SiriusXM (SIRI)’s Next Act: Cash-Cow or Comeback Kid?

Dissecting the Bull & Bear Case for SiriusXM

If you drive anywhere (or know someone who does), you’ve likely bumped into SiriusXM’s SIRI 0.00%↑ irrepressible satellite chime. But beneath the familiar voice prompts lies a story of a legacy media company at a crossroads, steady cash flows vs. disruptive streaming. Today, let’s unpack both the numbers and the chart to see whether SIRI is a defensive income play or a sleeper growth opportunity.

Key Takeaways

Fundamentals: Reliable, cash-generative subscription business, 5% net margins, $600 M free cash, but stuck in a slow-growth groove.

Technicals: Base between $20–$23, narrowing range, RSI neutral, ready to either rocket or retrace.

Trade Plan: Go long at $22.60 (stop $21.50), targets $23.64 & $26; short below $21.50, target $20.

Fundamental Analysis

A company’s balance sheet is its autobiography, every line tells a story.

1. Revenue & Profit Trends

2024: $8.10 B (–1.8% YoY)

2025F: Flat at $8.10 B (–0.2% YoY)

Net Income: $408 M (5.0% margin) in 2024; forecast to rise to $450 M (5.6% margin) in 2025

Drivers: Core automotive subscriptions remain SiriusXM’s cash engine, but growth is capped by streaming alternatives and ARPU (average revenue per user) pressures.

2. Cash Flow & Leverage

Free Cash Flow (2024): $600 M

Operating Cash Flow: $1.2 B

CapEx: $600 M

Leverage: Net Debt/EBITDA ~ 3.5x comfortable but higher than pure software peers.

Liquidity: Current ratio ~ 0.9x (typical for media), ample revolving credit facility cushion.

3. Balance Sheet Health

Total Assets (YE 2024): $12.3 B

Total Liabilities: $9.1 B

Shareholders’ Equity: $3.2 B

Debt Composition: Predominantly fixed-rate notes maturing 2027–2032; interest coverage healthy at 5x EBIT.

4. Forecasts & Risks

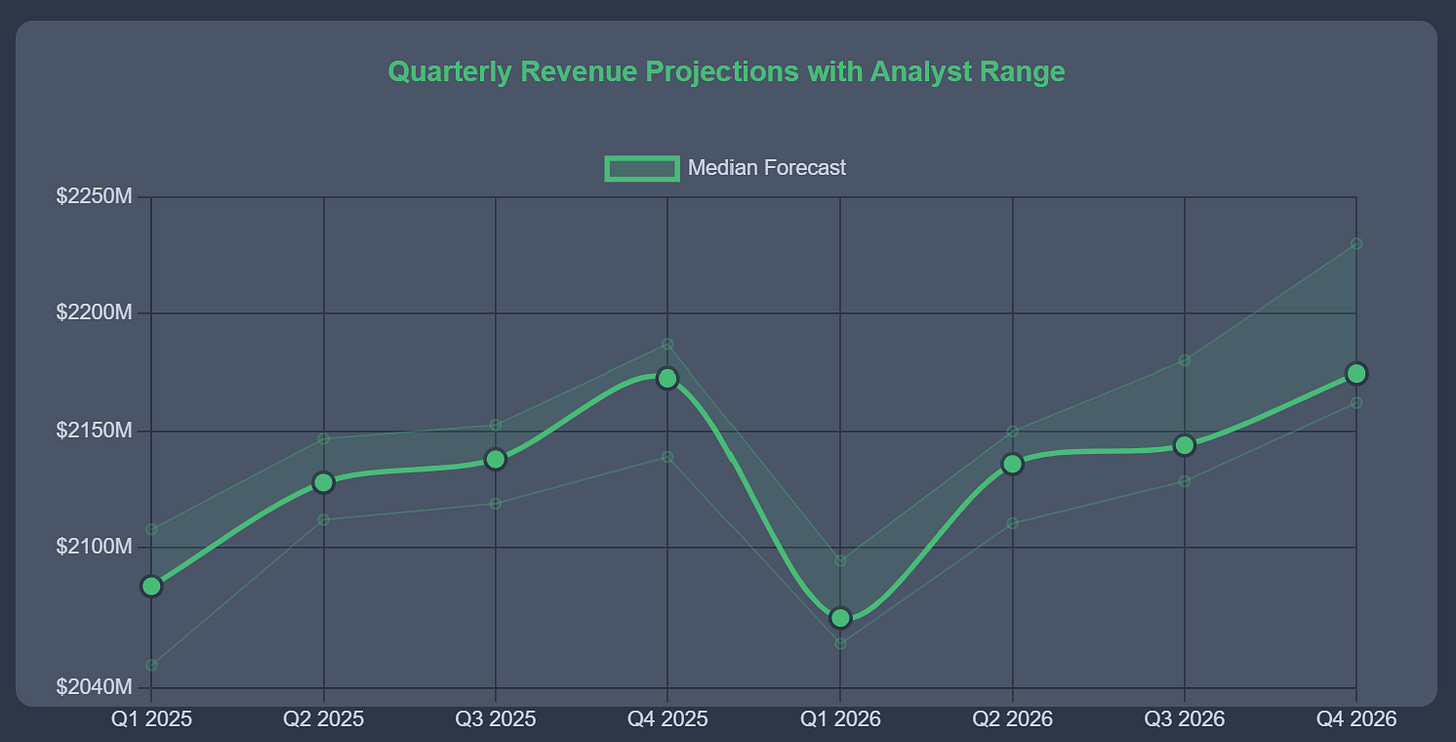

2026–27 Projections: Slight revenue growth (1–2% CAGR) as SiriusXM monetizes Pandora and expands bundled offerings.

Risks:

Rising content licensing fees

Competition from Spotify, Apple, and free ad-supported players

Macroeconomic slowdown impacting auto sales

Even with streaming’s roar, SiriusXM’s cash engine hums along.

Technical Analysis

“Price is truth. Indicators are just whispers.”

1. Trend & Key Levels (Daily/Weekly)

50-Day SMA: $21.69 ↗️

100-Day SMA: $22.58 ↘️

200-Day SMA: $23.64 ↘️

Support: $21.50 (recent double-bottom)

Resistance: $22.60–$22.75 (100-day SMA + short-term pivot)

2. Momentum & Oscillators

RSI (14d): ~ 56 (neutral–bullish)

MACD: Signal line flat at zero, no clear momentum bias

Stochastic (14,3): Pulling back from overbought, watch for mid-band support

3. Chart Patterns & Indicators

Base Formation: Since April ’25, price has held between $20 and $23, classic accumulation

Bollinger Bands: Daily bands are narrowing, hinting at a volatility squeeze

Ichimoku Cloud (1d): Price just above Tenkan/Senkou Span A, bullish bias if price holds above the cloud

When price breaks the mold, profit follows.

The Bottom Line

SiriusXM sits at an intriguing juncture: a stalwart cash producer under siege from digital upstarts. With fundamentals that cushion downside and chart patterns hinting at a squeeze, SIRI offers a uniquely asymmetric setup. Whether you favor the income cushion or speculate on a breakout, clarity on your entry, stop, and target will be your best ally.

Trade your plan, respect the tape, and let the satellite signals guide you.

Combine the certainty of your eyes (charts) with the wisdom of the balance sheet, and you’ll sleep better at night.