Nike Inc. (NKE) - The Sportswear Giant

Oversold, misunderstood, and sitting on support. Nike’s moment of truth.

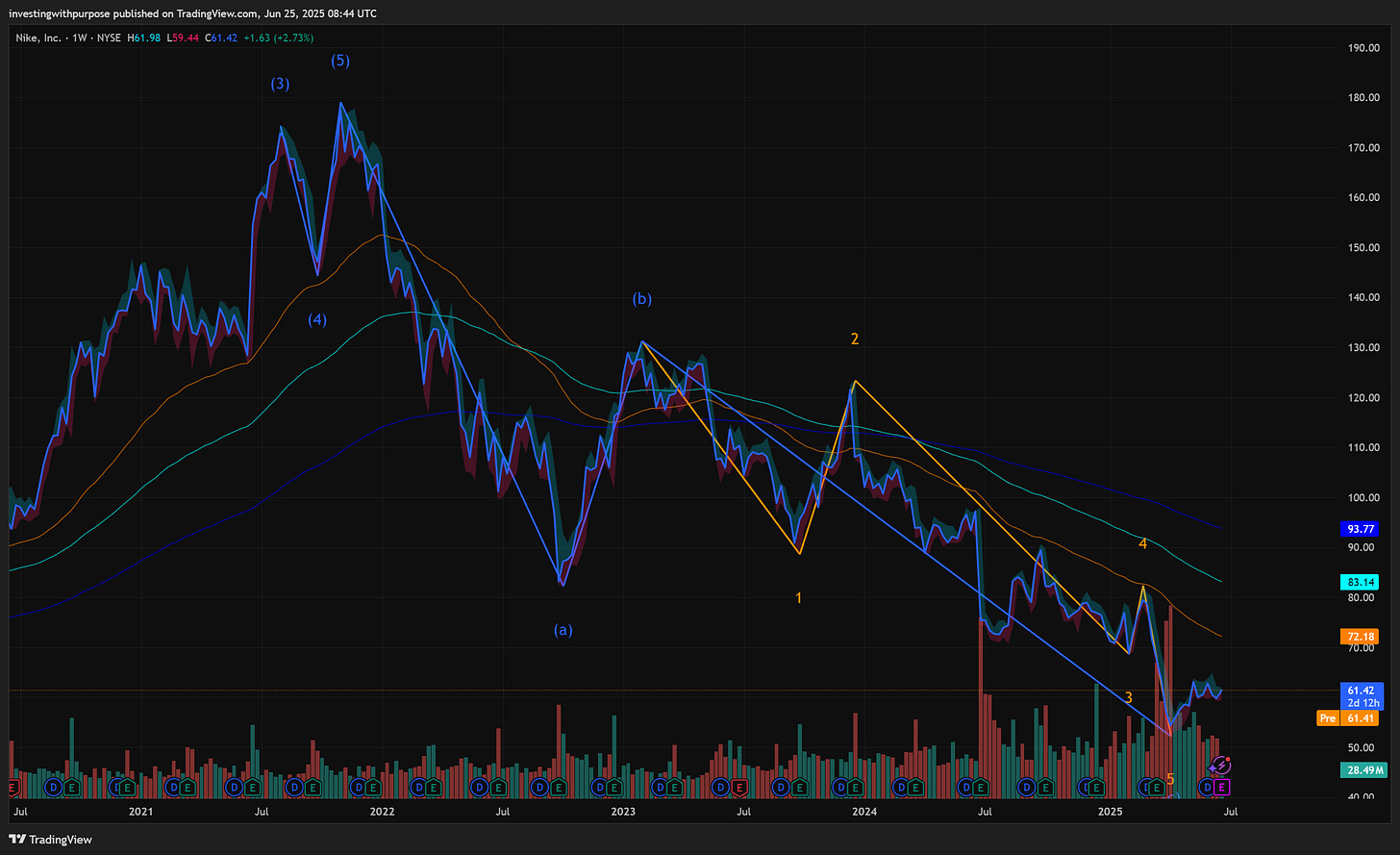

NKE 0.00%↑ reports this week. Bounced off 59.19 with a clean MACD cross and rising RSI. But this still looks like a wave (b) relief move inside a larger corrective structure. Big move coming. Earnings will choose the direction.

China sales are falling. Tariffs are back in play. Guidance could disappoint. But sentiment is wrecked and valuation is dirt cheap. Low bar + small beat = explosive move.

If NKE reclaims 64.01 post-earnings, it’s a long. Add above 66.93. Trim at 68.35, ride to 74.01 on strength. Stop under 59.19. No breakout, no trade. Let price lead. Here's how to look at this..

TL;DR

Current Setup: Price bottomed at $59.19 - a textbook fib + Elliott Wave (C) low. Bounce underway, but confirmation still needed.

Key Bull Thesis:

Technicals: Weekly MACD histogram just flipped positive. Daily RSI rising. Price consolidating under major resistance at $64.85.

Fundamentals: EPS down ~45% YoY, but margins remain resilient. Long-term P/E (~17× on 2028 EPS) suggests deep mispricing. Sentiment is washed out.

Catalysts: Earnings (June 27), tariff clarity, macro tailwinds (Fed pause/cuts), potential margin upside from DTC mix.

1. Fundamentals: Bad Optics, Strong Core

EPS & Valuation Reset

FY’25 EPS expected to fall ~45% YoY

But stock is already down ~36% from peak - most, and possibly all, of the pain is priced

Current forward P/E ~28× - expensive optically

But on 2028 EPS, $NKE trades at ~17× - historically cheap for a brand of this scale

Conclusion: Short-term optics are noisy. Long-term multiple suggests deep value.

Margins Holding Firm

Gross margin expected to fall from 44% → 42%

Decline is driven by volume, not pricing pressure

DTC strength and pricing power still intact

Conclusion: This isn’t a margin collapse - just a sales cycle compression.

Macro Headwinds Are Known

China sales are declining and expected to stay weak

Tariffs may weigh on investor sentiment, but impact is manageable

FX risk is real - but Nike has hedging and pricing levers

Conclusion: Headwinds are real, but already reflected in sentiment and price.

2. Technical Analysis: Multi-Frame Bottoming Structure

Weekly Chart: Base Formation

$59.19 marked the 1.0 fib extension of the wave (A)–(B) correction - classic wave (C) behavior

RSI (14) bounced from ~30 with bullish divergence

MACD histogram flipped green - early signal of reversal

Weekly EMA ribbon is flattening - first sign of longer-term stabilization

Implication: Weekly structure supports durable base-building and risk-defined entries.

Daily Chart: Trend Inflection Zone

Price stalled at $63.64 - near the 0.786 retracement of the prior downtrend

Still trading below $64.85 - critical breakdown level from early May

Daily MACD is rising toward zero, RSI climbing past 45

A clean close above $64.85 sets up a run toward $68.35, then $74.01

Implication: This is where the trend flips - but only on confirmation.

Intraday (2-Hour): Breakout Coiling

Price currently hovering below $64.01 Ichimoku cloud resistance

MACD crossed bullish; RSI holding above 50

Short-term structure suggests wave (b) may be ending

Implication: Clean breakout above $64.01 on earnings = early entry window. Below $61.25 = still unconfirmed.

3. Trade Plan: Phase-Based Execution

Phase 1 – Base Entry:

Enter between $59.50–$61.25 (wave (C) fib zone)

Stop under $58.80

Position size: 30% of full allocation

Phase 2 – Breakout Confirmation:

Add above $64.85 on MACD > 0 and RSI > 50

Target $68.35, then trail toward $74.01

Stop tightened to $61.25

Position size: 40% of allocation

Phase 3 – Trend Continuation:

Add remaining 30% on weekly close > $74.01

Long-term target: $114 (1.618× Fib extension from weekly wave structure)

Use trailing stop under weekly 50-SMA

Implication: Risk-defined, staged exposure into a macro reversal.

4. Macro & Catalyst Map

June 27 – Q4 Earnings: guidance clarity and margin commentary could spark re-rate

July 10 – CPI print: inflation slowing supports discretionary rotation

July 30 – FOMC Meeting: dovish tone or rate-cut hint = upside for consumer names

Q3 2025 – Margin updates from DTC push; potential stock buyback headlines

Ongoing – U.S.–China tariff talks: clarity or de-escalation could flip the sentiment switch

Bottom Line

$NKE is still one of the world’s most powerful brands.

But the market is pricing it like a broken story.

The chart disagrees.

With technicals stabilizing, valuation resetting, and sentiment wiped out - this is the kind of asymmetric setup worth watching.

Wait for confirmation.

Then ride the turn.