Options in a Personal Portfolio: Tools for Speculation, Hedging, and Strategy

How to integrate options trading into a sound financial plan, without gambling the future.

Options trading is often viewed as a high-stakes game for professionals. But with the right mindset, structure, and risk discipline, options can play a tactical role in a well-balanced personal portfolio. Whether you're using them to hedge risk or speculate on market direction, options can enhance your overall strategy, when used with purpose.

Let’s break down how to fit options into your personal finance framework, starting with your Investment Policy Statement (IPS), the Greeks, risk awareness, and a breakdown of core option strategies.

Why Talk About Options in a Personal Finance Context?

When most people think of options, they picture high-stakes trades, Reddit YOLOs, or Wall Street traders chasing short-term moves. But options aren't just about quick profits or directional bets. They’re powerful tools. Tools that, if used deliberately, can help manage risk, improve portfolio returns, and express market views with more precision and flexibility than buying or selling stock outright.

The challenge? Most individual investors never learn how to strategically incorporate options into their long-term plan. This post changes that.

We’ll cover:

The role of options in a disciplined personal investment strategy

How to use your Investment Policy Statement (IPS) to guide options allocation

The difference between speculative and hedged options trading

Why volatility and the Greeks matter

Core bullish, bearish, and hedging strategies you can use

How to think about risk allocation and portfolio design

Let’s start where all good personal finance strategy begins: with structure.

1. Anchor Your Options Strategy in Your Investment Policy Statement (IPS)

Think of your Investment Policy Statement (IPS) as your portfolio’s constitution. It defines your long-term goals, acceptable risk levels, and how you plan to allocate capital. Most investors write one for stocks, bonds, and real estate. But few ever account for options.

Here’s why that’s a mistake.

Options aren't a separate universe; they’re an overlay on the assets you already own or wish to trade. Your IPS should answer key questions like:

What percentage of my total portfolio is allocated to options trading?

For speculative trades, a conservative cap might be 5–10%.

For hedging strategies, that cap could be higher or based on exposure levels.

What is the purpose of using options in my portfolio?

Speculation? Hedging? Income? Tactical flexibility?

What criteria determine when and how I deploy options strategies?

Market volatility levels?

Earnings season or macro events?

Rebalancing or defensive positioning?

A sample IPS rule:

"I will allocate no more than 7% of investable assets to speculative options trades. Hedging strategies (e.g., covered calls, collars, protective puts) may be used up to 20% of assets under management, contingent on risk/reward ratios and volatility levels."

2. Know the Greeks: Measuring Risk Before You Trade

Options pricing isn’t just about the stock price. Tt’s about time, volatility, and movement probabilities. That’s where the Greeks come in. Think of them as the dials and meters on your risk dashboard:

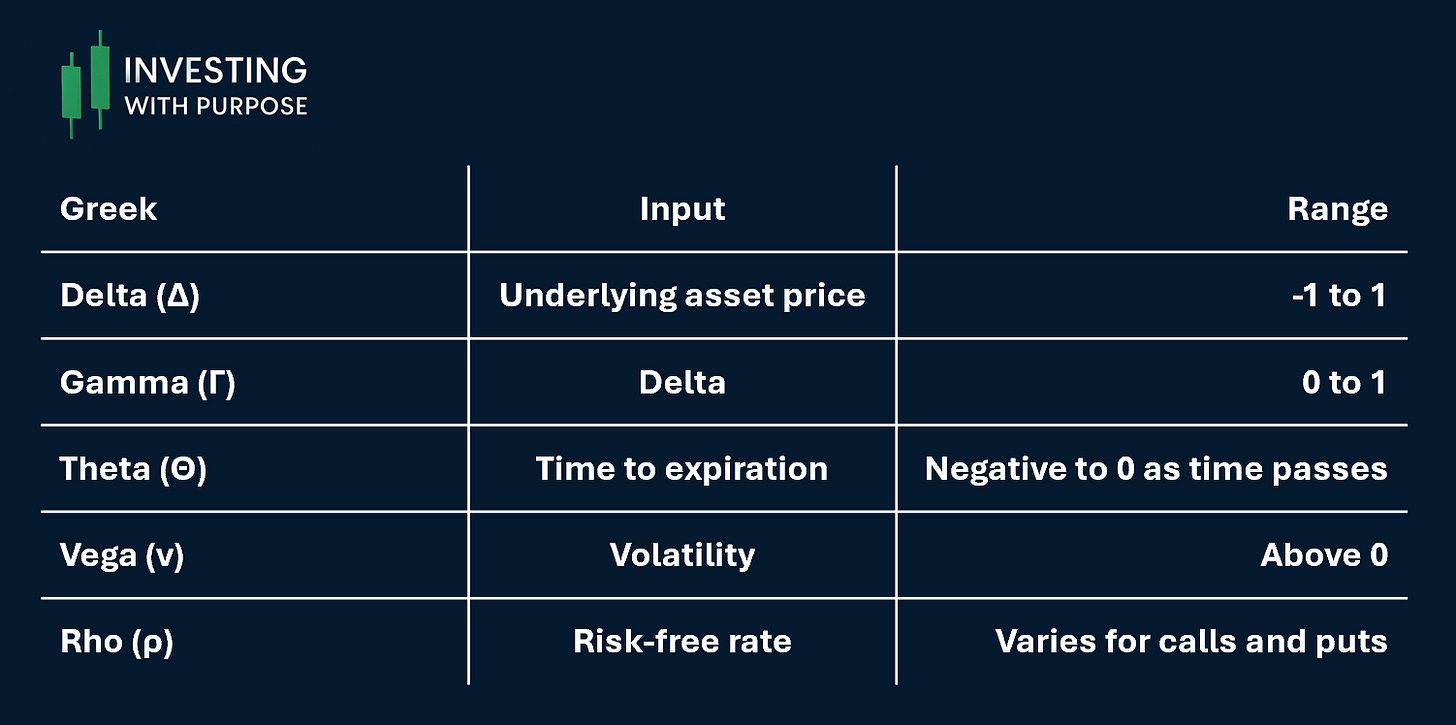

Delta (Δ): Measures how much an option’s price moves for every $1 change in the underlying.

A delta of 0.70 = the option moves $0.70 for every $1 stock move.

High-delta options behave more like the underlying stock.

Gamma (Γ): Measures how fast delta changes.

High gamma = your position becomes more directional quickly.

Theta (Θ): Measures time decay—how much value an option loses each day.

Short-term, out-of-the-money options are especially vulnerable.

Vega (ν): Measures sensitivity to implied volatility.

Long calls and puts gain value when volatility spikes; short options lose value.

Rho (ρ): Measures sensitivity to interest rate changes.

More relevant for LEAPS or long-dated options in a rising-rate environment.

Practical takeaway:

If you don’t understand the Greeks, you don’t understand the trade. Even basic strategies like selling a put can backfire if volatility drops or time decay erodes profits faster than expected.

Here’s a simple table summarizing each Greek, with ranges for a long position:

3. Volatility: The Invisible Force Driving Options Value

Volatility, especially implied volatility (IV), is arguably more important than the underlying stock movement itself. It tells you how much the market expects the asset to move in the future.

High IV: Option prices are inflated. Sellers are favored.

Low IV: Options are cheaper. Buyers are favored.

Use metrics like:

IV Rank: How current IV compares to its 52-week range.

VIX: A gauge of market-wide volatility.

Strategy implication:

Don’t just look at the direction. Ask whether the option is cheap or expensive based on IV. A neutral trade during high volatility can outperform a perfect directional call with poor volatility timing.

4. Speculation vs. Hedging: Two Very Different Games

A. Speculative Options Trading

This is where most retail traders begin. The allure? High upside, defined downside (if structured well), and leverage.

Bullish Strategies:

Long Call: Buy a call outright. Pure directional play. Cheap in low IV.

Example: Buy a $100 strike call on $AAPL expiring in 30 days. Risk = premium paid. Reward = unlimited.Bull Call Spread: Buy a lower strike call, sell a higher strike. Defined risk/reward.

Example: Buy $100 call, sell $110 call. Max gain = $10 spread - premium cost.Cash-Secured Put: Sell a put at a strike price where you’d be willing to buy the stock. If assigned, you buy the stock at a discount (great for income + entry planning).

Bearish Strategies:

Long Put: Pure downside bet. Works best in low IV and sharp selloffs.

Useful for short-term corrections.Bear Put Spread: Buy a higher strike put, sell a lower strike put.

Defined risk and cheaper than a naked put.Call Credit Spread: Sell a call above current price, buy a higher call for protection. Profits if stock stays below short strike.

Reminder: Speculative strategies should be position-sized based on total portfolio impact. You might make 300%, but if it’s 1% of your portfolio, it won’t change your outcome. And if it's 20%? You could blow up on one earnings report.

B. Hedging and Risk Management Strategies

Options shine when used to reduce risk or manage concentrated exposures. These aren’t bets, they’re safeguards.

Core Hedging Strategies:

Covered Call: Own 100 shares, sell a call above current price.

You generate income (the premium), but cap your upside.

Protective Put: Own stock, buy a put to limit downside.

Works like insurance. You pay a premium, but protect against large drops.

Collar: Own the stock, sell a call and buy a put.

Define a max gain and a max loss. Useful for protecting gains in volatile markets.

Index Hedges (SPY, QQQ puts): Hedge portfolio-level risk.

Particularly useful for retirement accounts or long-term holdings that can’t be touched tax-efficiently.

Why this matters:

If your job, pensions, and investments are all in tech, a put option on QQQ can diversify your downside exposure without having to sell core holdings.

Delta-Neutral Hedges: Hedging Without Taking a Directional View

For those with more experience, or those managing larger, more concentrated portfolios, here’s a way to remain market-agnostic while still extracting value from options pricing dynamics.

Delta-neutral hedging takes a more nuanced approach: it aims to eliminate directional risk (delta) by balancing long and short exposures in a position. You're not betting up or down, you're managing movement.

What is it?

A delta-neutral position has a net delta of ~0, meaning the portfolio is largely indifferent to small moves in the underlying asset.

Say you short 100 shares of a stock (delta = –100), and you buy a call option with a delta of +0.50. You’d need to buy two of those calls (2 × 0.50 = +1.00 or +100) to offset the short position. Now you’re delta neutral.

Where it fits in your portfolio:

For professionals or advanced retail investors who want to trade volatility or gamma without betting on price direction.

As a temporary hedge during uncertain macro conditions when your directional conviction is low.

Within a rules-based strategy—such as market-neutral funds or quantitative overlays.

Why it's useful:

Profit from volatility expansions (e.g., if implied volatility is low).

Reduce risk of price moves, while benefiting from other Greeks like theta (time decay) or vega (volatility exposure).

Downside:

Requires active management and constant rebalancing.

Exposure to gamma and theta risk (especially around expiration).

Not suitable for all portfolios due to complexity and transaction costs. It’s not necessary for everyone, but worth exploring as your knowledge and exposure grows.

5. Risk Management and Portfolio Allocation: Stay Grounded

Options should never dominate your portfolio. Even professional funds that specialize in derivatives rarely allocate more than 10–20% of their capital to active options positions.

Options Allocation Guidelines

Purpose: Speculation

Suggested Allocation: 2–5%

Notes: Treated like venture capital: high risk, high reward.

Purpose: Income (covered calls, cash-secured puts)

Suggested Allocation: 5%

Notes: Tied to core holdings. Risk-defined strategies with limited downside.

Purpose: Hedging

Suggested Allocation: 5–15%

Notes: Based on portfolio exposure. Concentrated positions may warrant more.

Execution Best Practices:

Always use limit orders. Option spreads can be wide and predatory.

Avoid illiquid options chains.

Check the Greeks before entry. Especially theta and vega on long-dated options.

Know your exits. Set a price target and stop-loss plan in advance.

Don’t let options distract you from your long-term goals.

Conclusion: Options With Purpose

Options aren’t magic. They don’t eliminate risk—they reshape it. But when embedded within a disciplined financial plan, they offer precision, flexibility, and risk control that traditional asset classes can’t match.

Used wisely, options can:

Provide downside protection

Generate income from core positions

Enhance returns on high-conviction trades

Express views with defined risk

But used recklessly, they can just as easily destroy capital and create behavioral traps.

The key? Have a plan. Know your purpose. Respect the risk.

Start small. Define the why. Align with your IPS. And always remember: in personal finance, your job isn’t to swing for the fences. It’s to stay in the game.

Thank you for reading.

-IWP