Shell Q2 2025: Cash Flow Over Optics

Don’t let the $4.3B EPS distract you. This is a $35B+ FCF machine, hiding in plain sight.

Shell SHEL 0.00%↑ just reported Q2 2025 results—and while headline earnings fell, the engine underneath is still purring.

TL;DR

Earnings are down, but cash is up. With $11.9B in Q2 CFFO and $6.5B in FCF, Shell reminds us why it’s built to outperform in any oil tape.

Adjusted EPS came in at $4.3B, down from $5.6B in Q1, and income attributable to shareholders was $3.6B. Not surprising given that Brent crude averaged just $71.7/bbl in H1 vs $84.1/bbl last year.

But the market saw it coming.

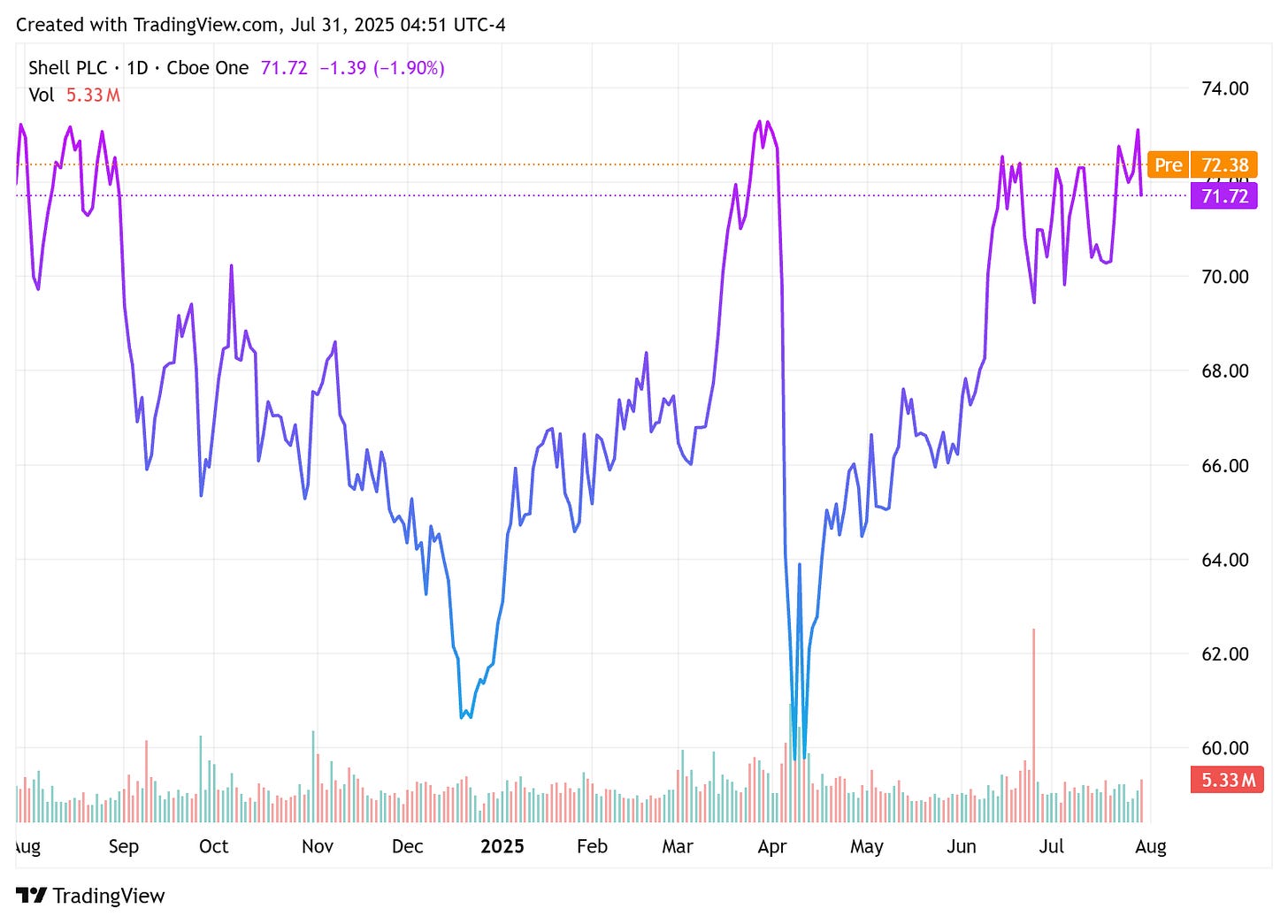

$SHEL dropped 1.9% into earnings, then bounced +1.37% in overnight trading to $72.70. The real story wasn’t about profit—it was about durability.

Quarterly Performance Highlights

Despite lower commodity prices, Shell’s fundamentals held firm:

CFFO: $11.9B

Free Cash Flow: $6.5B

Shareholder Distributions: $5.7B

Adjusted EBITDA: $13.3B

Gearing: 19%

Shell’s balance sheet remains rock solid, with prudent capital discipline and a cash-rich strategy that lets it return capital without sacrificing flexibility.

Segment Breakdown: A Closer Look

All major business units saw QoQ declines except for Marketing, which jumped from $0.9B to $1.2B. Here's the Q2 adjusted earnings by segment:

Integrated Gas: $1.7B (down from $2.5B)

Upstream: $1.7B (down from $2.3B)

Marketing: $1.2B (up from $0.9B)

Chemicals & Products: $0.9B (down from $1.1B)

Renewables & Energy Solutions: $0.2B (flat)

Key Takeaway:

Integrated Gas and Upstream remain profit centers, but were impacted by softer prices.

Marketing strength reflects Shell’s downstream leverage in a volatile macro tape.

Year-over-Year View

H1 2025 adjusted earnings totaled $9.8B, down from $14.0B in H1 2024—a 30% decline.

The sharpest drops came from:

Integrated Gas

Chemicals & Products

What happened?

Management attributes:

~$1.1B decline from lower prices/margins in Integrated Gas

~$0.3B from Downstream margin compression

This matches the commodity tape: weaker realized prices and thinner refining spreads across the board.

Strategic Initiatives: Progress Behind the Scenes

Shell continues to prioritize lean operations and long-cycle value creation:

$3.9B in cost reductions to date

Over 60% from structural/non-portfolio initiatives

Operating expenses cut from $39.5B (2022) to $34.6B (rolling four-quarter)

One major milestone:

Shell delivered its first LNG Canada cargo on June 30. With a 40% stake, this gives Shell a clear edge in Asia-bound LNG—shorter shipping times and better margins vs U.S. Gulf Coast exports.

Conclusion:

Shell isn’t playing for headlines. It’s playing for cash.

$6.5B in Q2 FCF

19% gearing = room to maneuver

High-return project pipeline (LNG Canada, integrated marketing, opex cuts)

Yes, earnings declined. But Shell did what Shell does—return capital and preserve resilience.

The information in this post is for educational and informational purposes only. It reflects the author’s personal research and analysis, which may be subject to error or omission. This is not financial, investment, or trading advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment or trading decisions.