Quantum Computing Mini-Supercycle: IONQ, RGTI, QBTS

Inside the quantum race: where IonQ, Rigetti, and D-Wave stand as AI, defense, and capital markets converge.

Quantum went from science project to “we need a board update” in <24 months. The catalyst wasn’t a single press release, it was the AI build-out. Hyperscalers, defense, pharma, and financials are all hunting for edge cases where quantum today saves real time or cost (optimization, sampling, Monte Carlo), while tomorrow promises fault-tolerant disruption.

This post compares three pure-plays across different hardware stacks:

IonQ IONQ 0.00%↑ – trapped-ion, cloud-delivered quantum as a service.

Rigetti RGTI 0.00%↑ – superconducting gate-model systems, fab + systems under one roof.

D-Wave QBTS 0.00%↑ – quantum annealing focused on near-term optimization at enterprise scale.

We’ll keep it approachable and practical: pipelines, fundamentals, technicals (levels you can actually trade), a conservative trade plan, then the bottom line.

Key takeaways

Different hardware, same customer pain point: optimization/simulation that sits next to AI, not against it.

IONQ has the best combination of top-line scale and margin profile, plus a deep cash stack ($547m total liquidity in cash+STI).

RGTI is a call option on execution with ample runway ($426m liquidity) and cleaner cap table risk than bears assume.

QBTS focuses where the money is now; industrial optimization via annealing, and carries extraordinary cash ($819m) relative to burn.

Technically, all three are in pullback mode within larger uptrends. Best entries cluster around 0.50–0.618 retracements with tight invalidations.

Macro matters: higher real yields pressure multiples; AI capex and defense funding offset cyclicality.

Pipelines (what are they really selling?)

Common buyer profile: cloud + enterprise innovation teams, national labs/defense, auto/aerospace, logistics, financials, pharma. POCs start small (five- to six-figure) and, if ROI is proven, grow to annualized commitments for capacity + support.

IONQ – sells QPU access (through AWS/Azure/Google & direct), application development, and custom projects with partners. Traction strongest where cloud marketplaces reduce procurement friction.

RGTI – offers QPU access + professional services and is pushing system deliverables/hosting with a vertical fab angle (controlled supply chain, faster design cycles).

QBTS – annealing-based optimization with full-stack software (Ocean, hybrid solvers). Clear line of sight to logistics/route planning, manufacturing yield, portfolio optimization, anomaly detection; use-cases that don’t need fault tolerance to pay back.

Takeaway: near-term revenue = usage + services tied to tangible ops wins; long-term upside = scaling qubit quality, availability, and dev-tools that make results repeatable.

