Mastercard Inc. (MA) - When a 38x Multiple Is Still Cheap

Premium Compounder, Hidden Beta

MA 0.00%↑ is the silent backbone of global commerce. With 96% gross margins, 50%+ operating margins, and ROIC above 55%, Mastercard is a digital toll road on a near $9T+ global card-based commerce highway. But the market is still sleeping on its optionality: blockchain rails, embedded finance, AI fraud detection, and global SME solutions.

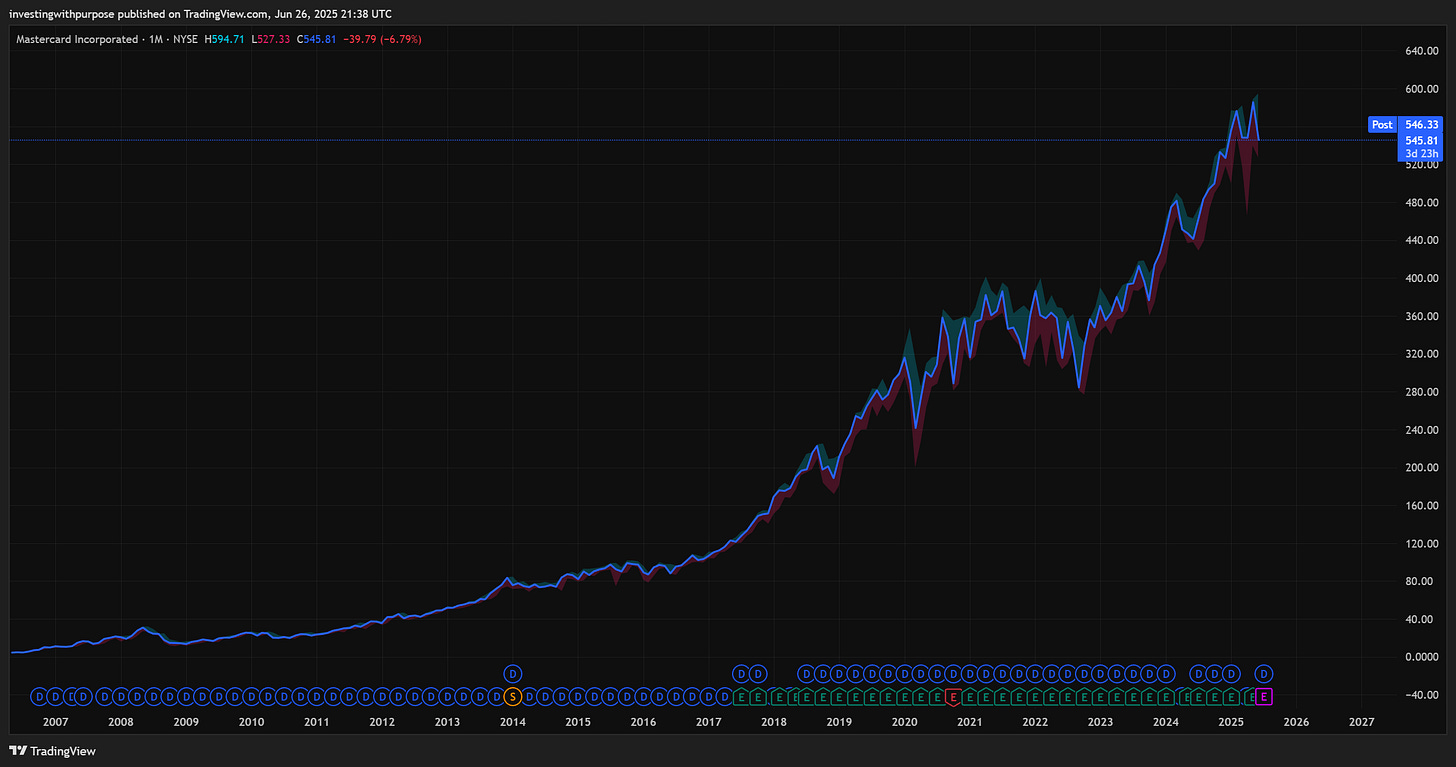

The stock has compounded at a ~24% CAGR since 2006 IPO. Can it do it again? Let’s break it down…

Fundamentals

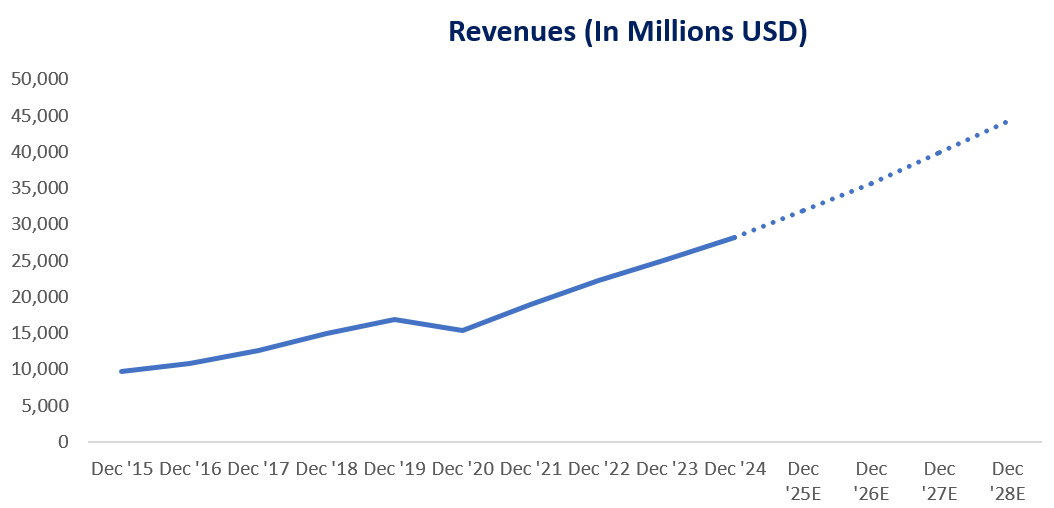

Revenue Growth:

FY24 revenue: $28.2B (+12.1% YoY)

FY25E: $31.9B (+13.1% YoY)

EPS: $14.6 (FY24) → $15.9 (FY25E) → $21.7 (FY27E)

Margins:

Gross margin: 96.3%

Op margin: 56.9%

FCF margin: 50.7%

ROE: 192% (on just 7B equity), ROIC: 55%

Cash:

FCF (TTM): $14.3B

Buybacks: $11B (2024), with net equity shrinkage ~2.1% YoY

Dividend: $2.74/share (+15.6% YoY), payout ratio ~19%

Use of Cash: Aggressively buying back stock (>$11B), $2.5B on M&A (e.g., MTN, identity, AI fraud), maintaining ~$9B in cash.

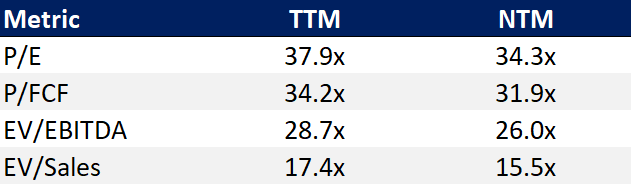

Valuation Snapshot

Versus Visa: V trades ~32x P/E NTM and ~28x EV/EBITDA NTM. The premium on MA reflects higher revenue growth and more aggressive expansion optionality (crypto, data services, SMB tools).

Strategic Catalysts

Crypto & Stablecoins: Partnership with Fiserv to accept USD-based stablecoins (FIUSD) at 150M+ merchants. Expanding blockchain settlement capabilities via Chainlink.

SME Expansion: “Small Business Navigator” suite targeting embedded payments, virtual cards, and risk tools for underserved SMBs.

Cross-Border Strength: 17% YoY growth in cross-border volumes. Still a key tailwind as travel normalizes and emerging markets digitize.

AI & Cybersecurity: Mastercard is embedding AI into fraud detection and merchant risk profiling. Identity and behavioral biometrics are being layered across services.

Buyback Machine: 5Y avg. net equity shrinkage >2% annually. Long-term compounding lever amplified by repurchases.

Technical Analysis

Monthly:

Wave (III) underway from 2022 lows. Rising channel intact. RSI at 65, not overbought. MACD histogram expanding bullish. 0.618 Fib retrace from COVID low held perfectly.

Weekly:

Clean impulsive structure. Currently completing subwave iii of (III). Major resistance at $565–570 (ATH zone). Break above clears runway to $600+. 21/55 EMA bull cross confirmed.

Daily:

Price consolidating in tight range $530–$550 post Q1 earnings beat. MACD curling up. RSI reset to 50s. Ichimoku cloud support intact. Looks like a classic Wave iv triangle before breakout.

Levels:

Resistance: $565 (ATH), $602 (Wave (III) fib ext)

Support: $528 (daily cloud), $510 (weekly base)

Invalidations: Weekly close below $502 breaks bull thesis short-term.

The Setup

A textbook high-ROIC compounder with secular tailwinds in global payments, digital ID, and crypto integration. Still trading at a premium - but one that compresses fast if growth holds.

Optionality: Blockchain rails, SME penetration, digital identity, and AI risk tools offer levers not priced into 34x NTM earnings.

Positioning:

Long-term: DCA-friendly zone below $530, but can initiate a small allocation today

Tactical: Add above $565 breakout

Risk: Tight stop under $502 (cloud break)

Next earnings: July 24, 2025

Conclusion

Mastercard isn’t flashy. But the pipes of the global economy don’t need to be. With double-digit revenue growth, massive cash flow, and stealth innovation in AI and blockchain, Mastercard is still a compounding machine.

If the next phase of financial infrastructure is programmable, cross-border, and identity-anchored, Mastercard is already there.

Just quietly executing.

Subscribed

The information in this post is for educational and informational purposes only. It reflects the author’s personal research and analysis, which may be subject to error or omission. This is not financial, investment, or trading advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment or trading decisions.