Does The January Effect Still Matter?

And if so, how should a modern investor actually use it? Let's take a look at the effect, its history, and how reliable it really is.

A new year always brings the same question: what kind of market are we walking into? Fresh capital gets deployed, portfolios get reset, and expectations quietly start forming. January feels like a checkpoint, even though markets rarely move in straight lines.

That’s why January gets so much attention. By no means does it predict the year, but it does offer us the first real read on investor behavior in a given year.

January also carries a reputation in markets. A strong start is seen as a good omen. A weak one raises doubts. But markets don’t work on omens. They work on incentives, positioning, and behavior.

Key Takeaways

January has a long-standing reputation in markets, but it is not a reliable predictor of the year ahead.

Long-term data shows January tends to be slightly positive on average, but outcomes vary widely from year to year.

What matters more than whether January is up or down is where strength shows up and how broad participation is.

When economically sensitive sectors lead early, it often signals growing confidence. When defensive sectors dominate, caution may still be in control.

Market structure has changed. Passive flows and global capital mean seasonality is less powerful and more conditional than it once was.

The right way to use January is as context, not as a trading rule or shortcut.

Disciplined investors focus on structure, fundamentals, and risk management, using seasonal patterns only as a supporting input.

January has a reputation. Reputation isn’t edge.

The first month of the year carries a weird amount of psychological weight. Fresh capital gets deployed. Portfolios get reset. Narratives get rewritten. Investors want the market to show its hand early, because uncertainty is uncomfortable.

That’s why the January Effect refuses to die. But history shows it’s closer to a coin flip than a trend.

The practical question shouldn’t ask if January will be positive, but rather what does January’s behavior tell us about risk appetite, breadth, and positioning, right now?

What the January Effect actually is

The January Effect is commonly described as “January tends to be strong”, often with a special focus on smaller, more volatile parts of the market.

Historically, the most sensible explanations sit in three buckets:

Positioning resets after year-end rebalancing and tax-related selling.

New allocations as institutional and retail capital is put to work at the start of a year.

Risk appetite rotation, where cyclicals and higher beta areas tend to respond first when investors move from defense to offense.

But none of these are rules. They are conditions that sometimes appear, and sometimes do not. Seasonality is a tendency, not a trigger.

One key driver is tax-loss selling, where investors sell underperforming stocks in December to offset gains, often creating temporary price pressure that reverses when capital is reinvested in January.

Institutional behavior also plays a role. Portfolio “window dressing” ahead of year-end is often followed by rebalancing in January, which can support demand for previously under-owned or undervalued stocks. In addition, January typically brings seasonal cash inflows as investors deploy bonuses or begin new investment plans, increasing liquidity in equity markets.

Finally, behavioral dynamics contribute to the effect. The start of a new year often coincides with renewed optimism and risk appetite, while market inefficiencies in smaller, less liquid stocks can amplify price movements when buying activity increases.

What the data shows

Statistically speaking, the January Effect shows up more as a modest seasonal tailwind than a reliable edge.

From 1975-2009, January was basically a coin flip: 18 of 35 Januarys were positive (~51% hit rate), with an average January return of ~+1.25% and big dispersion (strong upside years, but also ugly January drawdowns like 2003 (-6.41%) and 2009 (-6.70%)).

From 2010-2025, January looks more consistently positive: 11 of 16 Januarys were up (~69% hit rate), with an average January return of ~+1.41% and a higher median (~+2.41%).

But the key point is the same: variance is still high (e.g., 2018 -2.89%, 2022 -2.90%), so it’s not a stand-alone strategy.

January is better used as a risk regime read than a trade rule. When January is strong, it often signals improving breadth and risk appetite. When it’s weak, it’s an early warning that positioning and liquidity may be tighter. Either way, it’s context, not conviction.

Source: Trading Views

The missing piece

Here’s where most discussions go wrong.

People talk about January as if all positive Januarys are the same. They’re not.

What matters is where the strength shows up. A rally led by defensives is a different signal than a rally led by cyclicals. A month that’s green because a few mega-caps carried the index is different from a month where breadth expands.

That’s why the higher value question is sector behavior.

When investors feel confident about growth and the economy, they usually gravitate toward companies that benefit most from better conditions.

Businesses tied to consumer spending

Companies linked to investment, construction, or production

Banks that benefit from lending and activity

Technology firms when optimism is rising

When investors feel cautious, they tend to favor steadier businesses:

Utilities

Consumer staples

Healthcare

That’s investors leaning back, prioritizing stability over upside.

So a January rally led by economically sensitive sectors sends a very different message than a January where only defensive areas are holding up.

Why January is a lessor predictor today than it used to be

Even if seasonal tendencies exist, modern market structure changes how they show up.

Three shifts matter:

Passive and ETF flows are more continuous. Capital enters the market on schedule (payroll, retirement plans, allocations), not only at the calendar reset.

Narratives travel faster. Positioning and reactions compress in time. The market can front-run the seasonal move, or fade it quickly.

Global capital matters more. US tax timing is not the only driver of flow anymore, which dilutes the classic explanation.

So seasonality didn’t disappear. It became less dominant and more conditional on broader risk regime.

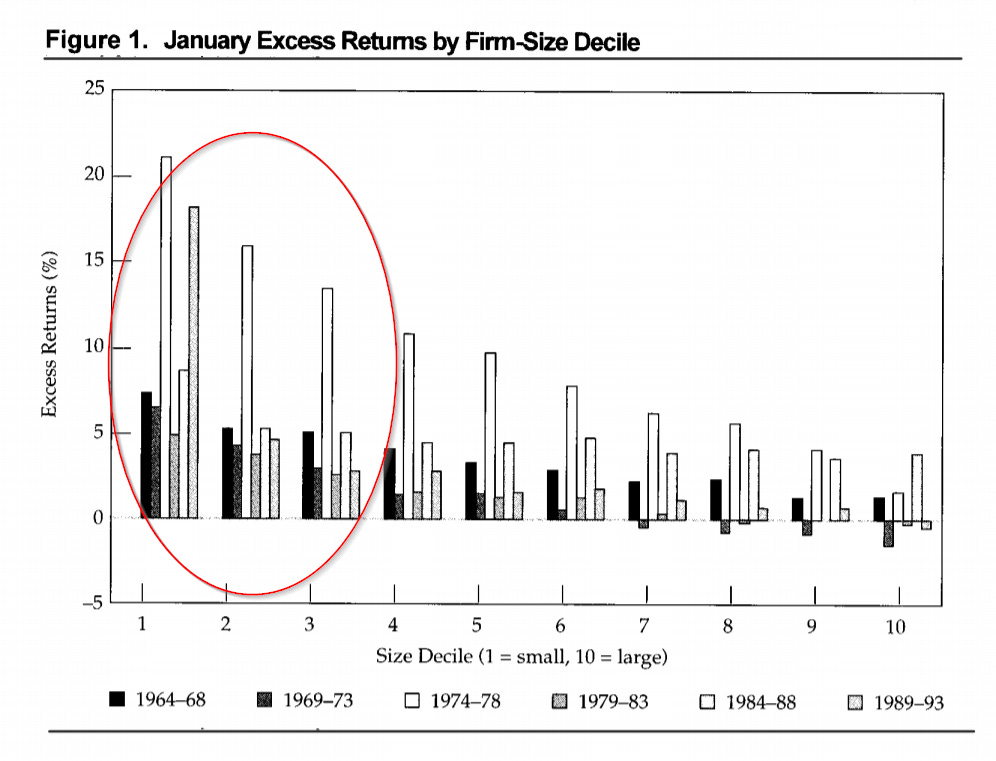

Source: FAJ, 1996

The IWP framework: seasonality as signal, not strategy

Here’s how we use January seasonality in a disciplined process.

We do not treat January as a trade trigger. We treat it as a context filter that improves decision-making.

What we look for

1) Leadership quality

Are cyclicals leading? Are defensives leading? Is leadership narrow or broad?

2) Breadth and follow-through

Is strength sustained beyond the first week or two, or does it fade quickly?

3) Alignment with structure

If January is strong but key indices are still below major resistance or breadth is weak, we treat the move with caution. If January is strong and structure confirms, we get more aggressive.

4) Risk management first

Even if the seasonal bias is favorable, entries need defined invalidation. Seasonality never replaces a stop.

The most important line: Seasonality helps decide when to pay attention. Structure decides what to do.

How to use January in real investing decisions

A practical way to translate this into action:

If January is strong and cyclicals lead:

It’s often a green light to lean into higher-quality growth, innovation, and selective cyclicals, assuming structure supports it.

If January is weak or leadership is defensive:

It’s a warning that risk appetite may be fragile. In that environment, you prioritize balance sheets, cash flows, and setups with cleaner risk-defined entries.

If January is mixed:

You do less. You get selective. You size down. You wait for confirmation.

This is exactly how you convert a seasonal tendency into a professional decision process.

Common mistakes investors make with the January Effect

Turning it into a trade. Instead of treating it as context.

Ignoring dispersion. Even in good months regimes, downturns can occur.

Forgetting market structure. Passive flows and global capital change behavior.

Overreacting to early-week noise. January is information, not instruction.

Bottom line

The January Effect is real enough to respect, and unreliable enough to use as an anchor.

The data supports a balanced conclusion: January has provided a modest tailwind over decades, and more consistently positive post-2010, but it remains far too volatile to trade mechanically.

The correct use is simpler and more powerful: January is a risk appetite read.

It helps you interpret leadership, breadth, and positioning early in the year.

In investing, the calendar is never the strategy.

Structure is the strategy.

This content is for educational purposes only and isn’t investment advice or a recommendation to buy or sell any security.

More from IWP: