Oscar Health (OSCR): Betting on Growth and Riding the Wave

Balancing the high-growth promise against execution risks in a fresh technical uptrend

Oscar Health has captured headlines as it races to redefine insurance through tech. After months of digesting costs, the stock burst higher this June, shaking off skeptics. Is this the start of a sustainable rally, or a short-term relief bounce?

Buckle up, it’s about to get interesting.

In a Nutshell

Fundamentals: Strong revenue growth, improving margins, solid liquidity, but a valuation that demands perfection.

Technicals: Broke out from a base at $17; new impulse wave targeting $22 and beyond.

Plan: DCA into $20–21 for the long haul; swing traders can buy a break above $20.90, stop $19.80, target $22.10+.

Let’s peek under the hood.

Fundamental Analysis

Oscar Health enters 2025 at the apex of its rapid‐growth phase, bolstered by impressive top‐line acceleration and a steadily narrowing cash burn. A close look at the numbers, and the trends behind them, illustrates why both growth investors and more valuation‐conscious buyers are keeping a close eye on this insurtech.

1. Revenue & Membership Momentum

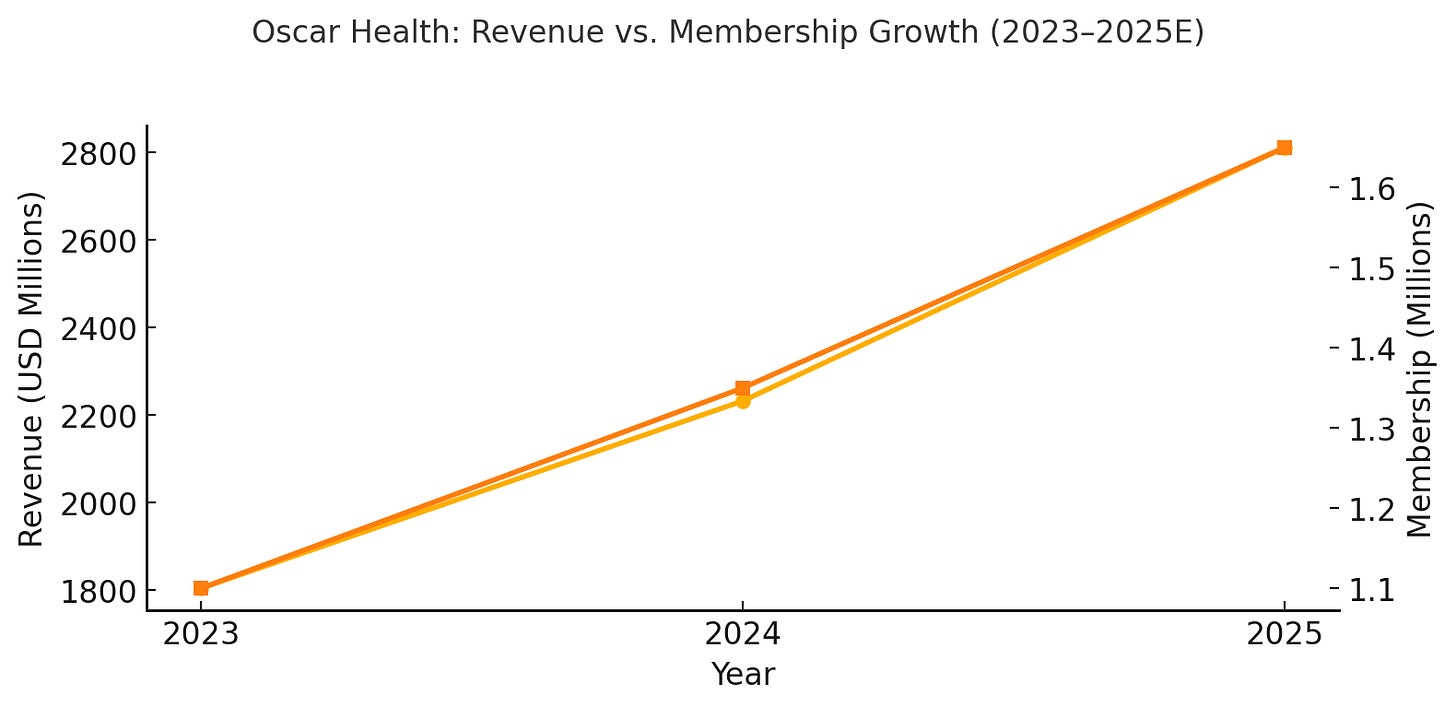

Explosive Growth: Revenue surged 23.7% year-over-year, from $1.80 billion in 2023 to $2.23 billion in 2024. Your internal forecasts show a further 26.0% climb to $2.81 billion in 2025.

