LVMH Moet Hennessy Louis Vuitton (MC) - The Fashion Powerhouse

Multi-Frame Technical & Fundamental Roadmap

MC 0.00%↑ just carved a textbook base at €450. Weekly RSI waking from oversold, MACD histograms shrinking. That’s your “buy the dip” signal.

Fundamentals: trading ~19× forward PE vs peers ~16×, operating margin ~21%, fwd dividend yield ~2.9%.

Catalysts on deck: China travel rebound, Q3 perfumes & watches launches, fresh buybacks. June LFL revenue likely +15% y/y. Here's how to look at this..

TL;DR

Wave 4 base carved at €444–455 on weekly Elliott + RSI/MACD divergence.

Medium-term pivot at €490 (daily 20-SMA reclaim + MACD flip).

Short-term chop zone under €462 (2h Ichimoku cloud); watch Stoch-RSI extremes.

Wave 5 target near €960 (1.618× Wave 1).

Fundamentals: forward P/E ~18.5× vs peers ~16×; 23% op-margin; 2.1% yield; rev growth 5–7% ’25.

Phase-based entries with tight, time-aligned stops.

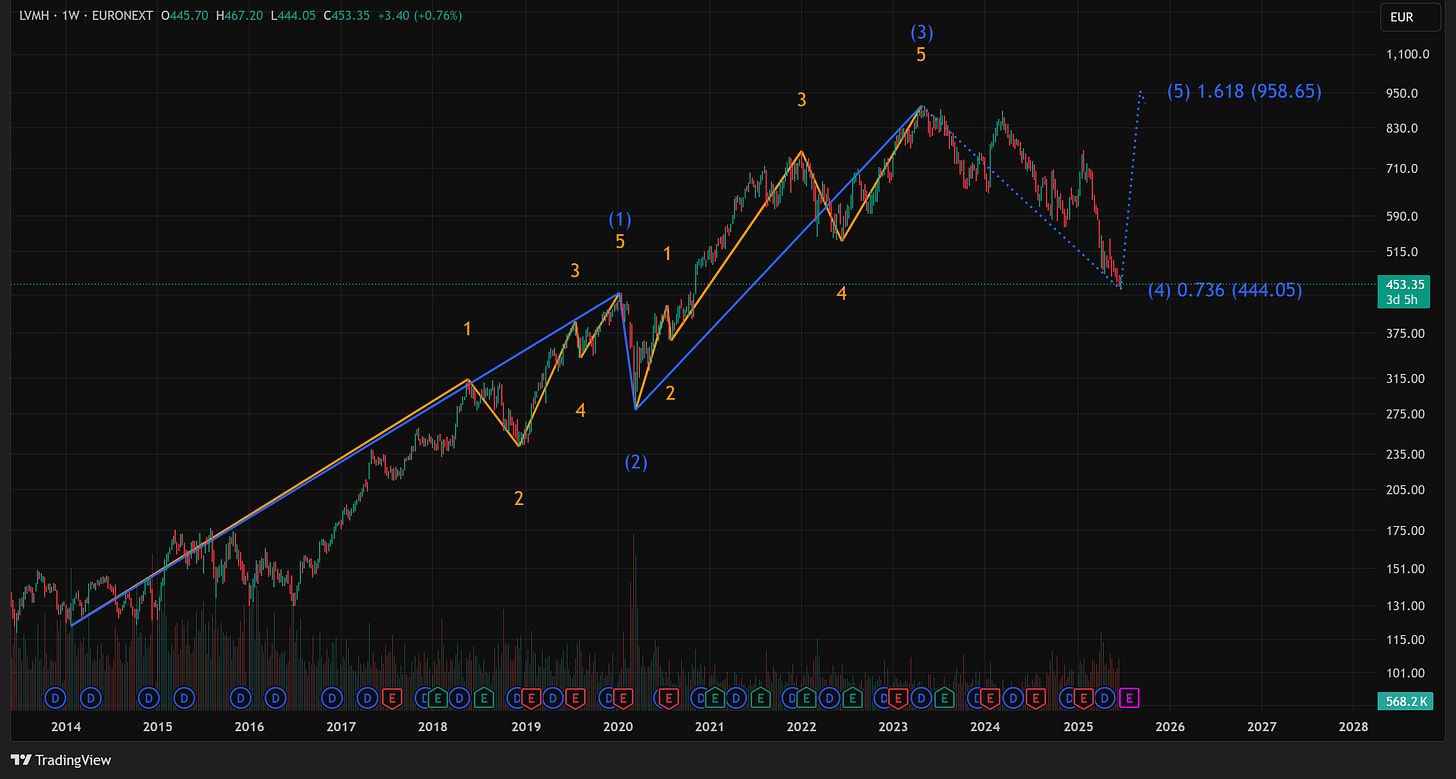

1. Elliott-Wave & Weekly Technicals

Wave Count: Completed five-wave impulse from 2014→2023; current drop is corrective Wave 4.

Retrace: Wave 4 sits at 73.6% of Wave 3 (≈€444).

Wave 5 Projection: Fibonacci extension (1.618× Wave 1) = €958.65.

RSI (14): ~29, bullish divergence against slightly lower price low.

MACD (12,26): Histogram bars contracting, signaling waning downside momentum.

Implication: Weekly signals align on a durable base, ideal for initiating core positions.

2. Daily Structure & Confirmation

20/50/200-SMA Ribbon: Bearish alignment, but ribbon is flattening.

Key Level: Daily 20-SMA sits at €490. A clean close above catalyzes a 20/50 golden cross.

MACD: Line approaching signal line from below; crossover >0 confirms medium-term upshift.

RSI: Bounced from ~30 to ~36, needs >50 to cement strength.

