Nebius Group (NBIS): Riding the AI Growth Rocket

From startup spin-out to hyperscale contender: can Nebius sustain its breakneck pace?

When growth is the game, scale is the only name.

Nebius Group NBIS 0.00%↑ has exploded onto the AI-infrastructure scene, vaulting from $4.7 M in revenue in 2021 to $161 M TTM into mid-2025. That’s a compound annual growth rate near 350%, powered by both one-off Yandex proceeds and the surging global demand for custom AI compute. In this deep-dive, we’ll explore:

Why growth has become Nebius’s signature metric

How fundamentals and technicals intersect for a growth-centric play

A trade approach keyed to scaling momentum with risk controls

Key Takeaways

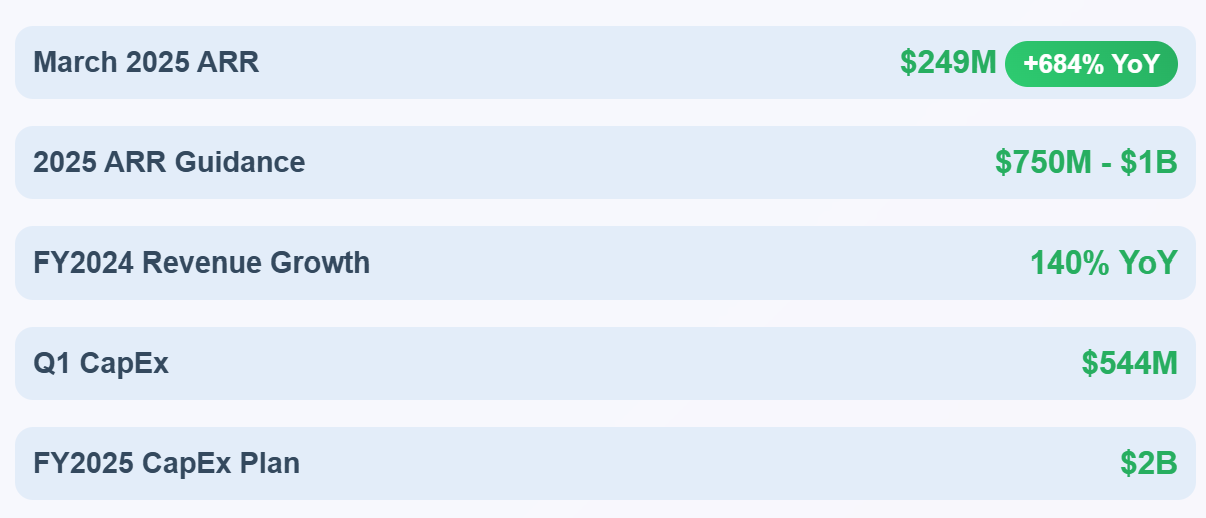

Revenue CAGR (2021–2024): ~350%

Q1 2025 YoY: +385% (from $11.4 M → $55.3 M)

Forecast (2025 ARR): $750 M–$1 B (+500% vs. 2024)

Balance Sheet: $5.4 B from Yandex divestment + $1 B convertibles = deep runway

Technicals: Strong base at $49–$52; upside to $63 (1.618 fib) → $73 (2.618)

Plan: Buy dips $49–$52; targets $63 / $73; stop $47.50

Bet on the curve, only if you respect the drawdown.

Fundamental Analysis: Growth in Focus

1. Stratospheric Revenue

2021 → 2022: $4.7 M → $20.9 M (+346%)

2022 → 2023: $20.9 M → $118 M (+462%)

2023 → TTM 2025: $118 M → $161 M (+37% ann.)

Q1 YoY: +385% (from $11.4 M → $55.3 M)

2. Investing to Grow

R&D CAGR (2021–2024): 82% (from $25 M → $145 M)

SG&A CAGR: 154% (from $18 M → $293 M)

EBITDA: Loss narrowing 12% YoY in Q1 2025 (–$70.9 M → –$62.6 M)

3. Cash & Runway

Operating burn: –$15 M → –$352 M (2021→2024)

Financing: $5.4 B (Yandex) + $1 B (convertibles)

Leverage: Traditional debt D/E ~0.2%

4. What’s Next?

ARR goal: $750 M–$1 B by end-2025 (+500% vs. 2024)

Risks: Capital-intensive builds, utilization hurdles, competition vs. hyperscalers.

Grow fast, but keep an eye on the burn.

Technical Analysis: Momentum Meets Growth

Weekly Base: $49–$50 support (200-week SMA + 61.8% fib).

Key Resistance: $55–$56 zone; break → $63.5 (1.618 extension), then $114.6 long term.

Daily Fib: Buy zone $52.7–$50.9 (38.2%–61.8% retracement).

Momentum: MACD flat, StochRSI neutral—setting up for next leg.

Volume Profile: Thicker on up-moves, lighter on dips—healthy accumulation.

When the trend is your friend, use pullbacks to join the party.

Our Investment Approach

Entry

Aggressive: $49.00–$50.00

Conservative: Wait >$52.70 daily close

Sizing & Risk

Stop at $47.50

Targets

Short: $63.00 (+25%)

Mid: $73.00 (+45%)

Long: $85–$95 if $1 B ARR is hit

Checkpoints

Q2 2025 ARR updates

EBITDA breakeven progress

Any guidance revisions

Bottom Line

Nebius is pure growth spectacular top-line momentum, deep pockets, but capital-intensive and not yet profitable. If you want AI-infra upside without perfect timing, layering in around $50 with tight risk control offers an attractive asymmetry.

Thanks for reading! Hit “subscribe” for more AI-infra trade ideas and deep dives!