Mastering Moving Averages

A crash course in using SMAs and EMAs to filter the noise and find the trend.

Imagine you’re in a bustling harbor. The stock market is like the ocean - tides rising and falling, winds shifting every minute. You, the captain, must chart a safe course. But how can you discern the trend from the noise? Enter the Moving Averages.

The Ship and the Tide

Moving averages (MAs) are like the tides of the market. A simple moving average (SMA) captures the average price of a stock over a set number of days. An EMA (Exponential Moving Average) adds weight to recent prices, making it more responsive. Together, they help you understand the underlying trend despite short-term fluctuations.

The Story of the 50 and 200-Day MAs

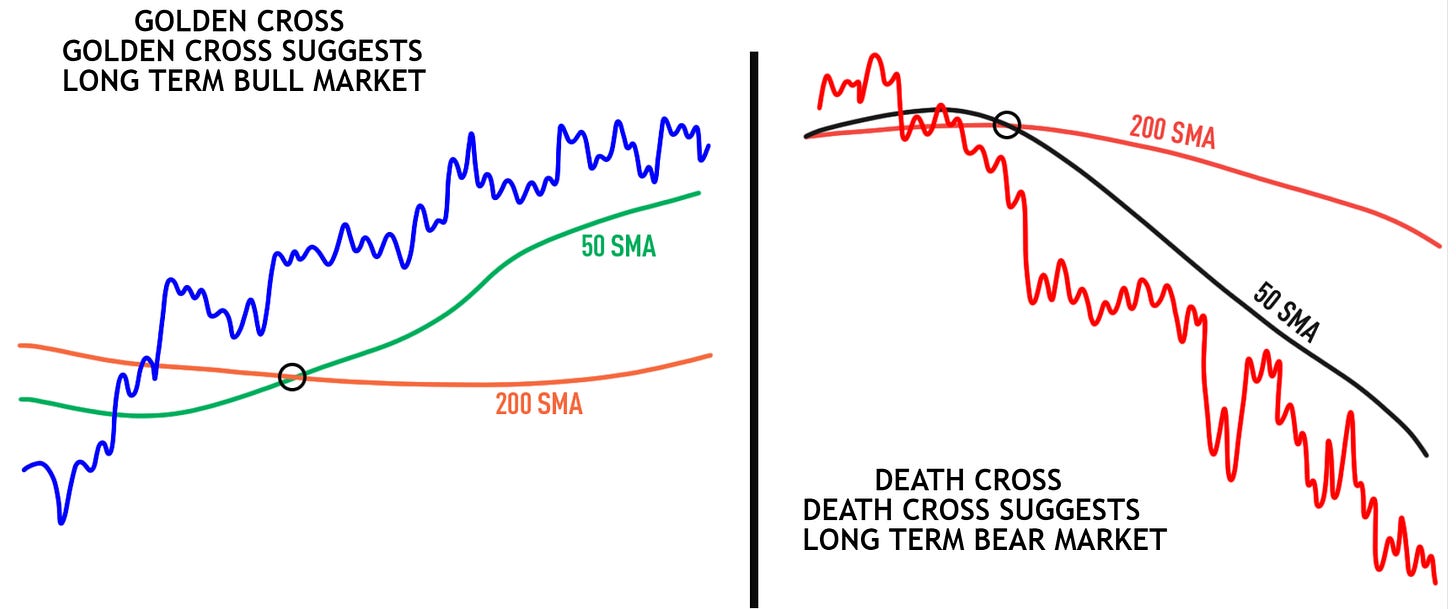

Picture a seasoned sailor teaching a novice about the seas. The 50-day MA is like the surface current, reacting quickly to changes in the wind. The 200-day MA is the deep, slow-moving undercurrent that shows long-term trend. When the 50-day MA crosses above the 200-day MA - a "Golden Cross" - it's like a favorable wind for your journey. Conversely, when it dives below - a "Death Cross" - it's a warning of rough waters ahead.

The EMA Advantage

An EMA is like a scout aboard your ship, alerting you quickly when the wind shifts. Its responsiveness makes it ideal for traders looking to make quick adjustments, especially in volatile markets.

Making Decisions with MAs

Moving averages don’t predict the future, but they give you a roadmap. They help filter out the noise, allowing you to focus on the trend. A quick rule of thumb: when the price is above the moving average, it often signals strength and an uptrend, while price below the moving average can imply weakness or a downtrend. Use them to determine entry and exit points, or to confirm other signals like RSI and Fibonacci retracements.

The Journey Never Ends

Mastering moving averages is like mastering navigation. It takes practice, patience, and an understanding of the elements. But with them, you can steer your trading ship towards calmer, more profitable waters.

Bon voyage, and may the trend be ever in your favor.