The market has shifted into a slower, more selective phase, but that doesn’t mean opportunity disappeared. In fact, many of the best moves over the past weeks came after pullbacks into well-defined support, not from chasing highs. Price came to the levels, structure held, and upside followed.

That’s the environment we’re still in.

Momentum hasn’t vanished, but it has become more conditional. Breakouts need confirmation, while pullbacks into demand continue to offer the cleanest risk-reward. The goal remains simple: let price come to us, define risk first, and only engage when structure confirms.

Patience isn’t defensive here. It’s what’s working.

The Market State

This is consolidation after strength, not distribution. Trends aren’t broken, but momentum has slowed, shifting the edge from speed to structure. Failed breakouts reset timing, while sideways markets reward patience.

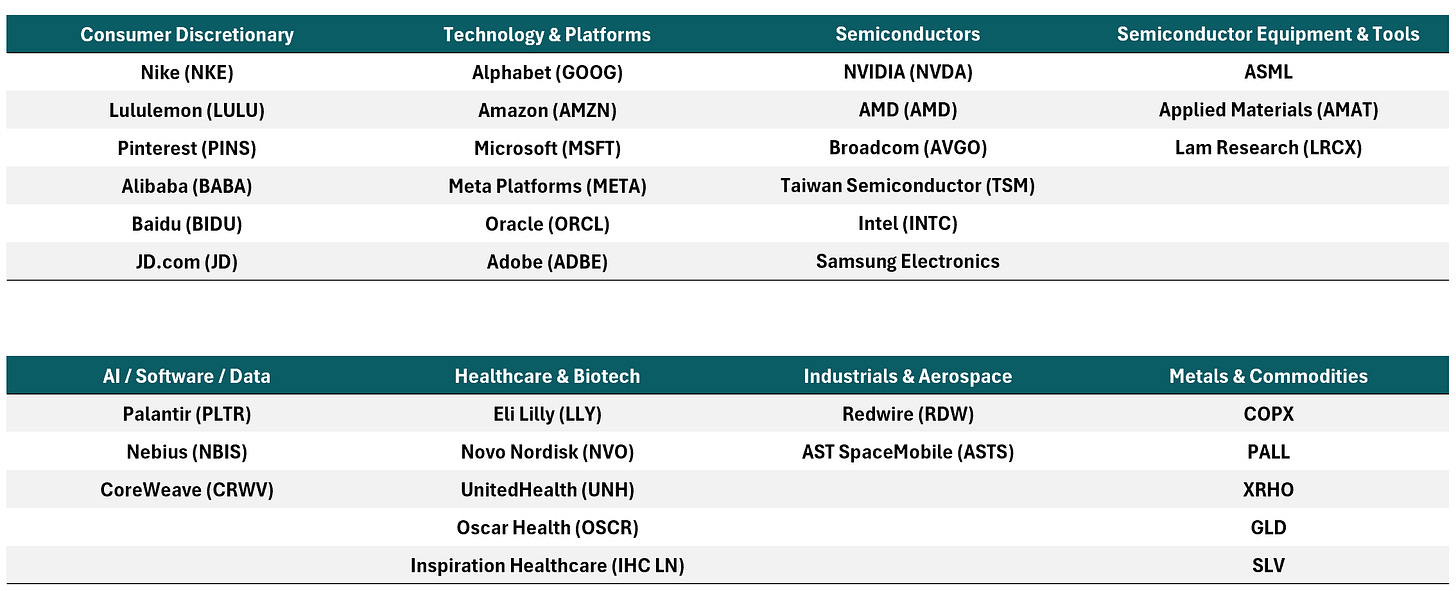

This trade plan update below covers all stocks and ETFs in the table that follows.

How We’re Executing

We act only at defined levels, where downside risk is already known.

We avoid the middle. We don’t chase strength. We step aside when structure breaks.

Not every dip is a buy. Not every bounce deserves exposure.

Cash is a position. Waiting is part of the plan.

Risk Comes First

This phase rewards risk control more than conviction.

Position sizing matters. Stops matter. Doing nothing matters.

Protecting capital now creates optionality later.

Don’t Miss out!

We’re still offering our 6-month complimentary trial through the end of December. Subscribers get full access to all deep-dive research, multi-timeframe technical analysis, and ongoing trade plans and updates. If you’ve been considering joining, this is the window to lock it in.

Technology – Mega Cap & Platforms

Alphabet (GOOG)

Buy pullbacks into 303–300 or a confirmed breakout above 322, with risk below 292. Upside targets sit at 315, 322–325, and 339–370 if momentum re-accelerates.

Microsoft (MSFT)

Price remains in a corrective phase, holding above mid-470s support. Accumulation is favored on pullbacks into 450–445, with deeper support at 440–430. A sustained hold above 500–505 would signal renewed trend continuation.