Inspiration Healthcare: Oversold, Underpriced, and Entering an Inflection Point

A micro-cap medtech with global reach, improving fundamentals, and a chart sitting at a high-probability reversal zone.

Inspiration Healthcare (IHC LN) is a UK-based specialist in neonatal intensive care, specialty ventilation, and infusion therapies. The company supplies critical equipment to hospitals in more than seventy-five countries, and its product range spans neonatal ventilators, resuscitation systems, thermal management devices, transport and MRI-compatible ventilators through Airon in the United States, and Micrel infusion pumps in the United Kingdom.

Despite this focused footprint in a life-saving niche, Inspiration Healthcare has spent the past two years in a financial and operational reset. Today the business sits at a compelling intersection: fundamental improvement is beginning to surface, capital discipline is becoming real, and the share price has washed out into deep-value territory at a time when the underlying turnaround is gaining traction.

This makes Inspiration Healthcare one of the more interesting micro-cap recovery stories in UK medtech.

Key Takeaways

The company is emerging from a difficult reset year marked by heavy impairments, portfolio rationalization, manufacturing consolidation, and cost reductions.

The first half of the current financial year delivered record revenue, stronger gross margins, and a return to operating profitability.

Valuation is extremely low for a business with global distribution, recognised IP, and a credible pathway to margin expansion and cash generation.

Technical indicators show a deeply oversold condition within a multi-level support area, providing the first signs of a potential bottoming formation.

The risk-reward profile is asymmetric, with controlled downside and meaningful upside if the operational turnaround continues to build.

Market Environment

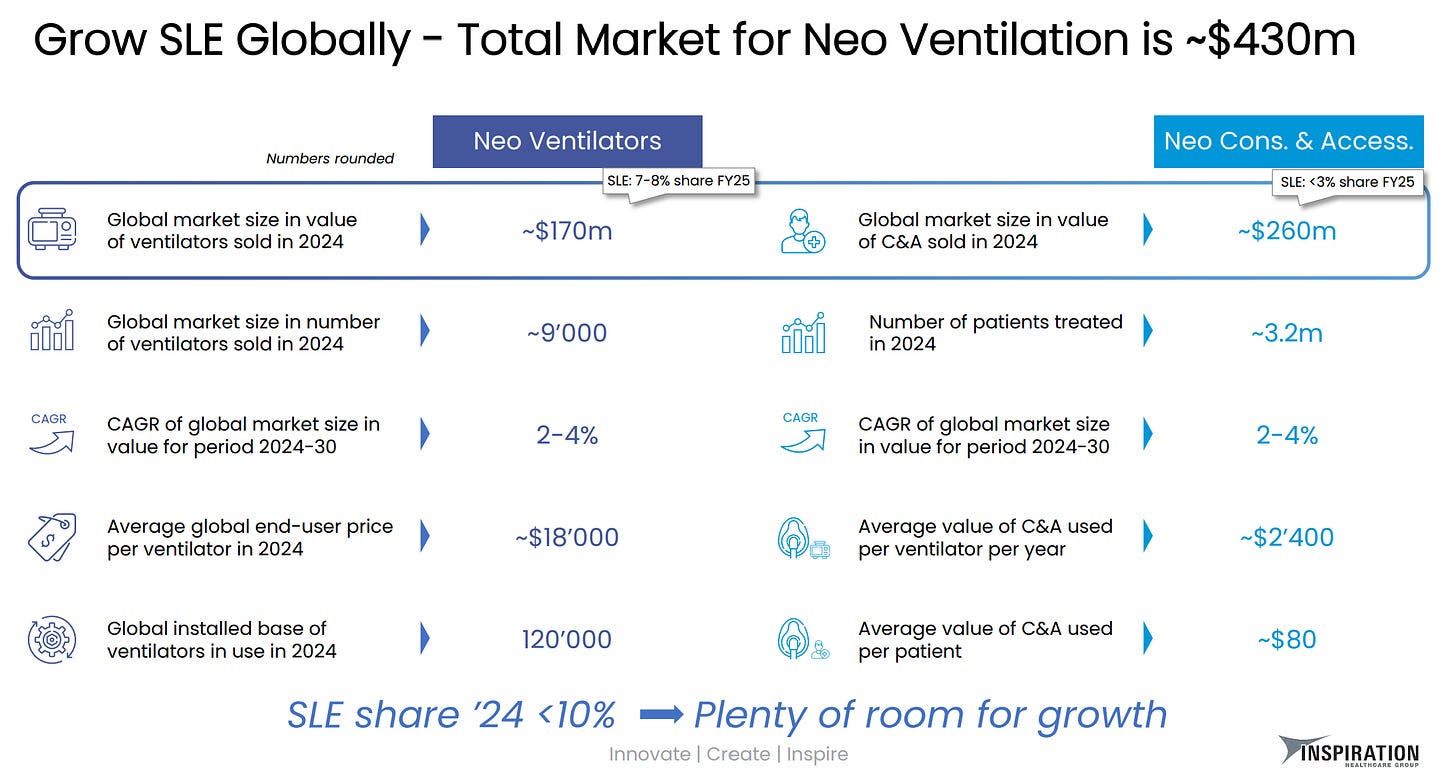

Inspiration Healthcare operates in one of the most defensible niches in medical technology. Demand for neonatal intensive care continues to grow due to rising preterm birth rates, increasing survival expectations, and the global expansion of neonatal units across emerging healthcare systems. Hospital spending in this category tends to be needs-driven rather than discretionary, and the equipment is mission critical.

North America represents roughly half of global NICU expenditure, which increases the strategic value of Airon as a US foothold. Meanwhile, the Middle East and parts of Asia continue to invest heavily in NICU infrastructure, providing larger order opportunities that can meaningfully impact a company of this size.

The UK market remains pressured by capital budget constraints, but this is offset by strong growth in infusion therapies and service-led recurring revenue, both of which carry attractive margins and more predictable demand.

Fundamental Analysis & Turnaround Potential

The most recent full-year results reflected a company clearing the decks. Revenue grew modestly, but margins compressed and large non-cash impairments drove a significant statutory loss. The balance sheet was re-based, older products were discontinued, manufacturing was consolidated, and costs were removed. These are the kind of actions that do not look good in the moment but create a cleaner foundation.

The first six months of the current financial year show the tangible benefits of that restructuring. Revenue reached record levels, gross margins improved toward the mid-forties, and the Group returned to positive operating profit. Net debt began to decline as inventory pressures eased and working capital started to normalize. This shift from stabilization to momentum is the defining catalyst of a genuine turnaround.

Strategically, the company is prioritizing core neonatal products, expanding higher-margin consumables and service revenue, integrating Airon more tightly to build a North American platform, and preparing major regulatory submissions for the SLE6000 ventilator. A successful Canadian approval in the near term and US progress over the next two years would unlock large incremental markets.

Valuation remains one of the most compelling elements of this story. The business trades at a fraction of sales and below book value despite holding specialized IP, global distribution, and an improving profitability trend. If margins continue to rebuild and the balance sheet keeps strengthening, the rerating potential is meaningful.

Technical Analysis

The share price has broken below a long consolidation range and has now fallen into a high-probability exhaustion zone between approximately seventeen and sixteen pence. This area is supported by a cluster of Fibonacci extension levels, Elliott Wave completion geometry, and extreme oversold momentum.

Daily RSI is in the low teens, Stochastics are pinned at zero, and the price is trading well below the lower Bollinger band. These signals rarely persist without a relief rally. At the same time, the longer-term trend remains downward, and the 18 to 20 pence region now acts as overhead resistance that needs to be reclaimed before a full trend reversal can be confirmed.

In simpler terms, the technical picture suggests that selling pressure is stretched and that the market is testing the lower boundary of a typical correction structure. While the bigger trend needs work, the probability of a rebound from this region is elevated.

Trade Plan

A constructive trade framework balances the improving fundamentals with the still-weak technical trend. The approach below reflects that balance.

Entry Zones

The first accumulation area sits between 17.5 and 16.8 pence, where the oversold condition and support confluence begin.

A deeper liquidity zone between 16.5 and 16.0 pence captures the next layer of structural support should the market overshoot.

Breakout Confirmation

A daily close above 18.2 to 18.5 pence would signal a shift in short-term momentum and confirm early signs of a structural repair. This area can be used for either add-on positioning or for more conservative investors who prefer confirmation rather than buying into weakness.

Risk Management

The broader thesis is invalidated on a weekly close below roughly 14.5 to 15.0 pence. A move of that magnitude would imply new negative information and a breakdown of the recovery structure.

Upside Targets

The first target sits around 19.0 to 19.5 pence, where initial resistance lies. The second target is 21.0 to 21.5 pence, marking the underside of the cloud and a major recovery level. A full swing toward 23.5 to 25.0 pence completes the move back to prior highs if the turnaround gains traction.

The risk-reward framework across these stages typically ranges from two to three times the downside risk when position sizing is done properly.

Bottom Line

Inspiration Healthcare is a micro-cap medtech emerging from a difficult restructuring year into a period of renewed operational momentum. The early financial signals are pointing in the right direction and the company is positioned in a specialized, defensible, and globally relevant niche.

The valuation remains depressed, the technicals show signs of exhaustion at important support levels, and the trade structure allows for controlled risk with meaningful upside potential. For investors who can tolerate micro-cap volatility and are willing to underwrite a multi-quarter turnaround, this is a name worth watching closely.

This content is for educational purposes only and isn’t investment advice or a recommendation to buy or sell any security.