The September Effect: A Snapshot into Wall Street’s Most Persistent Anomaly

Why Stocks Struggle Every Fall, and What Investors Should Do

Introduction: A Pattern That Refuses to Die

Every market has its myths. Some fade with time. Others stubbornly persist. The “September Effect” falls into the latter camp.

For nearly a century, September has earned a reputation as the worst month for equities. The pattern is subtle but stubborn: the S&P 500, Dow Jones, and other major benchmarks underperform in September more than in any other month. From 1928 through today, the average S&P return in September is negative (roughly -1%), while most other months deliver gains. More than half of Septembers end in the red.

Unlike October, which has been scarred by famous crashes (1929, 1987, 2008), September has no single dramatic collapse to explain its weakness. Instead, it’s a recurring tendency for stocks to lose momentum just as summer fades and autumn begins.

To get why this happens, we need to dig into history, investor psychology, institutional mechanics, seasonal economics, and macro cycles. The September Effect isn’t one neat anomaly, it’s a blend of forces that overlap, amplify, and sometimes contradict one another.

The History

The September Effect is not folklore, it’s backed by nearly a century of data:

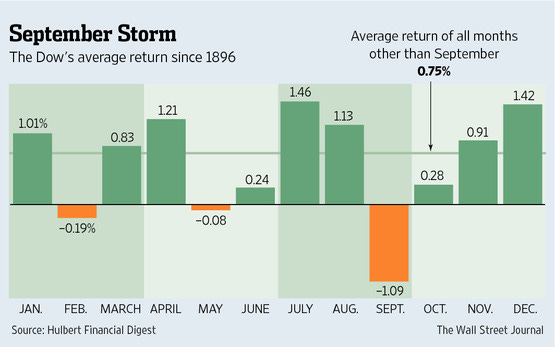

The S&P 500 has averaged a -1.1% return in September since 1928.

The Dow Jones has averaged a -1.09% return in September since 1896.

On a rolling 10-year basis, September has been the most frequently negative month.

It has finished negative around 55% of the time.

This is unusual. Over long stretches of time, equities are biased upward, reflecting economic growth, inflation, and risk premiums. Calendar months should be essentially random, with some stronger, some weaker, but no systematic loser. Yet September stands out.

Even when the average decline is modest, the persistence of the pattern is statistically striking. If returns were truly random, September shouldn’t consistently underperform across nine decades.

But while the averages paint a clear picture, the details complicate it. Some Septembers deliver rallies. Others post devastating drawdowns. The tendency is not predictive in any single year, but powerful in aggregate.

Notable Septembers in Market History

September 1929: The Dow peaked in early September before cascading into the crash that defined the Great Depression.

September 2001: Markets plunged in the aftermath of 9/11, with the Dow falling nearly 700 points on September 17 (then the largest single-day point drop in history).

September 2008: Lehman Brothers collapsed on September 15, triggering a global financial panic. The S&P 500 fell almost 9% that month.

September 2022: Amid inflation fears and rapid Fed hikes, the S&P 500 dropped 9.3%, its worst September since 2002.

These events reinforce the perception of September as a dangerous month. But the truth is subtler: not all Septembers are catastrophic, yet enough disappoint to sustain the legend.

Theories and Explanations

There is no single explanation for the September Effect. Instead, analysts point to overlapping factors: institutional behavior, tax policy, investor psychology, economic seasonality, and even self-fulfilling prophecy.

1. Institutional Portfolio Mechanics

Quarter-End Rebalancing

Large asset managers like pensions, insurers, and sovereign wealth funds, often adhere to target allocations (e.g., 60% equities, 40% bonds). After summer rallies, those equity weights creep higher. September, the end of Q3, is when portfolios are reset. That means selling equities in bulk.

The selling pressure ripples across markets, depressing returns.

Tax-Loss Harvesting

September is also the unofficial kickoff of tax planning. Underperforming positions get sold to offset gains, creating more supply. Though U.S. tax years end in December, institutions often begin adjustments in September to avoid liquidity crunches later in the year.

The result: excess selling pressure just as seasonal optimism fades.

2. Investor Psychology and Behavioral Finance

The Post-Summer Reality Check

Markets are quiet in July and August. Volume is light. Optimism lingers. But September marks a return to full attention: policymakers return from recess, economic data piles up, earnings season looms. Suddenly, optimism is replaced by caution.

