From Exposure to Execution: Positioning for 2026

From momentum to selectivity. From narratives to structure. From noise to decisions.

Markets rarely announce regime shifts. They drift into them quietly.

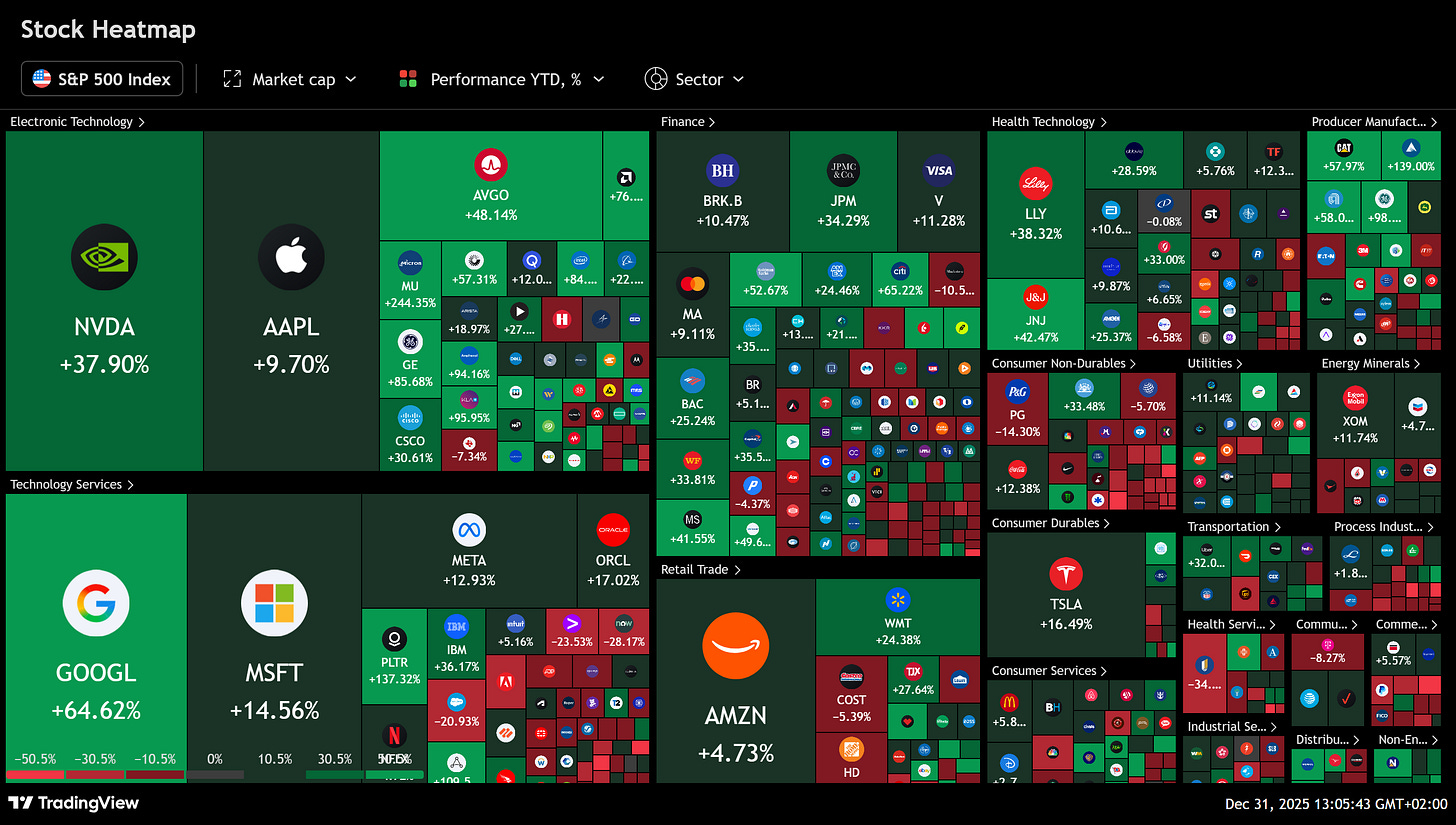

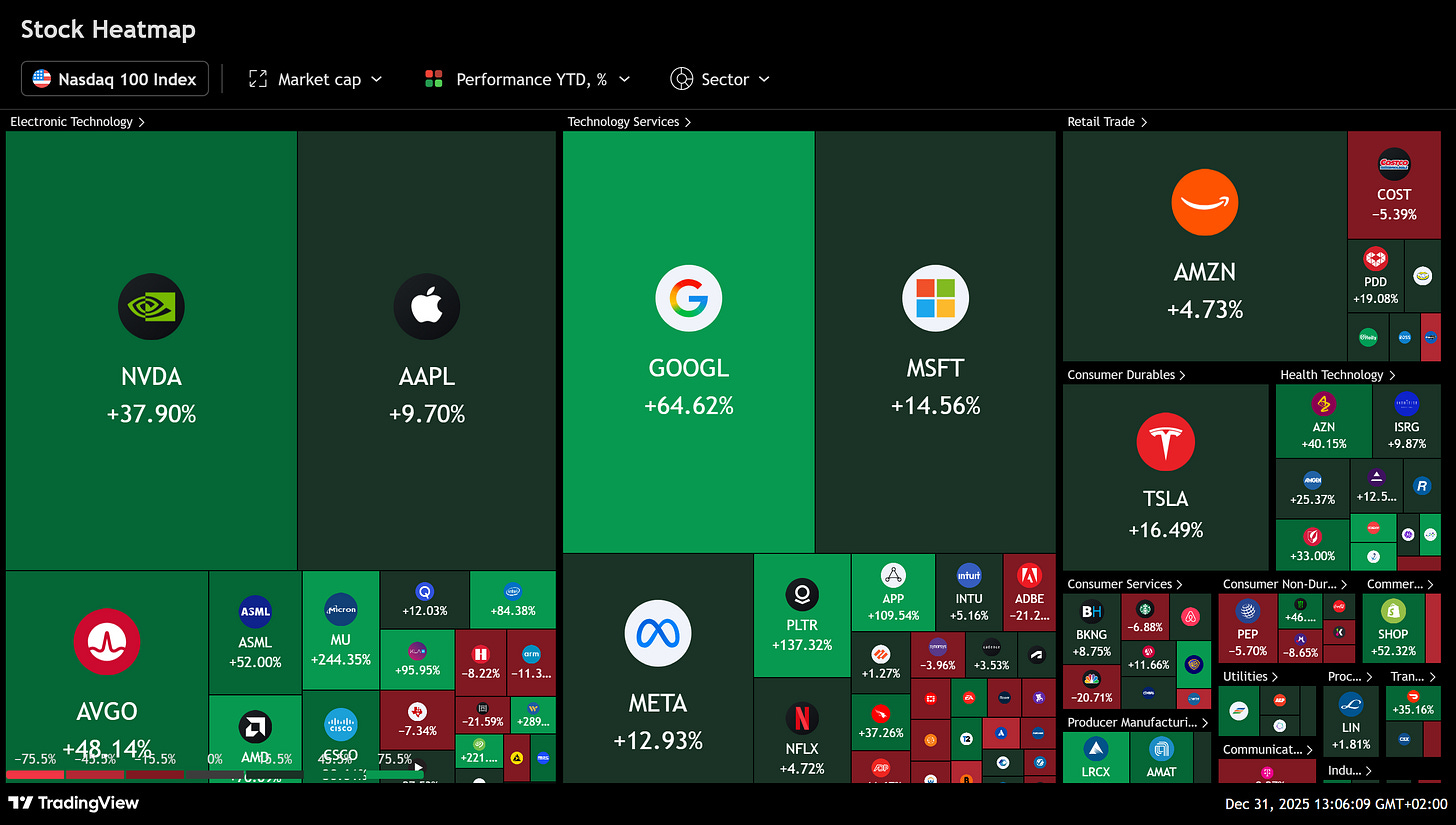

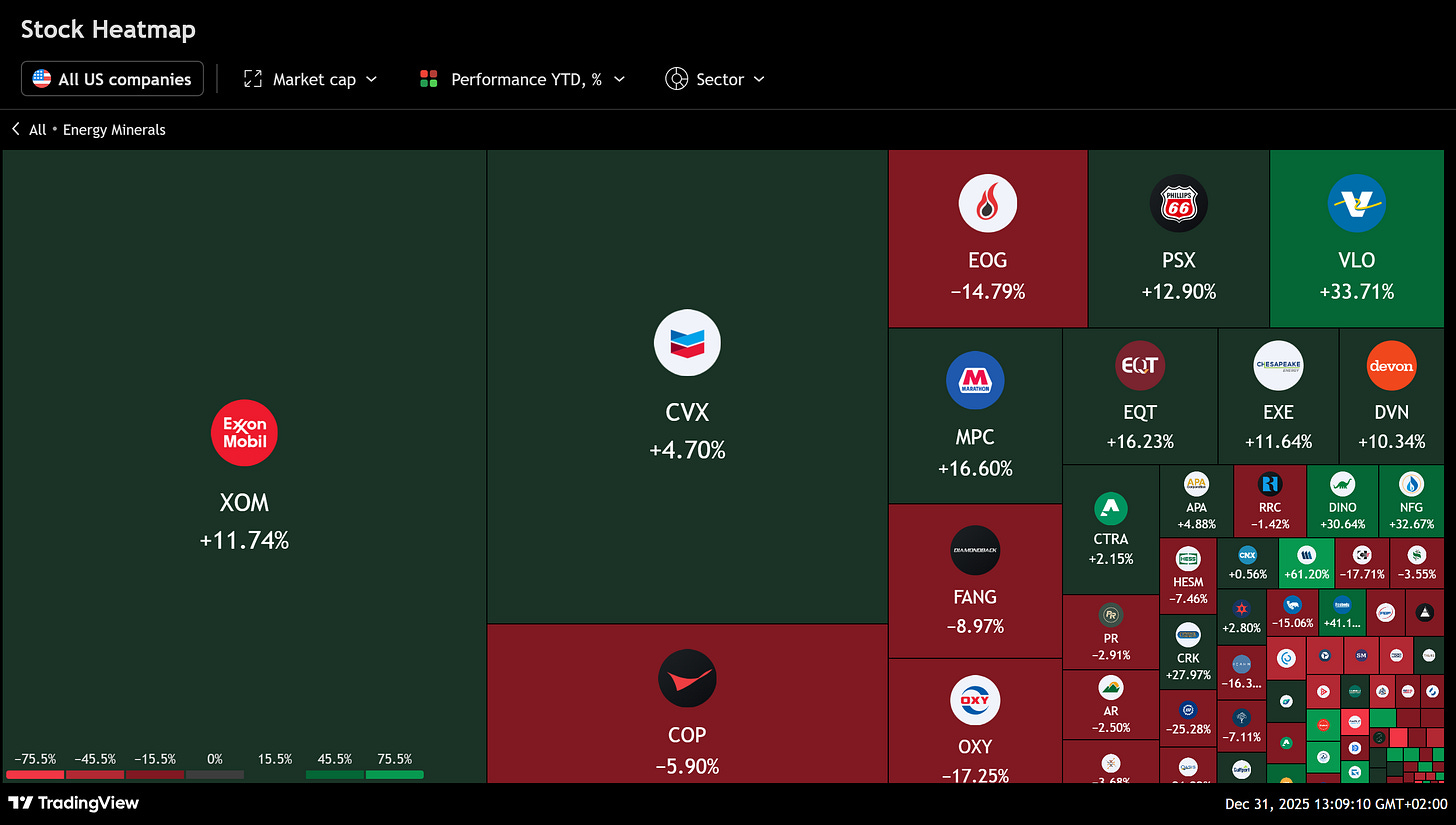

2025 was not a bad year. It was a confusing one. Liquidity returned unevenly, innovation narratives regained traction, and risk assets broadly held together. Yet beneath the surface, leadership narrowed, dispersion widened, and conviction became harder to sustain.

That matters, because 2026 is shaping up to be a year where strategy matters more than exposure.

Not because a crash is coming.

Not because growth is over.

But because the margin for error is shrinking.

This piece outlines how we are thinking about positioning into 2026 and, more importantly, how any serious investor should be framing the year ahead. Not as a list of predictions, but as a disciplined response to a market that is becoming more selective, more valuation-aware, and less forgiving.

The Market We’re Entering Is Not Fragile, But It Is Demanding

The dominant risk heading into 2026 is not volatility.

It is complacency around expectations.

