Palantir (PLTR): Navigating the Next Wave – A Deep Dive Fundamental & Technical Review

Balancing explosive growth, improving margins, and an actionable trade plan amid a fresh pullback.

Palantir Technologies PLTR 0.00%↑ has commanded headlines with its government contracts, AI platform ambitions, and recent surge to new all-time highs. But after a sharp ~9% pullback in the past two days, questions swirl: Is the broader up-trend intact? Are fundamentals robust enough to shoulder current valuations? And most importantly, where to place your next trade?

Key Takeaways

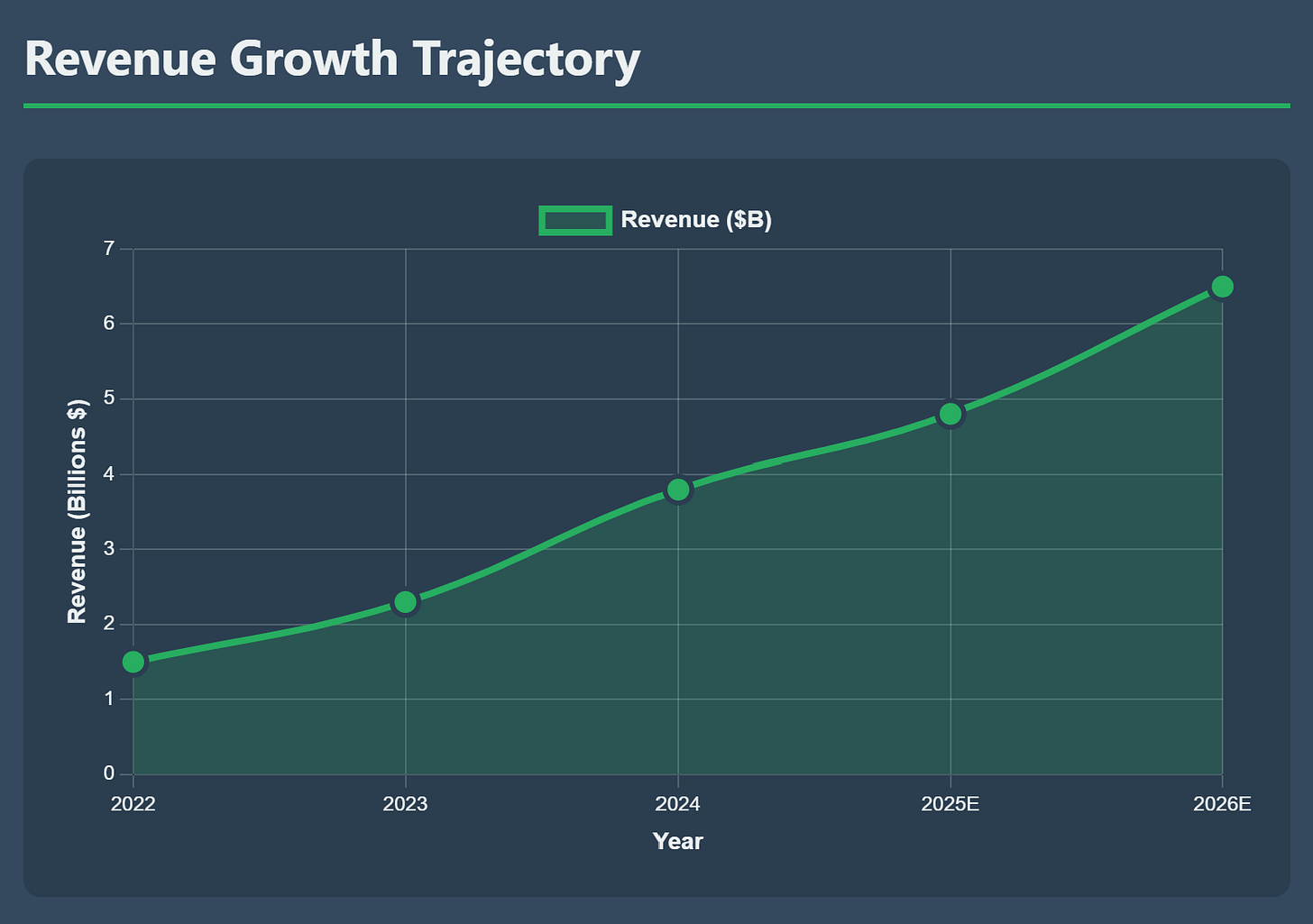

Fundamentals: Revenue +25% YOY to $3.8 B (FY24), 75% gross margins, narrowing operating loss, net loss down ~40%, cash +$3.5B+$3.5 B+$3.5B, zero net debt, positive FCF in FY24. Projections: revenue +35% in FY26, EBITDA margin ~20%.

