$SoFi Is Back. This Time, It’s Crypto Ready

Fintech growth, blockchain ambition, and a price chart that just might break out. From lending to staking, SoFi is quietly building a financial empire.

In a Nutshell

Fundamentals: Profitable. 10.9M members. $772M quarterly revenue. Crypto relaunch adds high-margin upside.

Technical Setup: Clear 5-wave Elliott impulse just completed. Minor ABC correction underway. Fib targets suggest $21+ upside.

Catalyst: Crypto trading (BTC, ETH, staking, blockchain remittance) relaunched June 2025.

Trade Plan: Phase-in near $16.50–17.20, add above $18.32. Targets $19.72 and $21.69. Stop below $15.50.

SoFi’s Silent Revolution

SOFI 0.00%↑ started as a student loan refinancer. Now? It’s a profitable bank, a financial super app, and once again, a crypto exchange.

While Wall Street debates the valuation, retail interest is rising. The stock has surged over 40% in 2 months. Momentum is back.

SoFi is entering a new multi-pronged growth phase.

Fundamentals: A Fintech That Finally Prints Profit

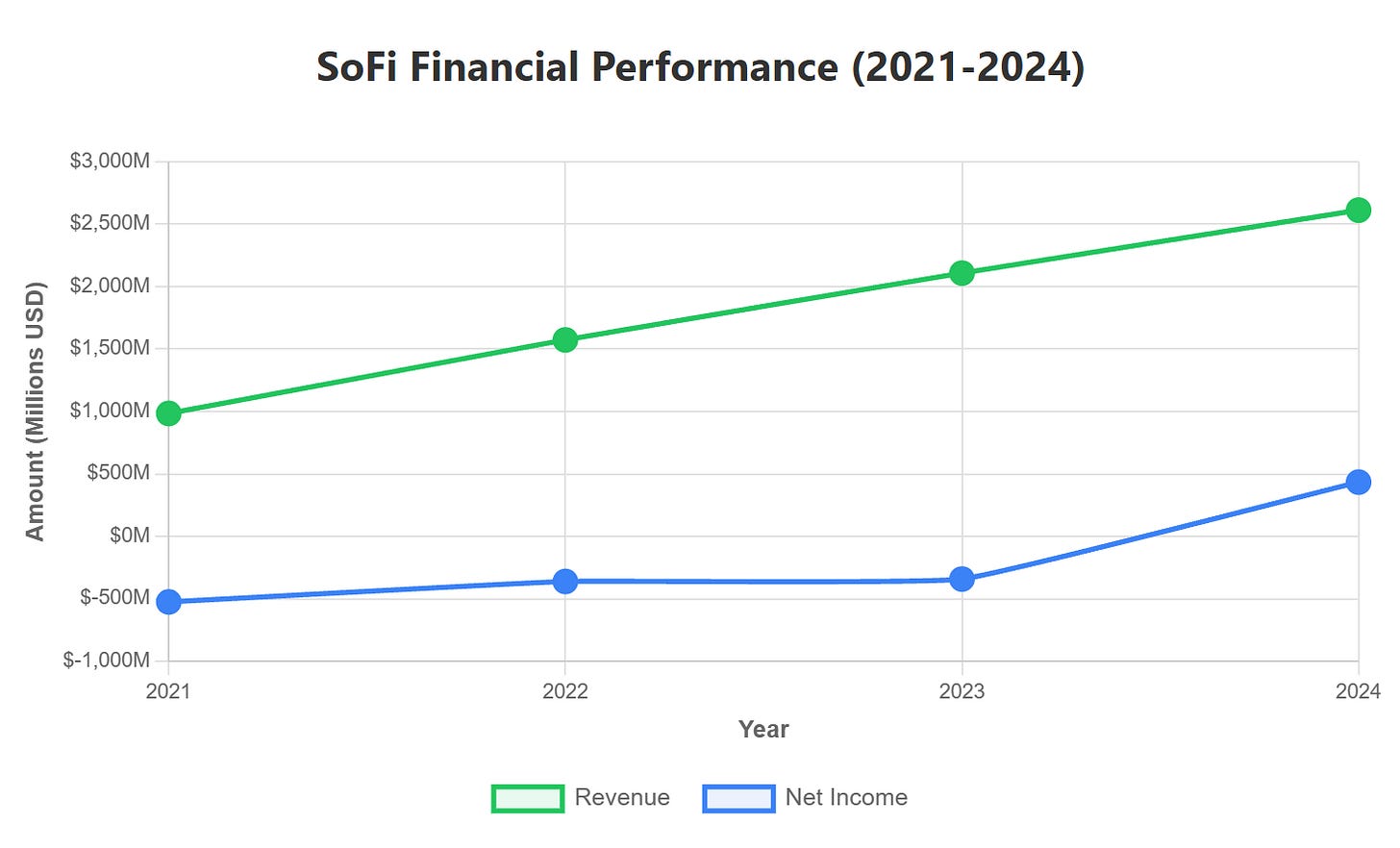

Income Statement

TTM Revenue: $2.8B

Q1 2025 Revenue: $772M (+20% YoY)

TTM Net Income: $472M

Diluted EPS: $0.43

Adj. EBITDA Margin: ~27%

Normalized Income: $483M

Interest Income (TTM): $1.78B

SoFi has crossed the GAAP profitability threshold. No more “adjusted-only” numbers. Their net income margins are now real.

Cash Flow & CapEx

Operating CF (TTM): -$1.84B

Investing CF (TTM): -$5.0B

Free Cash Flow: -$2.02B (TTM)

CapEx: -$184M

Despite negative FCF, the business is investing heavily in tech infrastructure, crypto integrations, and expansion. Financing CF is positive: $5.4B funding growth via equity and debt markets (but with minimal dilution this year).

Balance Sheet Health

Total Assets: $36.25B

Total Equity: $6.52B

Net Tangible Assets: $4.49B

Net Debt: Just $555M (down from $4.1B in 2022)

SoFi has a clean balance sheet, substantial tangible equity, and minimal net debt. Strong liquidity, improving leverage, and no red flags.

User Growth

Members: 10.9M (+34% YoY)

Products: 15.9M (+35%)

Deposits: Growing fast and strong. Reportedly double the rate of competitors

SoFi’s user acquisition engine is powerful. They’ve cracked CAC-to-LTV economics and now benefit from vertical integration (banking, investing, credit, and now crypto, all under one UX).

Crypto Relaunch: A Hidden Catalyst

This month, SoFi announced its return to the crypto game. The new platform includes:

Bitcoin + Ethereum trading (live now)

Staking services (Q4 2025)

Blockchain-powered remittances (late 2025)

Built natively inside the SoFi app

This is big. Crypto is not just a “side hustle”, it’s a high-margin vertical. And in a year where Coinbase, Cash App, and Robinhood are fighting over crypto users, SoFi is quietly returning with a full-stack fintech advantage.

Technical Analysis: All Waves Lead Higher

SoFi’s chart isn’t just strong, but it’s also structured. Wave 5 looks complete with overbought RSI and MACD divergence starting to form. ABC correction expected before larger rally resumes.

Daily & 2H Elliott Wave

Clear 5-wave advance from April lows (~$7.90) to current ~$17.80.

Completed wave (5) of larger cycle likely finishing around here.

Expecting ABC corrective wave to $16.50–15.95 support range.

Strong volume and structure = shallow corrections favored

Zooming In on Correction

SoFi is now in early Wave A of an ABC correction.

Expect downside into $16.08–15.74, which aligns with 0.5 and 0.618 Fib retracement and EMA clusters.

EMA 50/100/200 all rising. Trend is intact.

Momentum Indicators

RSI: 74.37, so slightly overbought

MACD: Bullish but flattening

Ichimoku: Bullish Kumo twist → trend remains intact

Current momentum indicators support short-term cooling before a larger breakout continuation.

Macro Support and Fib Zones

Price is consolidating near $17.17, before tagging a local high of $17.7 in pre-market.

Support zones:

$15.74 (0.618 retracement)

$16.91 (1.618 extension)

$15.52–15.95 (confluence zone & EMA stack)

Resistance ahead:

$18.32 (2.618 Fib)

$19.72 and $20.59 (extensions from multi-leg structure)

This looks like a bullish Fib with clean extensions. Price remains above all key EMAs and consolidating in a healthy direction.

Trade / Investment Plan

Entry Zones:

Zone 1 (accumulation): $16.50–17.20

Ideal spot to begin exposure during ABC correction

Zone 2 (breakout): Add above $18.32 with volume confirmation

Targets:

Target 1: $19.72

Target 2: $21.69

Stretch Target: $23.00 (only if crypto volume explodes)

Risk Management:

Stop-loss: $15.50

Max position size: 4% of portfolio

Scale in phases: 50% near $16.70, rest on breakout

Key Triggers to Watch

Q2 earnings (August 5): look for crypto revenues, deposit growth

Staking & blockchain remittance rollout timelines

Crypto regulation (especially SEC clarity on ETH/BTC)

Macro risk (rates, recession probability)

Buy the Pullback, Not the Top

SOFI 0.00%↑ has finally earned the right to be taken seriously. It’s profitable. Scaling. And now re-entering crypto at the perfect time.

Technically, the chart says don’t chase and wait for the pullback. But if that pullback holds above $15.50 and SoFi continues executing on crypto and growth? The upside into 2026 could be explosive.

This isn’t just a short-term momentum trade.

It’s a long-term structural play on the future of digital finance.

The information in this post is for educational and informational purposes only. It reflects the author’s personal research and analysis, which may be subject to error or omission. This is not financial, investment, or trading advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment or trading decisions.