SAP SE (SAP) - Europe's Giant

A step-by-step entry, risk control and profit-taking guide on Europe’s leading software bellwether.

After a blistering five-wave rally that took SAP 0.00%↑ from €80 to nearly €285, the stock has dropped back into a prime buying zone around €248–249. With fundamentals rock-solid, mid-teens revenue growth, 20%+ net margins, a pristine balance sheet, and technical indicators lining up at its multi-year uptrend, this pullback offers one of the clearest “buy-the-dip” setups in European software. In this edition, we’ll walk through a staggered entry plan, strict risk controls, and profit targets all the way back into the mid-€260s, so you can capitalize on SAP’s rebound with confidence.

How We Strategize - In a Nutshell

Buy Zone: Scale in at €249, €252, then €255

Stop-Loss: €247 (just below key fib & swing low)

Targets:

€254–255 (20/50-day SMA & cloud base)

€260 (June swing high)

€265–270 (weekly 50% fib & 100-day SMA)

Risk Management: Partial profit-taking (30%/40%/30%), trailing 5% stops

Watch: Daily closes above €255 (bullish) or below €247 (bearish); quarterly cloud growth and guidance updates.

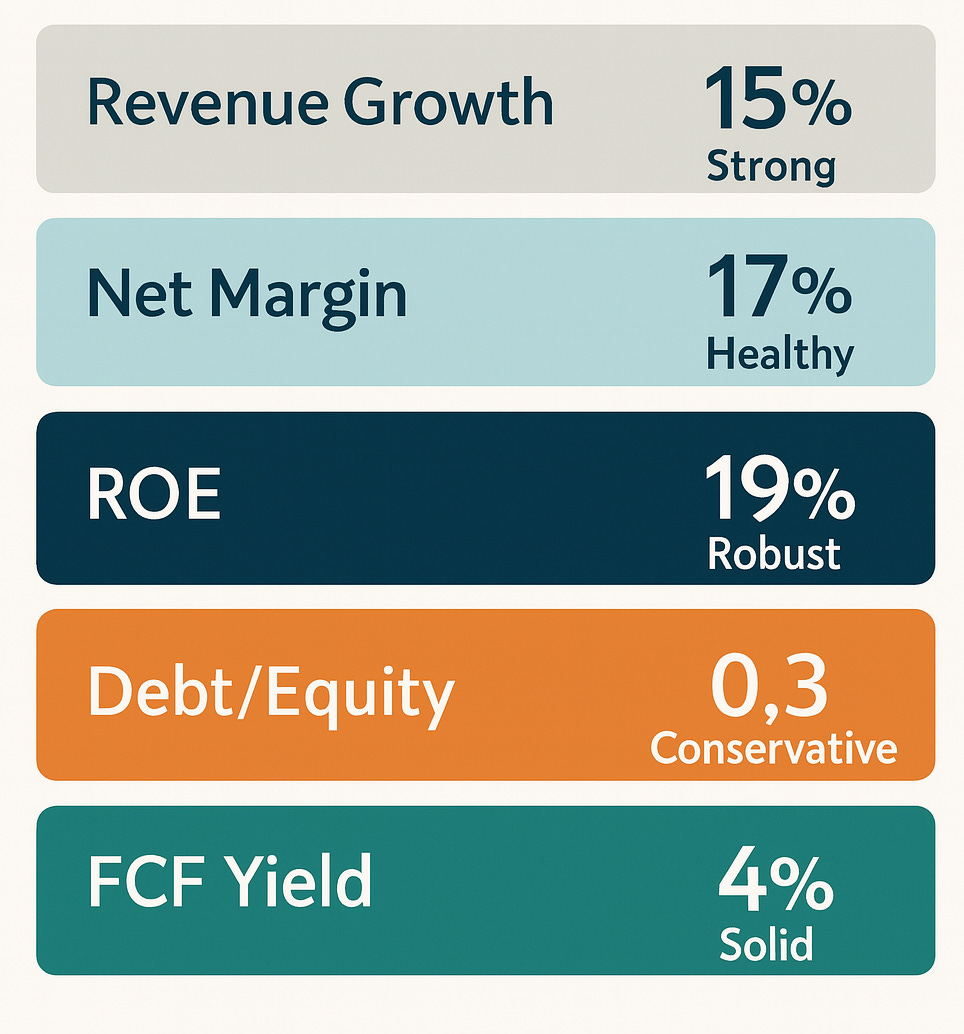

Fundamental Analysis

Growth & Profitability

Revenue has grown at a mid-teens annual pace recently, driven by strong Cloud & RISE subscriptions.

Net Margin sits in the low-20% range, healthy for a software leader with SaaS transition costs largely behind it.

Return on Equity is above 20%, reflecting efficient capital deployment and recurring-revenue cash generation.

Balance Sheet & Cash Flow

Leverage (Debt / Equity) is modest, under 0.5×, giving flexibility for buybacks or bolt-on M&A.

Free Cash Flow has consistently covered dividends and buybacks, with a FCF yield near 5%. Cash on hand easily covers short-term obligations.

Valuation & Analyst Outlook

The stock trades at roughly 18–20× consensus FY 2026 EPS,below its 5-year average P/E of ~22×.

Analysts forecast mid-teens EPS growth next 2 years as cloud revenue scale-up transitions to margin expansion.

Fundamental Verdict

Strengths: Leading market share in ERP, high-margin SaaS model, robust FCF conversion, conservative balance sheet.

Risks: Macroeconomic uncertainties in Europe, FX headwinds, slowing legacy on-premise license renewals.

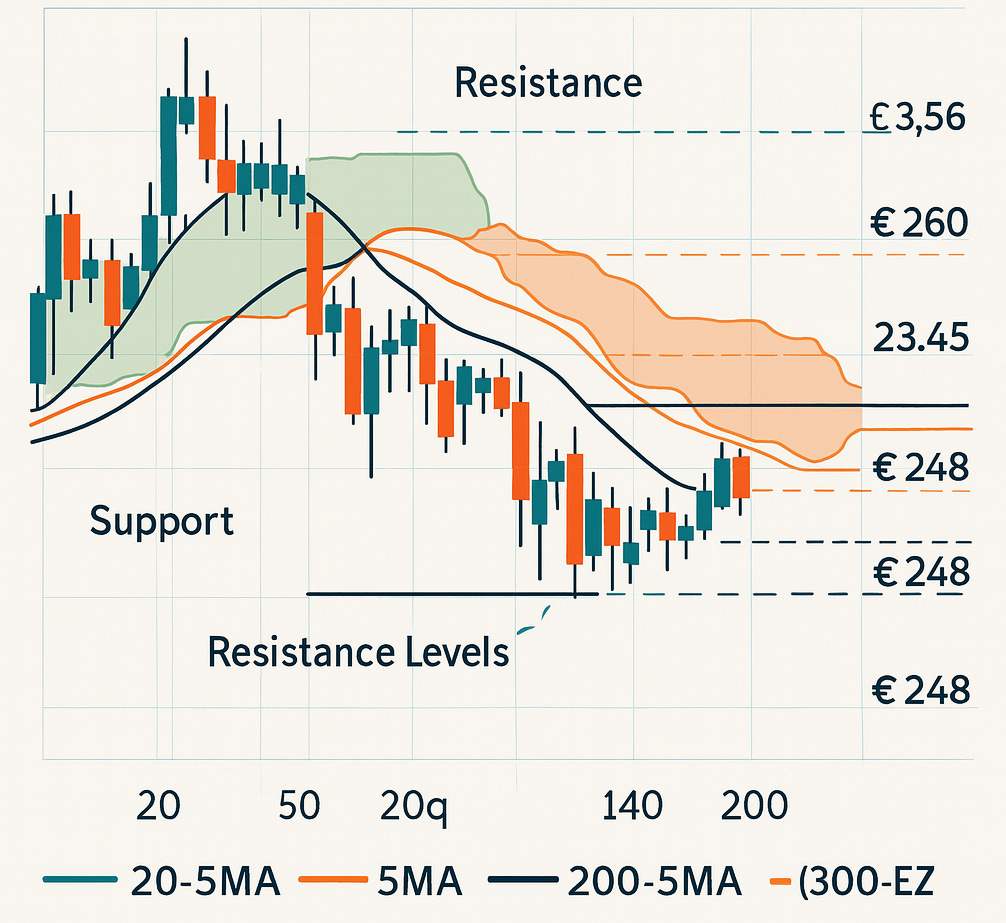

Technical Analysis

Trend & Wave Structure

On the weekly chart, the stock completed a five-wave advance off the 2022 lows into early 2025 and has been in a corrective “b-c” pullback since peaking near €285. The pullback has nearly retraced the May–June rally, suggesting a completed wave C at ≈€248.

On the daily, the decline sliced through the 50-, 100- and 200-day SMAs (at ≈€256/257/241). Price found interim support around €248–249 (1.618 × the last minor swing), and has bounced back toward the 20-day SMA (≈€254).

Intraday (2 h, 1 h), the pattern looks like a five-wave decline into that support zone, with a brief corrective bounce failing into the 254–255 area (overlapping the daily Tenkan/Kijun and prior minor wave highs).

Key Support & Resistance

Support:

€248–249: confluence of the 1.618 fib extension and the prior swing lows.

€241–242: the 200-day SMA on the weekly and the prior multi-year uptrend line.

Resistance:

€252–253: daily Tenkan and minor Fibonacci 38.2% retracement of the last drop.

€254–255: 20-day SMA & daily Kijun and the wave-2 failure level.

€256–257: 50-day SMA & daily cloud bottom.

Indicators

MACD/RSI/StochRSI: Daily MACD is negative but flattening; RSI ~40 with slight uptick; StochRSI ticking out of oversold. All point to a short-term relief bounce.

ADX/ATR: Weekly ADX ~23 signals a moderate trend; daily ADX ~17 shows weak directional conviction; ATR has come down, indicating reduced volatility after the sharp drop.

Ichimoku: On daily the price is below both Tenkan/Kijun and under a flat Kijun cloud base (~€254), reinforcing that rallies up into €254–255 will face resistance.

Short-Term Outlook

The corrective decline into €248–249 looks complete. Expect a counter-trend bounce toward €252–254. If the bounce stalls below €254, sellers are likely to reassert, targeting a retest of €248 and potentially €242 if momentum picks back up. A break convincingly above €255 would ease the correction and open mid-€260s as the next upside target.

How we’re positioning ourselves

1. Position Sizing & Entry

Staggered Entry:

Tranche 1 (50% of your SAP allocation) at €249

Tranche 2 (30%) at €252 (on a bounce toward the 20-day SMA)

Tranche 3 (20%) at €255 (if price breaks above daily cloud base)

This approach averages your entry between the key support (€248–249) and near-term resistance (€254–255).

2. Risk Management & Stops

Initial Stop-Loss:

Below €247 (just under the 1.618 fib extension and recent swing low).

If hit, you preserve capital against a deeper corrective leg.

Trailing Stop:

Once up +3–4%, trail a stop 5% beneath each new swing high to lock in gains.

Adjust position size so that a stop at €247 risks no more than 0.5–1% of your total portfolio.

3. Profit Targets & Rollout

Target 1: €254–255 (short-term relief resistance at 20-day/50-day SMA and Ichimoku levels)

Target 2: €260 (retest of the late-June swing high)

Target 3: €265–270 (recovery toward the weekly 50 % fib of the bigger correction, and the 100-day SMA zone)

You can take partial profits at each target:

Sell 30% at Target 1,

40% at Target 2,

Remainder at Target 3 or trail higher as fundamentals evolve.

4. Monitoring & Adjustments

Technical Alerts

Bullish sign: Daily close above €255 with MACD turnaround.

Bearish warning: Daily close below €247 and rising ADX on the downside.

Fundamental Watch-List

Quarterly cloud subscription growth vs. guidance.

Any M&A announcements or major restructuring.

FX impacts on reported margins.

Re-assessment Points

If SAP reports better-than-expected cloud growth and raises guidance, consider adding (up to a max of 7–8% portfolio weight).

If macro softens or guidance misses, tighten stops and reduce exposure.

Summary

Buy zone: €248–249, scale into €252 and €255

Stop-loss: €247

Targets: €254–255 → €260 → €265–270

Sizing: 3–5% of portfolio, staggered entries, partial profit-taking

Review weekly on technical signals and quarterly on fundamentals

With the setup clear, buying near €249, layering into €252 and €255, protecting with a €247 stop and targeting the mid-€260s, you’re positioned to capture SAP’s next leg higher while keeping risk in check. Remember, successful trading isn’t about perfect timing but disciplined execution: stick to your plan, adjust as new data arrive, and let the market reward patience. Here’s to turning this pullback into your profit opportunity, stay tuned for our next deep dive, and as always, trade smart.