Fundamental analysis

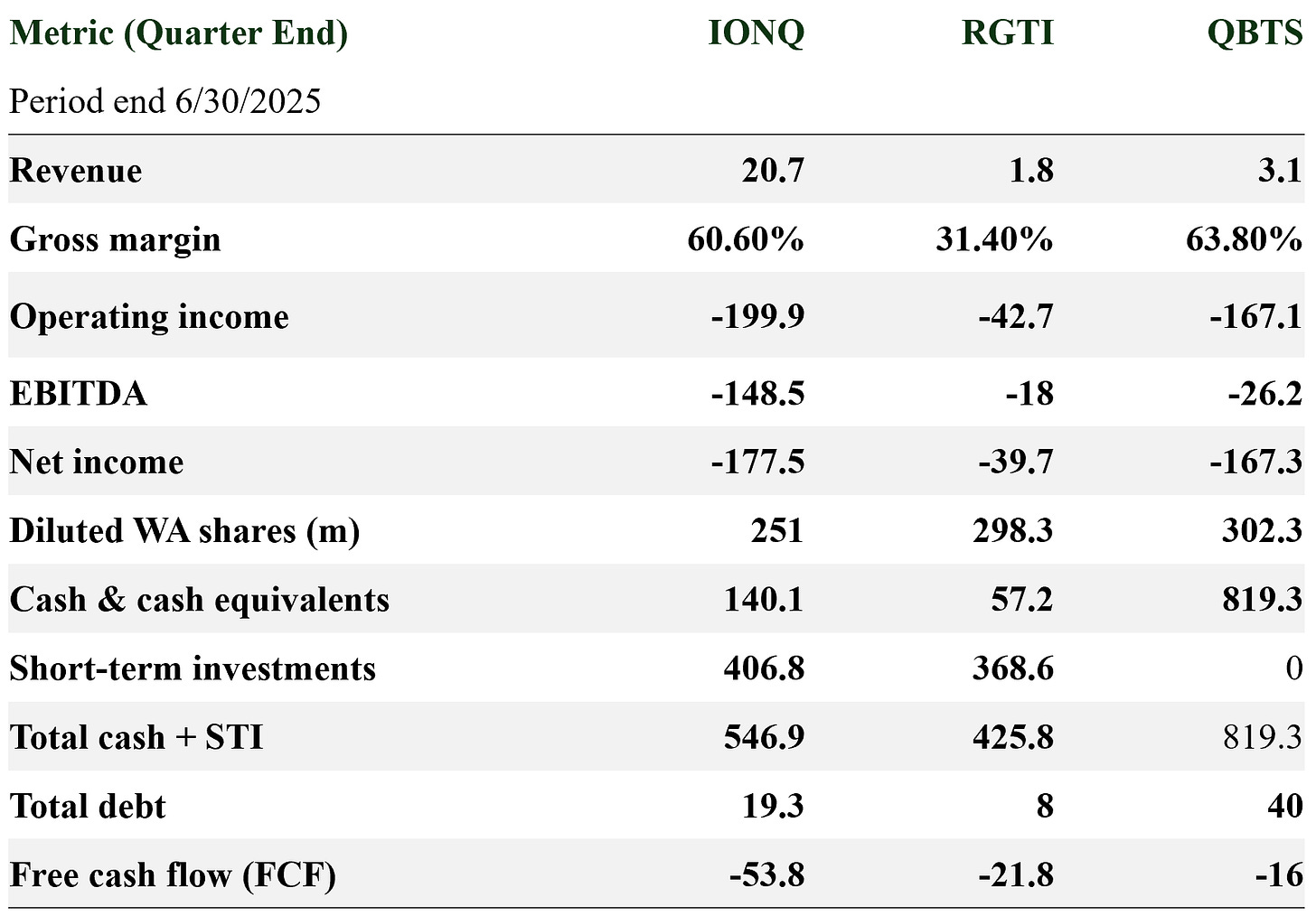

Quality of revenue & runway

IONQ: Best absolute revenue and software-like gross margin (~61%). With ~$547m cash+STI vs. FCF ~-$54m/q, you’re looking at multi-year runway even before factoring in potential mix shift or capex cadence.

RGTI: Small top line but meaningful liquidity (~$426m cash+STI) relative to scale; FCF ~-$22m/q → ample time to execute on architecture road map.

QBTS: The outlier on liquidity, cash ~ $819m on the balance sheet. Despite bigger net losses (driven by opex and non-cash items), FCF burn ~-$16m/q reads as conservative runway.

Margins & mix

IONQ/QBTS gross margins >60% reflect cloud delivery + software tooling.

RGTI margin (~31%) is consistent with hardware-heavier mix and services under absorption, improves structurally as utilization rises.

Balance sheet risk

All three carry minimal debt relative to cash; dilution remains the bigger lever than leverage.

Technical analysis (multi-timeframe levels you can act on)

IONQ

Trend: Strong up-move into Sept; pullback in October.

Daily EMAs: 20 ~ 68.5, 50 ~ 60.2, 100 ~ 51.7, 200 ~ 42.4.

Fib (daily) from recent swing: 0.382 ~ 65.6, 0.50 ~ 59.7, 0.618 ~ 53.8, 0.786 ~ 45.4.

Spot ~ 62–63 sits between 0.382 and 0.50.

Upside extensions (weekly ref leg): 1.618 ~ 85, 2.618 ~ 116, 3.618 ~ 147 if trend resumes.

Read: Momentum cooled (MACD rolling on 4h/daily; RSI back to mid-40s). First real support cluster $60 → $59.7 (0.50 Fib), then $53–54 (0.618 + rising 50/100-EMA zone).

RGTI

Trend: Vertical run from single-digits; orderly pullback.

Daily EMAs: 20 ~ 41.7, 50 ~ 31.2, 100 ~ 23.7, 200 ~ 17.3.

Retracement (4h): 0.382 ~ 41.5, 0.50 ~ 36.5, 0.618 ~ 31.2.

Spot ~ 47 above 20-EMA after first bounce. Weekly RSI elevated but off extremes.

Healthy digestion above $41–42 keeps trend intact. Lose that, the $36–37 pocket (0.50) is the higher-probability reload.

QBTS

Trend: Stair-step rally; two-bar shakeout from highs.

Daily EMAs: 20 ~ 33.8, 50 ~ 26.8, 100 ~ 21.6, 200 ~ 16.1.

Retracement (4h): 0.382 ~ 37.9, 0.50 ~ 35.2, 0.618 ~ 32.5, 0.786 ~ 28.6.

Spot ~ 37 sits right on 0.382.

First bounce zone is $35–36 (0.50 + rising 20-EMA daily). Deeper flush → $32–33 (0.618 + cloud/MA confluence) where reward/risk improves.

Industry & sector context

Sector: Next-gen compute / IT services (application layer) wrapped around specialized hardware.

Competitive moats: qubit fidelity & scaling curves, error rates, software stack ease-of-use, and cloud distribution.

Near-term TAM: optimization + simulation (logistics, manufacturing, finance). Mid-term: hybrid quantum-classical workflows integrated into AI pipelines. Long-term: fault-tolerant algorithms that replace or dramatically accelerate classical workloads.

Macro drivers (practical):

AI capex: Hyperscalers and Tier-1 enterprises are in a multi-year spend cycle. Quantum that co-locates with AI workflows (sampling, optimization) captures budget line items sooner.

Rates & liquidity: Quantum names trade like long-duration growth, higher real yields compress multiples; rate-cut expectations or easing liquidity re-rate the group.

Geopolitics/Defense: Government programs and strategic funding (US/EU/UK/CA) buffer cycles; procurement tends to be sticky once validated.

Regime uncertainty: New tech standards, export controls, or security requirements can delay deployments, but also entrench domestic vendors.

A simple, risk-averse trade approach

Positioning rules (applies to all three): Size for risk, not conviction: 0.5–1.0% portfolio max loss per idea; pyramids only after higher-high + higher-low.

Concrete levels

IONQ: Add $59–60 (0.50); add more $53–54 (0.618). Stop $45.3–45.8 (0.786). First targets $66, then $75–80, stretch $85.

RGTI: Add $41–42 (0.382 + 20-EMA); second $36–37 (0.50); final $31–32 (0.618). Stop $28–29. Targets $52, $58–60.

QBTS: First nibble $35–36 (0.50 / 20-EMA); add $32–33 (0.618). Stop $28.5–29.0 (0.786). Targets $40–41, $45–47.

Risk notes

Treat funding/dilution as non-price risk: all three can raise opportunistically.

Avoid riding full size through known capital-markets events (offerings, lock-ups).

Respect liquidity: RGTI/QBTS can move fast; use limit orders.

Bottom line

If you’re new to the space, start with a basket (⅓ each) and work adds at the Fib levels above. If you’re selective:

Core: IONQ for scale + margin + balance sheet.

Torque: RGTI for upside if execution/partnerships compound.

Cash-anchored optimization: QBTS for enterprise ROIs that don’t need fault tolerance.

Keep the playbook boring: buy pullbacks, define risk, let compounding do the rest.

This analysis is for informational and educational purposes only and does not constitute investment advice.