Technicals: Weekly Ichimoku & BBands bullish, but daily and intraday show Tenkan-Kijun cross fading and price testing lower BB. Key support at $123.80 (monthly pivot/Kijun), next at $108.37 (100-day SMA).

Trade Plan: Scale into long near $124–120, stop <$115, targets at $150 (upper Bollinger band) and Fibonacci extensions $160–$172. Confirmation: daily close >$124 and bullish RSI/Ichimoku turn.

Fundamental Analysis

1. Robust Growth & Improving Profitability

Revenue: $3.8 B in FY24, +25% YOY. Enterprise & gov’t segments both gaining traction.

Margins: Industry-leading 75% gross margin; operating losses shrinking as G&A and R&D scale more slowly than top line. Adjusted EBITDA margin turning positive (~10% in FY24), forecast to hit ~20% by FY26 (per management guidance).

Cash Flow & Balance Sheet:

Operating cash flow turned positive in FY24 (~$150 M).

Free cash flow positive (~$50 M) and rising.

Cash & equivalents of $3.5 B vs. negligible debt – ample runway.

Forward Outlook: Consensus forecasts (2025–26) point to accelerating revenue growth into the mid-30s percent range and further margin expansion. This positions Palantir to finally deliver sustainable profitability and FCF growth.

From red ink to green light – fundamentals are lining up for Palantir’s next act.

Technical Analysis

Multi-Timeframe Ichimoku & Bollinger Bands

Weekly: Price sits above a bullish Kumo cloud, Tenkan (green) > Kijun (blue), and Chikou span (lagging line) well clear of price – long-term trend remains strongly bullish. Weekly BB has expanded, and last week’s candle touched the upper band near $150 before reversing.

Daily: Recent pullback has price breaking below the 20-day BB middle line , but still above Kijun . RSI sits ~48. Daily Bollinger squeeze has released into a bearish expansion, signaling elevated volatility.

Intraday (2h/30m): Short-term RSI dipped below 30 on the 2h chart, stochastics deeply oversold on 30m; both suggest a relief bounce is likely soon.

Pivot Levels & SMAs:

Monthly pivot: $123.80 (converges with 50-day SMA).

Support zones: $123.80 ➔ $108.37 (100-day SMA) ➔ $83.39 (200-day SMA).

Resistance: $141.74 (monthly R1), $150 (weekly BB upper band), then $160 (1.618 fib extension).

Technicals flashing a short-term red, but the weekly green light stays on.

What we’re doing bout it

Strategy Type: Swing trade with longer-term clawback into uptrend

Entry Zone (Scale In):

First tranche at $125–123 (near monthly pivot/Kijun).

Second tranche at $121–120 (approaching 61.8% fib retrace/$120 psychological).

Stop Loss: <$115 (below Ichimoku daily cloud and 200-day SMA).

Targets:

T1: $150 (upper weekly BB).

T2: $160–$172 (fib extension clusters + next quarterly pivot).

The Bottom Line

Palantir marries compelling long-term fundamentals — strong growth, improving profitability, and pristine cash flow — with a technical structure that’s simply on a healthy short-term breather. This confluence argues for a dip-buying opportunity:

Fundamental bulls lean on revenue accelerations and margin take-up.

Technical bulls watch for daily green-signal reconfirms at $123–120 to resume the uptrend.

Across the board, patience to scale in on weakness with disciplined stops and clear targets sets you up to ride Palantir’s next data-driven wave.

Ready to jump in? Or waiting for that bullish daily Tenkan cross? Drop your thoughts and let’s navigate this together!