Our Trade Plan Update For The Week Ahead

From the last week of 2025 to the first week of 2026, here are our updated trade plans for the key securities we covered in December.

As we start the final week of 2025, this update reflects how the market has evolved since the holidays, not a change in philosophy. Price has moved, momentum has selectively re-accelerated, and several setups have transitioned from pullback entries into momentum tests or digestion zones. The work now is about distinguishing continuation from exhaustion, and participation from patience.

This is still a market that rewards structure over speed. Some positions are working and approaching targets. Others require confirmation before exposure increases. A few have shifted into observation mode after breaking structure. The objective remains the same: engage only where risk is defined and asymmetric, and step aside when it isn’t.

Execution matters more than conviction here. Let price confirm the next move.

How We’re Executing

We act only at defined levels, where downside risk is already known.

We avoid the middle. We don’t chase strength. We step aside when structure breaks.

Not every dip is a buy. Not every bounce deserves exposure.

Cash is a position. Waiting is part of the plan.

Risk Comes First

This phase rewards risk control more than conviction.

Position sizing matters. Stops matter. Doing nothing matters.

Protecting capital now creates optionality later.

Don’t Miss out!

We’re still offering our 6-month complimentary trial through the end of December. Subscribers get full access to all deep-dive research, multi-timeframe technical analysis, and ongoing trade plans and updates. If you’ve been considering joining, this is the window to lock it in.

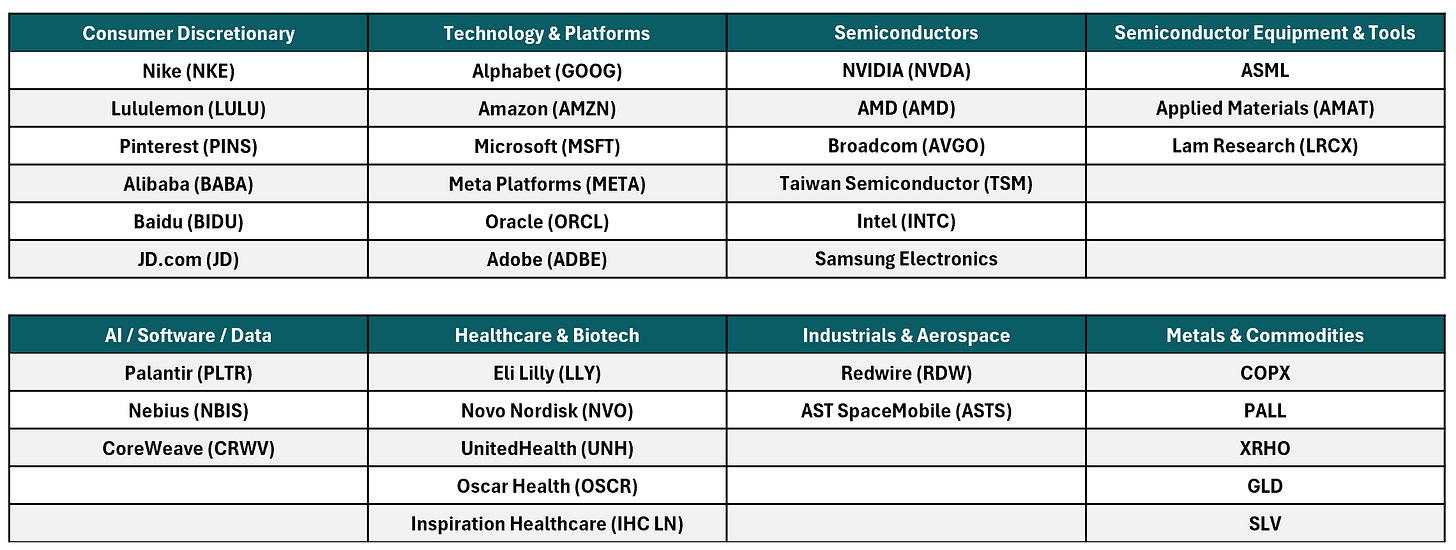

This trade plan update below covers all stocks and ETFs in the table that follows.

Technology - Mega Cap & Platforms

Alphabet GOOG 0.00%↑

Buy pullbacks into 300-303, where prior demand and structure align. A confirmed breakout requires a daily close above 322. Risk is defined below 292. Upside targets remain 315 first, then 322–325, with a broader extension toward 350–370 if momentum re-accelerates.