Harvesting High-Yield: Top 10 Dividend Stocks for Growth and Income

How we screened for juicy payouts, solid fundamentals, and upside potential in today’s market

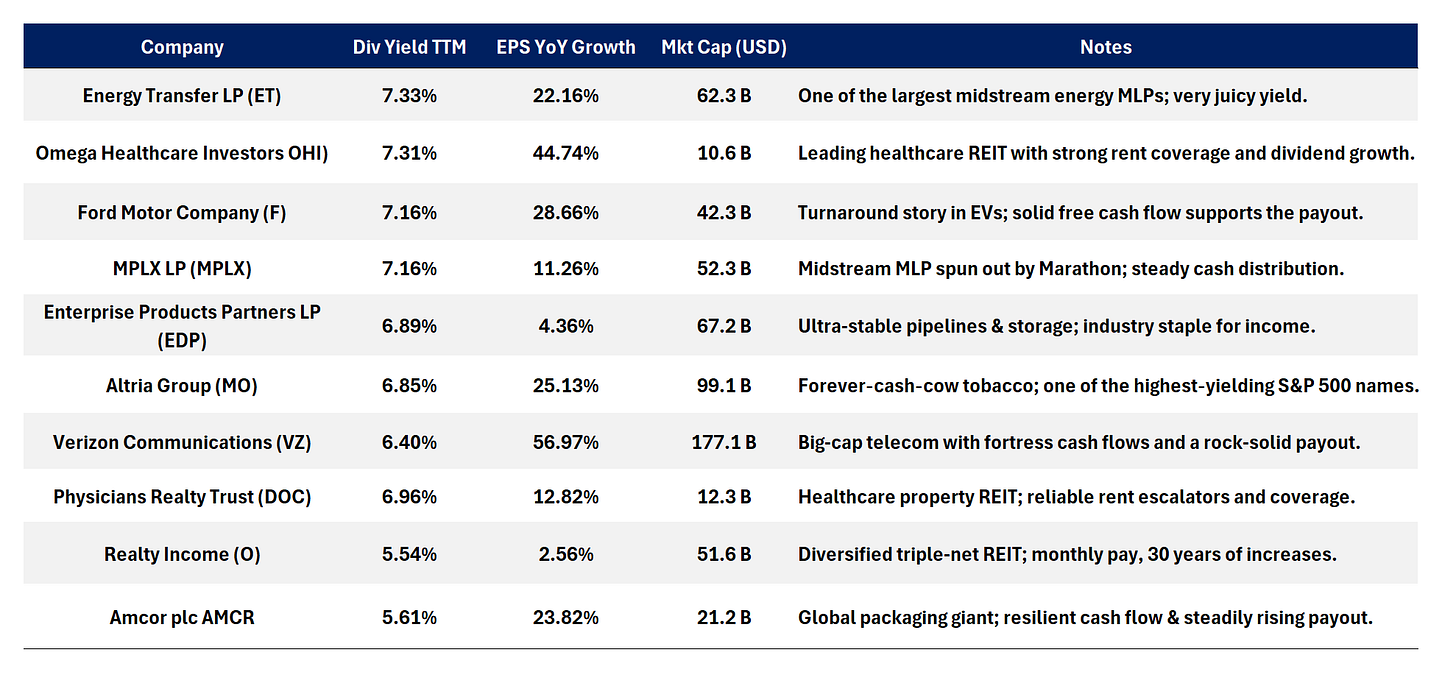

In an era of low interest rates and market volatility, reliable dividend income has become a cornerstone of many portfolios. But not all dividend payers are created equal: some struggle to maintain their payouts, while others combine attractive yields with real earnings power and balance-sheet strength. In this post, we’ll walk you through our process for finding ten large-cap, recession-resilient companies that offer both high current yields and healthy year-over-year growth, so you can harvest dependable income without sacrificing upside potential.

Our Selection Criteria

Dividend Yield ≥ 5.5 %

We looked for companies paying at least 5.5 % annually, to ensure each name delivers a meaningful income stream.Positive EPS Year-Over-Year Growth

A rising earnings base underpins sustainable payouts—so every pick has shown YoY earnings growth.Market Cap ≥ $10 B

Large-cap scale helps absorb economic shocks and provides liquidity for investors.Defensive or Essential Business Models

We focused on pipeline MLPs, REITs, telecoms, consumer staples and other sectors with predictable cash flows.Investment-Grade Balance Sheets

Manageable debt levels and healthy coverage ratios reduce the risk of dividend cuts.

By combining above-average yields with solid earnings momentum and balance-sheet resilience, these ten names strike a balance between income and security. They represent a cross-section of industries, energy infrastructure, healthcare real estate, telecom, consumer staples and more, so you can diversify your income sources. As always, do your own due diligence on payout ratios, sector outlooks and valuation before pulling the trigger.

Here’s to building a portfolio that keeps the dividends rolling in!

The information in this post is for educational and informational purposes only. It reflects the author’s personal research and analysis, which may be subject to error or omission. This is not financial, investment, or trading advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment or trading decisions.