Markets are entering the year with:

Valuations that already discount improvement in many growth areas

Inflation that is lower, but no longer falling effortlessly

Central banks closer to neutral than accommodative

Earnings growth that must be delivered, not assumed

This is an environment where optimism alone is no longer sufficient.

In past cycles, liquidity masked mistakes. In the next phase, execution will expose them.

The challenge is subtle but critical:

many assets are priced for progress, while fewer companies are positioned to actually deliver it.

That creates a different type of risk. One that does not arrive with panic or headlines, but through quiet underperformance, stalled multiples, and capital rotating elsewhere.

Dispersion Is the Defining Feature of 2026

One of the most important shifts investors must internalize is that markets are no longer moving as a single organism.

Dispersion across:

Sectors

Sub-sectors

Balance sheets

Business models

is widening, not narrowing.

This is why broad thematic investing feels less reliable. Owning “AI,” “tech,” or “defensives” is no longer enough. Within every theme, there are companies compounding quietly and others treading water.

2026 will reward:

Selection over exposure

Quality over velocity

Process over intuition

This is uncomfortable for investors used to riding momentum. It is liberating for those willing to slow down.

Our Strategic Lens for 2026

Rather than forecasting macro outcomes, we anchor our approach around four strategic principles.

What This Means at IWP

At Investing With Purpose, strategy is not a slogan.

It is an operating system.

Every idea we publish in 2026 will follow the same discipline:

A clear fundamental thesis

A defined technical structure

Explicit risk levels

A reason to enter, a reason to wait, and a reason to exit

We do not publish ideas to sound early or clever.

We publish ideas that can be managed over time.

That means:

Updates when structure evolves

Reductions when risk expands

Patience when confirmation is missing

Consistency matters more than frequency.

Our role is not to predict every move.

It is to help subscribers think clearly, act deliberately, and avoid the mistakes that quietly erode returns.

This is what “Investing With Purpose” means in practice.

1. Structure Before Conviction

Conviction without structure is opinion.

Structure without conviction is paralysis.

2026 requires both.

Every position we engage with must answer:

Where does the thesis clearly fail?

What confirms continuation?

What changes our mind?

This is not about predicting tops or bottoms. It is about ensuring that risk is defined before capital is deployed.

In a market where upside still exists but drawdowns can be sharp and selective, respecting structure becomes a competitive advantage.

Cash is not indecision.

Patience is not passivity.

Waiting is often the trade.

2. Innovation Still Matters, But It Must Be Earned

Innovation remains one of the most powerful long-term drivers of value creation. That has not changed.

What has changed is the market’s tolerance for innovation without economics.

In 2026, innovation must show:

Operating leverage

Cost discipline

Clear monetization pathways

Balance-sheet resilience

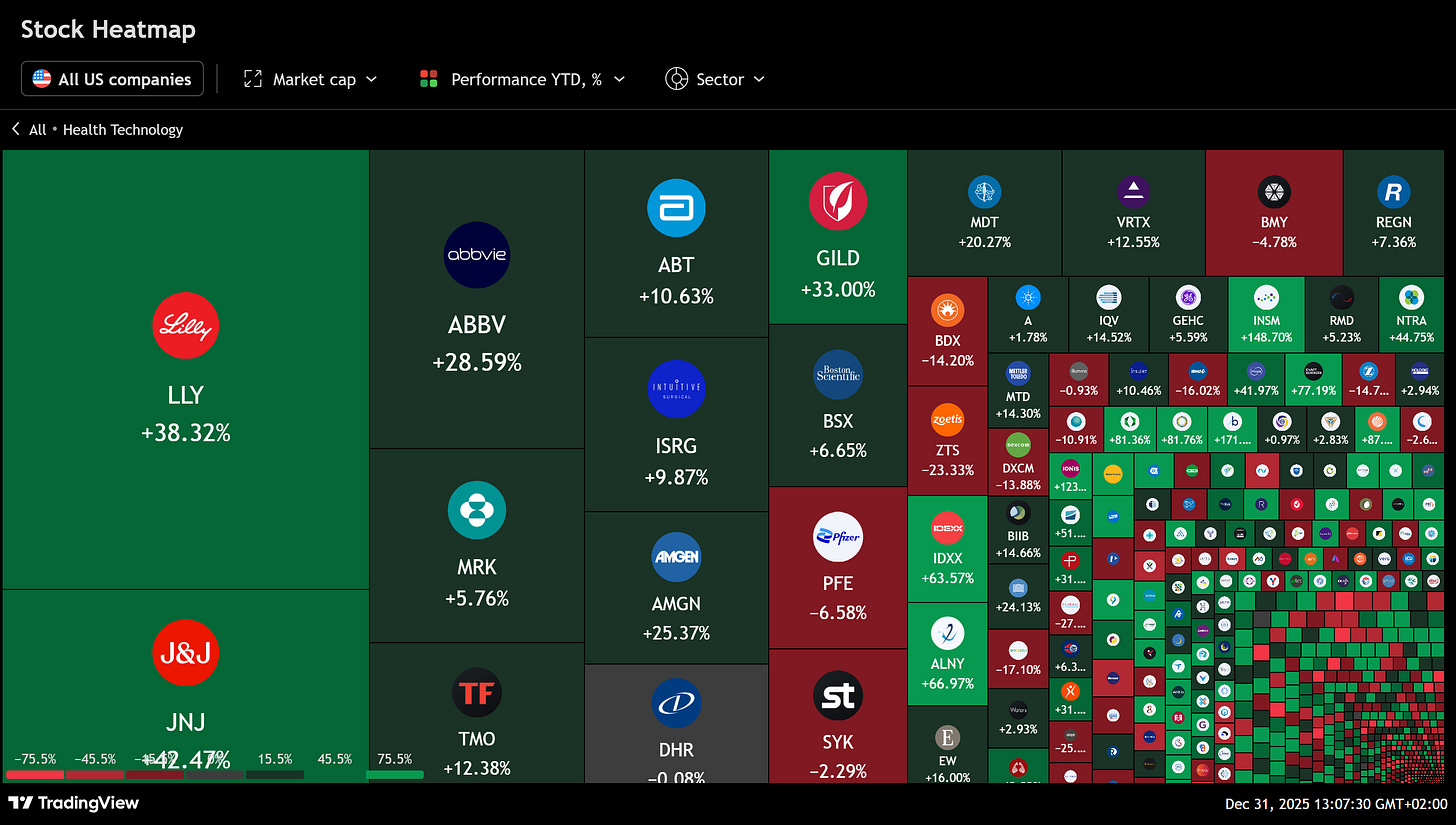

We remain constructive on areas such as:

AI infrastructure and compute enablers

Semiconductor equipment and process bottlenecks

Automation, software, and productivity tools

Select healthcare innovation with visible pipelines

But we are increasingly cautious of:

Concept-driven growth

Businesses dependent on continuous capital access

Revenue growth that masks margin erosion

The market is moving from asking “what could this become?” to “what is this becoming now?”

That distinction matters.