Loss Aversion and Herd Behavior

Behavioral finance teaches us that investors feel losses twice as strongly as equivalent gains. September’s weak reputation creates an anchoring bias: traders expect trouble, so they pre-emptively sell. Herd behavior magnifies it. The expectation of weakness becomes the cause of weakness.

Seasonal Mood Shifts

Psychologists have even proposed links between seasonal affective tendencies and risk appetite. As daylight shortens and routines harden, investors become more defensive. The idea is speculative, but fits within the broader theme of sentiment shifts in September.

3. Economic and Policy Timing

Fiscal Year Deadlines

The U.S. government’s fiscal year ends on September 30. That makes September the month of budget debates, debt ceiling battles, and shutdown risks. Markets hate uncertainty, and fiscal noise often spikes at precisely the wrong time.

Corporate Positioning Before Earnings

September is the last chance to adjust before Q3 earnings. Companies may take write-downs, book charges, or tidy up balance sheets. Investors, wary of earnings misses, sometimes lighten exposure in advance.

Federal Reserve Spotlight

September often hosts pivotal Fed meetings. Rate changes, policy announcements, and updated projections land in September just as markets return to full liquidity. That adds another layer of potential volatility.

4. The Consumer and Business Cycle

Back-to-School Spending Shifts

Consumer spending peaks in summer. Travel, leisure, retail all benefit. By September, that wave recedes. Families focus on school expenses, cutting discretionary spend. For retailers and leisure companies, this marks a natural lull. Markets, forward-looking, anticipate it.

Commodity Seasonality

Even commodities show seasonal quirks. Oil demand often softens after the driving season. Agricultural cycles shift as harvests begin. These factors subtly filter into equity performance.

5. The Self-Fulfilling Prophecy

The most powerful explanation could be belief itself. The September Effect has been written about for decades. Investors know the pattern. Many try to sell early to avoid losses, then buy back later. That behavior creates pressure, amplifies volatility, and reinforces the very pattern they fear.

In this sense, September is not cursed. It’s expected to be cursed. And expectation is one of the strongest forces in markets.

Global Perspective

Interestingly, studies using U.K. data back to the 1600s find no evidence of a September Effect. Mean returns in September were no worse than other months over multi-century spans.

That suggests the effect may be less about the calendar itself and more about institutional and cultural dynamics specific to U.S. markets. Fiscal year timing, Wall Street portfolio practices, and U.S. investor psychology.

Global equity indices sometimes mirror U.S. weakness, but that may reflect contagion.

Modern Market Dynamics: Is the Effect Fading?

The September Effect has persisted for nearly a century, but there are signs it is weakening.

In the last decade, the median September return has often been positive, even as averages remain negative.

Many institutions now pre-position, selling in August to avoid September weakness. That shifts the pattern forward, diluting its power.

Algorithmic and globalized trading reduces the impact of seasonal U.S.-centric quirks. Liquidity flows respond more to macro shocks than calendar cycles.

Some economists argue the September Effect may be little more than a historical quirk, that markets have arbitraged away as awareness spread.

Investor Takeaways: How to Navigate September

Don’t Panic, Don’t Anchor

The September Effect is not destiny. More than 40% of Septembers deliver gains. Avoid anchoring decisions to superstition.Expect Volatility

Liquidity rises, policy events cluster, and psychology turns cautious. Even if returns don’t collapse, volatility tends to increase.Look for Opportunity

Seasonal weakness can create entry points. If quality assets are sold down on psychology alone, patient investors can add exposure at attractive levels.Context Over Calendar

Macro forces dominate. Fed policy, earnings, inflation, and fiscal risk will drive markets more than the calendar itself.

Conclusion: Myth and Market Reality

The September Effect is one of Wall Street’s strangest anomalies. A modest but persistent tilt toward weakness, reinforced by nearly a century of data and decades of investor storytelling.

It is not a curse. It is not destiny. It is a reflection of how institutions rebalance, how investors behave, and how narratives take hold.

In modern markets, the effect may be fading, but its reputation ensures it will never fully die. As long as investors expect September to be dangerous, their actions will keep it so.

For disciplined investors, September is not a month to fear. It is a month to understand. And, when others are nervous, it is a month that can offer opportunity.