Meta’s New Era: Big Capex, Big Pressure, Big Opportunity

Why one of the best businesses on earth is trading like a problem child

Huge cash flows, huge capex, rising regulatory heat. Time to be precise, not emotional.

META 0.00%↑ is one of those names everyone thinks they understand.

“Ads on Facebook and Instagram. Prints money. Spends it on VR toys.”

That used to be a decent shorthand. It is not enough anymore.

Under the surface, Meta is turning itself into a heavy infrastructure company for AI, sitting on top of one of the most powerful attention funnels in history, while regulators and politicians line up with real questions about how that attention is monetized.

The result is exactly what the recent price action shows: a world-class franchise going through a sharp, emotional re-rating.

Let’s walk through what actually matters for medium to long term investors: the business, the cash flows, the regulatory temperature, the technical setup, and how to turn all of that into a clear trade plan.

Key Takeaways

Meta’s core business is still a monster: high-20s revenue growth with operating margins in the low 40s and massive operating cash flow.

Free cash flow is being deliberately crushed by an enormous AI capex cycle. Think 70 billion dollars plus in annual capex for the next couple of years.

The scandal risk is real. Regulators are now probing how much of Meta’s revenue comes from scams and prohibited ads, on top of privacy and antitrust pressure.

Technically, the stock is in a classic corrective phase after a big multi-year run. Price bounced from strong support in the high 500s and is now pushing into a thick band of resistance around 640 to 680.

For new money, this is not a “close your eyes and buy any price” story. The better spots are either:

Buying controlled pullbacks toward 600, or

Waiting for a clean reclaim and hold above roughly 680 to confirm the next leg higher.

Business and sector backdrop

The simplest way to think about Meta:

A giant, high-margin advertising engine across Facebook, Instagram, WhatsApp and Messenger.

A multi-year, very expensive build-out of AI infrastructure and models.

A long-term, capital-intensive bet on AR/VR and wearables through Reality Labs.

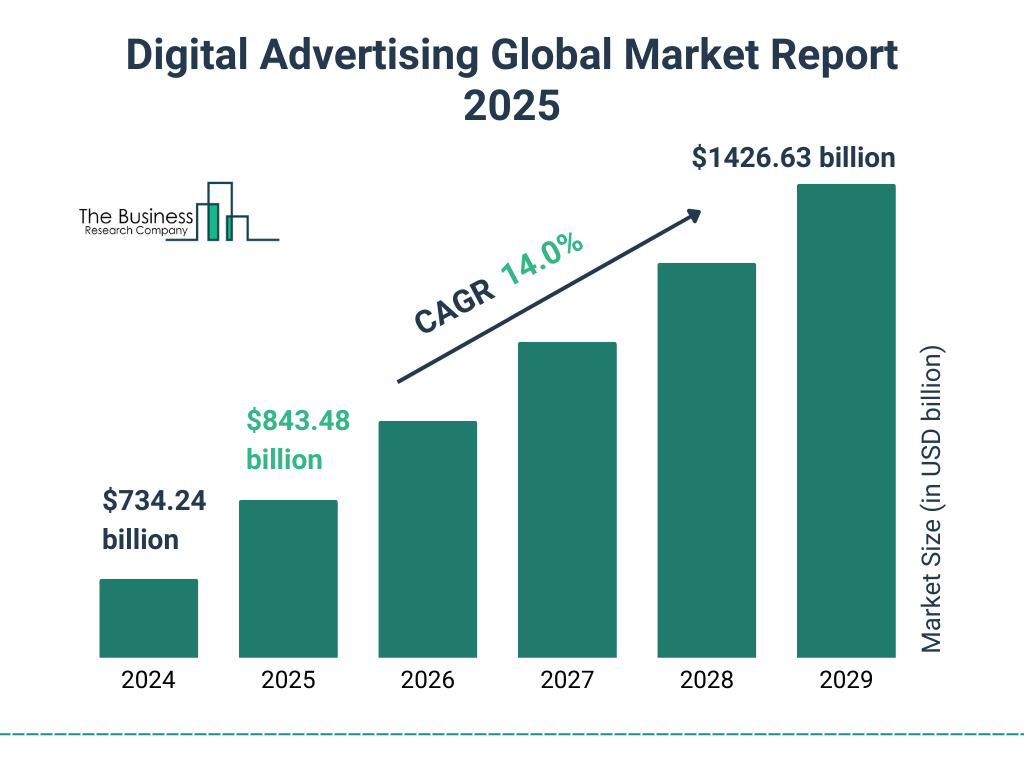

Digital advertising is still the growth engine. Global digital ad spend is compounding at a healthy clip and Meta is one of the primary beneficiaries. Engagement is massive, with well over three billion people using at least one Meta app daily. Reels and short-form video have gone from experimental to core, and AI-driven ranking has turned Reels into a serious revenue contributor rather than a drag.

At the same time, Meta is no longer “just an ad company”. Management is steering the company toward being an AI platform that:

Uses large models to power ranking, recommendations and ad targeting across its own apps.

Offers open-source models (Llama) that enterprises and developers build on.

Embeds an assistant layer (Meta AI) inside its social products and hardware like Ray-Ban glasses.

That shift is strategically smart. It is also brutally expensive.

Fundamental picture

Growth and margins

Over the last year, Meta’s revenue has been growing in the low-20s percent range. That is the kind of growth rate you expect from a younger platform company, not from a business of this scale.

Operating margins sit in the low-40s. That is elite territory. For all the headlines about spending, the core “Family of Apps” segment still throws off enormous profits.

The headline GAAP numbers recently looked ugly, thanks to a one-off, non-cash tax charge that made EPS collapse for a quarter. Stripping that out, earnings power is much healthier than the raw TTM EPS suggests. The market knows this, but the optics still matter for how the story is perceived.

Cash flow and capex

Where the story changes is cash flow.

Operating cash flow over the trailing year is comfortably above 100 billion dollars. Under a “steady state” capex profile, this would be a free cash flow machine.

Instead, capex has exploded into the 60-plus billion range, with guidance pointing to 70 to 72 billion next year and “notably larger” dollar growth again the year after. That is the AI build-out: data centers, networking, in-house chips, and a mountain of GPUs.

Free cash flow has actually drifted down even as revenue and operating profit climb. Management is consciously reinvesting the bulk of that operating cash into infrastructure.

On top of this, Meta continues to:

Buy back stock at scale.

Pay a small but symbolic dividend.

The balance sheet can support it. Net debt is modest. Cash and marketable securities are significant. The risk is not solvency. The risk is return on that capex.

Reality Labs

Reality Labs is still a large, deliberate sinkhole. Quest hardware, Horizon, and related efforts lose more than ten billion dollars a year.

There is strategic logic here: if AR glasses or mixed reality headsets become the next major computing platform, owning that layer is incredibly valuable. But in any realistic base case, these losses will continue for years. Investors are paying for that option via lower free cash flow today.

Regulatory and reputational heat

This is where the fundamental story gets messy.

Meta is now under pressure on three fronts:

Privacy and data use in Europe, including enforcement under the Digital Markets Act and fines tied to “consent or pay” models.

Competition and platform power concerns that sit in the background in multiple jurisdictions.

A newer, sharper focus on scam and prohibited ads. Internal documents and external reporting suggest that a meaningful slice of Meta’s ad revenue comes from questionable advertisers. Regulators and politicians are asking whether Meta knowingly profits from this activity.

If those investigations force Meta to clean house and cut out a meaningful chunk of low-quality revenue, there is a short-term hit to top line and margins, plus potentially large settlements or fines.

The bigger, slower risk is that regulatory regimes increasingly treat platforms as responsible for what they monetise, not just what they host. That would raise Meta’s cost base and chip away at the “infinite margin ad slot” model investors have enjoyed.

Fundamental conclusion

The core business is outstanding: high growth, high margins, enormous operating cash generation, and a balance sheet that can easily carry the current investment cycle.

The problem is not whether Meta is a good company. It is whether the combination of:

Huge, multi-year AI capex, and

Rising regulatory and reputational risk

will meaningfully reduce the long-run return on that cash and cap the multiple.

In other words, you are buying a great franchise in the middle of a very expensive and politically noisy transition.

Technical setup

The chart reflects that transition almost perfectly.

On the longer timeframe, Meta has already put in a big, clean advance from the 2023 lows into the 790 to 800 area in 2025. That run looks like a textbook five-wave impulse in Elliott terms.

From that peak, the stock broke hard. The autumn selloff drove price down into the high 500s, where several important pieces of structure sit on top of each other:

A deep retracement of the prior leg higher.

Long-term moving averages on the weekly chart.

The lower side of volatility bands that have contained the trend for the last couple of years.

Price reacted strongly from that zone, which is exactly what you expect when a secular uptrend goes through its first genuine shakeout.

From there, we are now in the middle of a sharp bounce. That bounce has already:

Retraced into the 0.38 to 0.5 Fibonacci area of the prior selloff.

Pushed back above short-term averages on daily and four-hour timeframes.

Driven momentum indicators from oversold back toward overbought in a hurry.

The issue is where it is happening.

Meta is now pressing into a very heavy band of resistance between roughly 640 and 680:

Prior breakdown levels and congestion from before the selloff.

The underside of important moving averages on the daily and weekly charts.

The first meaningful Fibonacci retrace cluster from both the daily and four-hour perspectives.

Elliott on the daily count treats the drop from the highs as an A-B-C style correction, with the recent bounce looking very much like a B-wave candidate. If that interpretation holds, a later C-wave would take another swing at the low 600s or even the high 500s.

Momentum supports that caution. Shorter-term oscillators are already overbought. MACD has turned up but is still below zero on the weekly. Volatility remains elevated. None of that screams “fresh, clean uptrend” yet.

Technical conclusion: this looks like a strong reaction rally inside a larger corrective phase. There is room for the bounce to stretch further, but the risk of another leg down is still alive until price can convincingly clear and hold above the upper 600s.

Our Risk Adjusted Trade Approach

Meta is in the middle of a corrective phase. It’s not the moment to chase strength into resistance, and it’s not the moment to pretend the pullback is guaranteed to keep going. The right approach is to let price come to you, either by offering a discount or by proving it’s ready for the next leg higher.

That means two very different ways to get involved: a pullback entry and a breakout entry.