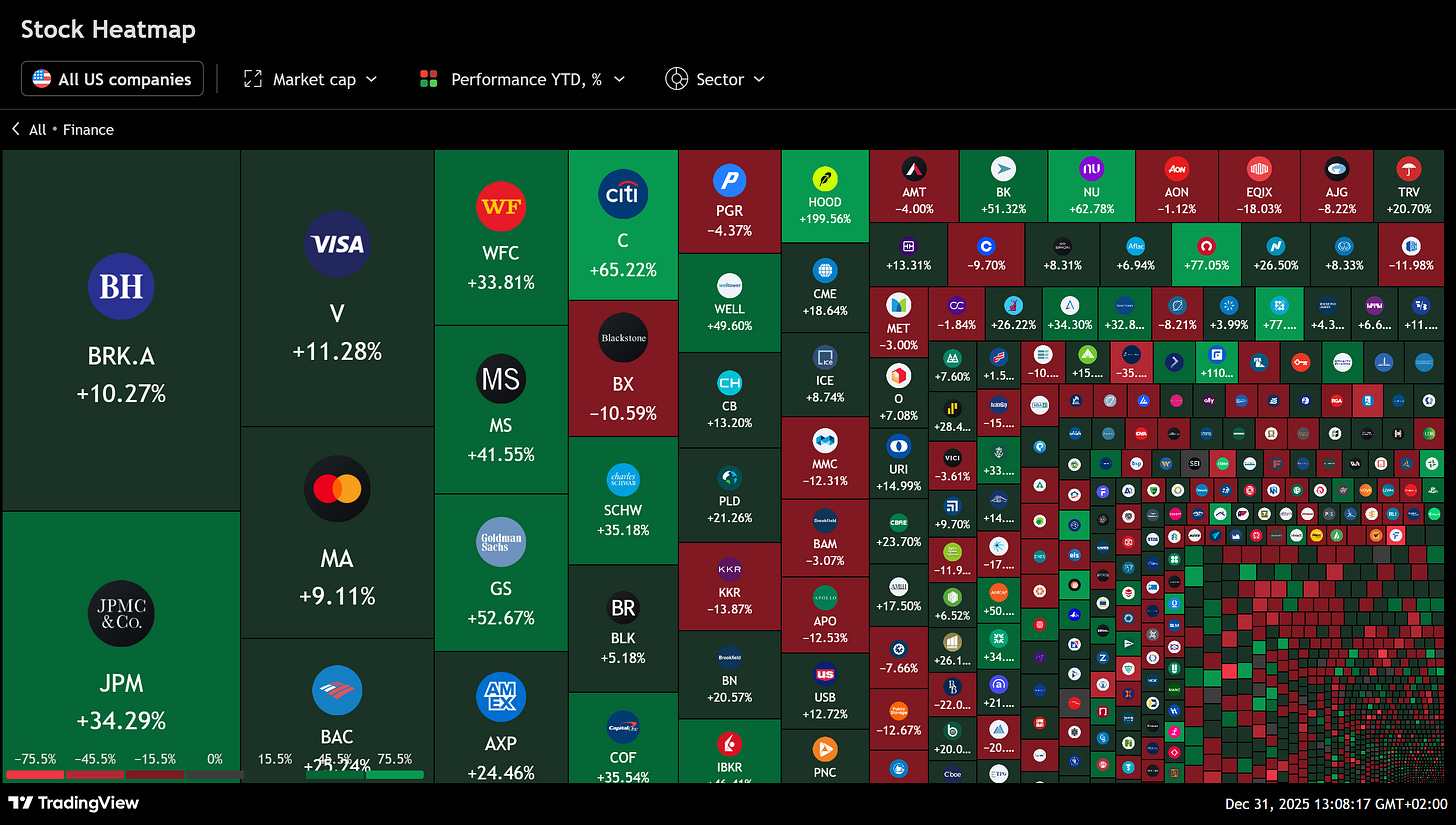

3. Value Is Quietly Re-Entering the Conversation

Value is not a style rotation.

It is a discipline of pricing durability correctly.

Some of the most interesting opportunities emerging are not in the cheapest assets, but in:

Companies exiting temporary earnings troughs

Businesses with strong cash generation but weak narratives

Capital-intensive firms where balance-sheet strength is underappreciated

Select consumer and industrial names with real pricing power

In 2026, value works best when paired with:

Operational inflection points

Improving return profiles

Rational capital allocation

Cheap without improvement is not value.

Improvement without patience is not investable.

4. Think in Sectors, Execute in Subsectors

The next phase of markets will not reward broad sector bets.

It will reward granular understanding.

Within every sector:

Some business models are structurally advantaged

Others are exposed to subtle headwinds

Many will look similar on the surface but behave very differently

Our focus increasingly shifts toward:

Infrastructure over applications

Enablers over end demand

Services over hardware where margins are defensible

Second-order beneficiaries rather than headline winners

This is slower work.

It is also more repeatable and less fragile.

Portfolio Construction: Fewer Ideas, Better Defined

All of this translates into a clear portfolio philosophy for 2026:

Fewer positions, each with a clear role

Distinction between long-term holdings and tactical opportunities

Dynamic sizing rather than static conviction

Willingness to step aside when structure breaks

Exposure is earned, not assumed.

Conviction is conditional, not permanent.

This is how portfolios survive periods where returns are uneven rather than abundant.

The Bottom Line

2026 will not be defined by one big call.

It will be defined by:

How investors manage risk

How they respond to disappointment

How willing they are to adapt without abandoning process

This is a market that rewards discipline, humility, and preparation.

Strategy matters again.

Process matters again.

And patience is once more a source of edge.

That is the lens guiding our work into 2026 and the framework behind every idea we publish going forward.

IWP

See the latest from IWP: