food, utilities, insurance)

Bucket 2: Growth (debt payments, retirement contributions, education)

Bucket 3: Lifestyle (entertainment, dining out, travel)

When income is strong, all buckets get filled. In slow months, you may only fill Buckets 1 and 2. This keeps your core financial health intact without feeling like you have “failed” at budgeting.

Step 5: Manage the Psychology of Variable Income

Money stress for freelance workers is often less about the numbers and more about the uncertainty. The psychological benefit of paying yourself a set salary each month cannot be overstated. It creates stability in your personal life, even if your business life is unpredictable.

Another mental strategy is to celebrate good months without overspending. This could mean setting a fixed “bonus” amount you allow yourself when income exceeds a target, while still saving the majority of the excess. This turns windfalls into growth rather than short-lived indulgence.

Step 6: Plan for Skill Growth and Slow Seasons

Inconsistent income is not only a budgeting challenge, it is also a career challenge. You can smooth the ride by investing in your skills during slow seasons. This can open higher-paying opportunities, diversify your income streams, and reduce your dependence on a single client or platform.

Planning for downtime also means saving enough in your buffer account to cover these quieter months without panic. Think of it as building professional breathing room.

Closing Thoughts

The gig economy offers freedom, but freedom without structure can quickly lead to instability. By separating your income, paying yourself a consistent salary, building a buffer, and prioritizing expenses, you create a personal financial system that turns volatility into flexibility.

You cannot control exactly when clients pay or how much they hire you, but you can control how that income flows through your life. With the right setup, your wallet can adapt to feast and famine alike, giving you peace of mind and the freedom to focus on your work.