Membership Expansion: This top-line lift is driven squarely by member growth, lives covered rose from 1.10 million at year-end 2023 to 1.35 million in 2024 (+22.7%), with a 2025 target of 1.65 million lives (+22.2%). This consistent 20-plus percent annual ramp confirms Oscar’s ability to scale its digital enrollment engine across new states and product lines.

Because growing isn’t enough, scale matters.

2. Stable Gross Margins & Operating Leverage

Gross Profit & Margin: Gross profit climbed from $710 million in 2023 to $885 million in 2024, keeping gross margin steady at ~39.7%. The fact that margins held flat despite rapid growth suggests Oscar is neither sacrificing profitability for scale nor encountering unexpected medical-cost inflation.

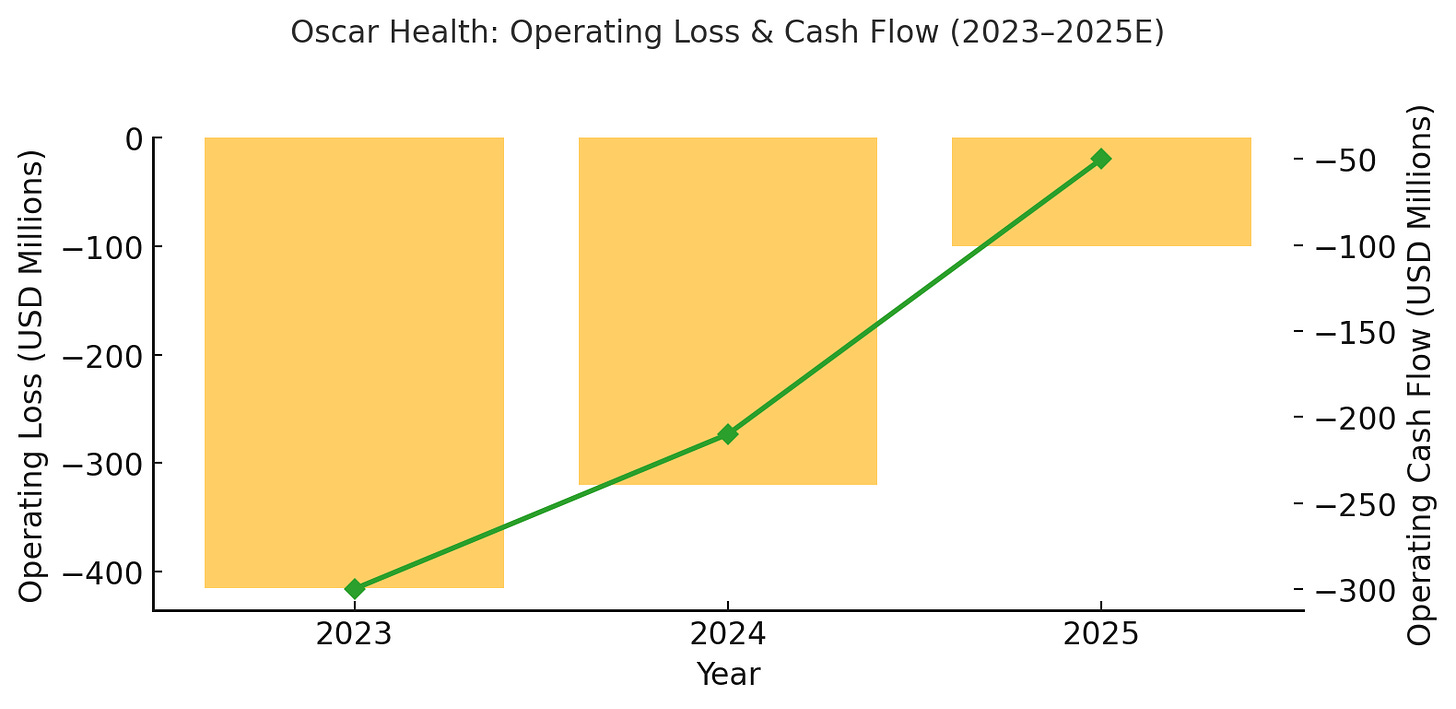

Improving Opex Efficiency: On the cost side, operating losses narrowed from –$415 million to –$320 million, even as sales & marketing and technology spending continued. This represents a meaningful improvement in operating leverage, Oscar is beginning to earn more per incremental dollar of revenue.

Profitability isn’t just a buzzword...it’s the endgame.

3. Path to Profitability

Adjusted EBITDA Turning Positive: Adjusted EBITDA losses fell by half (–$160 million → –$80 million) and are forecast to swing to a $10 million positive in 2025.

Net Loss Trajectory: Net loss likewise improved from –$455 million (2023) to –$350 million (2024), with a 2025 estimate of –$120 million, bringing the company tantalizingly close to breakeven at the bottom line.

Breakeven is on the horizon.

4. Cash Flow & Liquidity

Shrinking Cash Burn: Operating cash flow improved significantly (–$300 million → –$210 million → –$50 million projected), while free cash flow followed suit (–$350 million → –$245 million → –$60 million). Oscar’s balance sheet now carries $525 million in cash and equivalents, enough to fund the business well into positive free-cash-flow territory.

Healthy Coverage Ratios: A current ratio of 1.4× and minimal long‐term debt ($150 million) leave ample runway for further expansion without imminent refinancing risk.

Cash is king, runway is queen.

5. Valuation Context

Premium Multiples, Cooling Forward Multiple: Oscar trades at 2.3× trailing-12-month revenue, a notable premium to the ~1.2× average among younger insurtech peers. However, on 2025 sales of $2.81 billion, its forward EV/Sales multiple compresses to 1.9×, making the valuation more palatable as the company reaches scale.

Here’s where the rubber meets the road.

6. Key Catalysts & Potential Headwinds

Catalysts:

Medicare Advantage Launch (2025): Entry into a high-margin government line of business could further elevate average premiums and profitability.

Provider Partnerships: Deepening risk‐sharing arrangements with health systems may unlock better cost controls and improve loss ratios.

Platform Extensions: Roll-out of virtual primary care, pharmacy benefit enhancements, and employer group products offer additional revenue and margin levers.

Catalysts are great, just don’t forget the landmines.

Risks:

Regulatory Shifts: Changes to ACA subsidies or state insurance rules could pressure enrollment economics.

Margin Pressure: If medical cost trends outpace pricing flexibility, gross margins could erode.

Execution Risk: Scaling across new geographies and product types adds complexity; missteps could weigh on member satisfaction and retention.

Time to connect the dots.

Fundamental Verdict

Oscar Health sits at a compelling inflection: revenue scaling north of 25% a year, membership growth exceeding 20% annually, and a clear glide path toward adjusted EBITDA breakeven in 2025. Its fortress‐like liquidity and improving cash flows buy the company time to perfect its tech-backed insurance model. The premium valuation reflects lofty expectations, but with forward revenue nearly $3 billion and adjusted EBITDA turning positive, Oscar may finally be stepping out of the “growth at any cost” phase into a more sustainable, free-cash-flow–generating future.

Now, onto the price action.

Technical Analysis

Timeframes:

Daily (1D): Price broke above the $17.00–17.50 consolidation, now trading $20.80. Fibonacci extensions project near-term targets at 1.618×: $22.10, 2.618×: $24.00, and 3.618×: $26.00.

4H/2H/1H: Elliott wave counts suggest the stock completed a five-wave advance into the recent high (~$22.30), followed by a corrective ABC finishing near $19.00–19.50. A fresh impulsive wave up appears underway.

30m/5m: Short-term momentum (StochRSI, MACD) is bullish after bouncing from the 1.618 fib swing, with support at the 20 EMA (~$20.20).

Indicators:

RSI/StochRSI: RSI ~68 (daily) signals strength but not overbought; StochRSI on 5 min now oversold → short-term lift likely.

MACD: Positive MACD divergence on daily & hourly, indicating bullish momentum.

Ichimoku: Price well above the cloud, Tenkan crosses above Kijun, bullish signal.

Bollinger Bands: Bands widening, volatility rising, and price hugging the upper band, confirming upward pressure.

ADX/ATR/OBV: ADX ~30 (2H) confirms a strong trend; ATR rising signals higher volatility environment; OBV climbing, showing volume confirms the move.

Dip-buy zone: $20.20–$20.50 (20 EMA & daily 23.6% retrace) offers a favorable entry with tight risk (~$19.70–$19.90).

Technical Conclusion: The uptrend is intact. Key support at $20.20–20.50; failure below $19.80 would warn. Upside targets: $22.10, $24.00, then $26.00.

Let’s talk execution.

How We’re Moving

Investment (2–12 month):

Entry: Dollar-cost average between $20.00–21.00.

Weighting: Initial 50% size; add on pullbacks toward $19.00–19.50 if fundamentals remain intact.

Stop: Below $18.50 (a break of the daily swing low).

Targets: Scale partial at $24.00 (2.618 fib), remainder at $30.00 (3.618–4.236 fib).

Swing Trade (1–4 week):

Entry trigger: Close above $20.90 (recent high).

Stop-loss: $19.80.

Target: $22.10, then $23.50.

Because a plan without rules is just a wish.

In the end, it’s all about balance.

Oscar Health blends compelling growth with execution risk. Technically, it’s in a clear uptrend, an appealing swing setup and a structured ladder for investors. But valuation is rich, and regulatory or operational missteps could derail. A balanced approach, capitalizing on momentum with disciplined stops while layering in for the long term, offers the best of both worlds.