Implication: Reclaim of €490 triggers confirmation, perfect for adding to initial exposure.

3. Intraday Signals (2-Hour)

Ichimoku Cloud:

Price below cloud (resistance zone ~€462–470).

Tenkan/Kijun nearly cross bullishly, watch for cloud breakout.

Stoch-RSI (3,3,14,14):

Currently extreme overbought (~96/81) or just bounced from oversold—signals short-term whipsaw risk.

Heikin-Ashi:

Small bodies + mixed wicks reflect low conviction, expect choppy moves until cloud is cleared.

Implication: Intraday traders will chop around €455–€465. As long-term investor, avoid chasing spikes; use them to scale.

4. Fundamental Underpinning

Forward P/E: LVMH ~18.5× vs peers ~16×

Operating Margin: LVMH ~23% vs peers ~20%

Dividend Yield: LVMH ~2.1% vs peers ~1.7%

’25 Revenue Growth: LVMH +5–7% vs peers +3–5%

Growth Drivers: China travel rebound, new Perfume & Watch launches, online luxury acceleration

Capital Return: €5 bn buyback (’24–’25) + stable dividend

Valuation Edge: Premium justified by best-in-class brands and resilient high margins

5. Phase-Based Entry & Risk

Phase 1 (Base): 30% at €444–455 │ Stop €440

Phase 2 (Confirm): 40% on daily close > €490 │ Stop €480

Phase 3 (Trend): 30% on weekly close > €605 │ Trailing stop under weekly 50-SMA (~ €575)

6. Macro & Catalyst Calendar

Fed Timing: Looming pivot, lower real rates bolster luxury spend.

FX: Euro near multi-year lows vs. USD, boosts tourist wallet power in Europe.

Seasonality: Q3 historically strongest for luxury goods (holiday preview buys).

Key Dates:

June 28: Q2 earnings & LFL sales print (~+10–15% y/y expected).

July 15: ECB meeting & Eurozone CPI.

Aug 5: Fed minutes (pivot clues).

Final Thought: This isn’t a spray-and-pray buy-the-dip. It’s a multi-frame, data-backed roadmap—capitalizing on technical inflection and fundamental tailwinds.