UnitedHealth Group (UNH) - The Care Vanguard

Where Wall Street’s balance sheets meet the price charts

In a Nutshell

UnitedHealth UNH 0.00%↑ combines double‐digit revenue growth, expanding margins, and fortress cash flows with a beaten‐down valuation (∼17× forward P/E).

Technically, it’s in a corrective range ($285–336) with a key inflection at $303–307.

Look to scale in around $300–303, add on a daily close above $307, and target $336–382, with tight stops below $293.

Fundamental Analysis

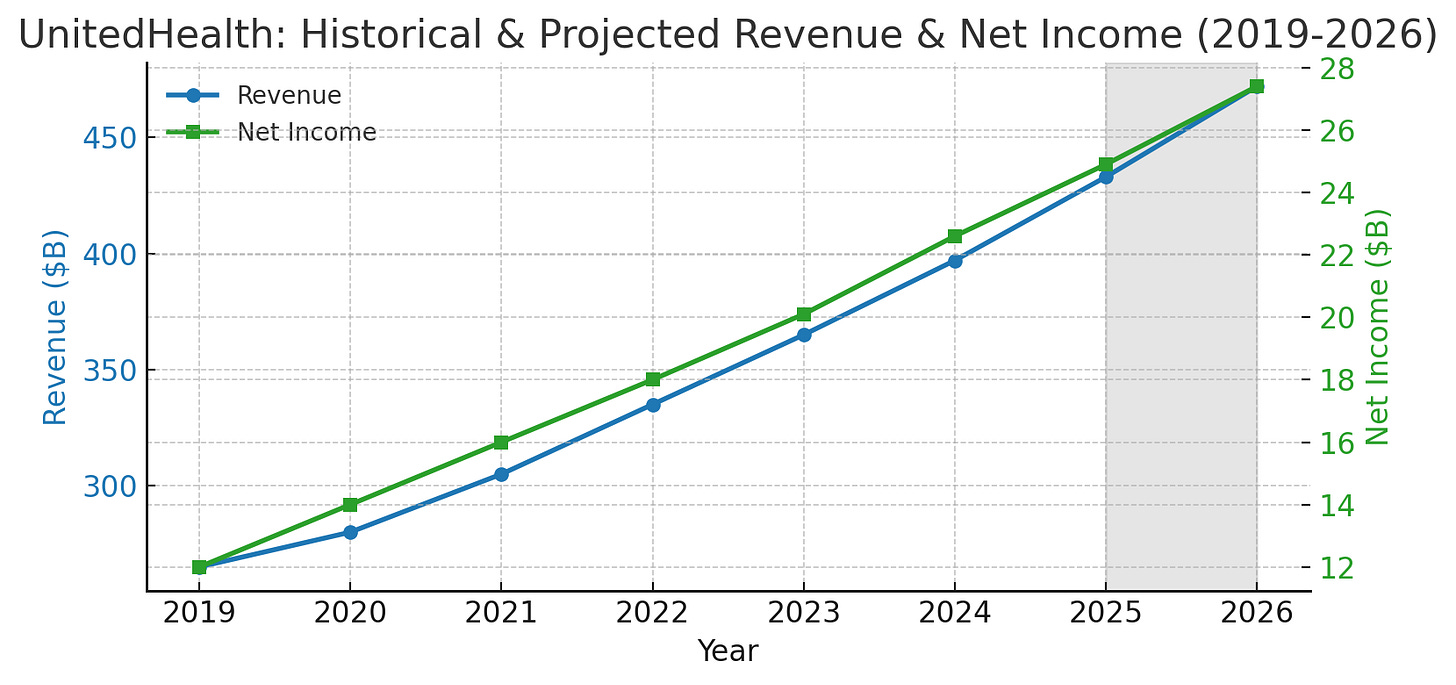

Top‐Line Growth: 2024 revenue reached $397 B (+8 % YoY); 5-year CAGR ≈11 %. Growth driven by premium hikes in Health Benefits and Optum’s expanding services.

Profitability: Net income of $22.6 B (+13 % YoY) yields a 5.7 % net margin (up from 5.3 %). Operating margins sit near 6.5–7 %, benefiting from scale in pharmacy and care delivery. ROE remains a robust ~25 %.

Cash Flow & Balance Sheet: Operating cash flow of ~$30 B and free cash flow of ~$20 B support dividends (∼1.3 % yield; 25 % payout) and $8 B of buybacks. Debt/EBITDA ≈2.5× and current ratio >1.0 underline solid liquidity and investment-grade metrics.

Valuation: Forward P/E ∼11.6× (down from 21×), EV/EBITDA ∼9× (low end of 9–12× historic band), P/CF ∼10× vs. 12× average. Post‐selloff levels offer a margin of safety for long‐term holders.

Technical Analysis

Weekly (Long Term): Deeply bearish trend; price below all SMAs (20/50/100/200-week at 356/434/506/499). Weekly support at 303 (1.618 fib extension) → 240, resistance at 356 → 434. MACD histogram flattening; RSI recovering from the low‐30s.

Daily (Medium Term): Rangebound in 285–315 since May. Key levels: support 293 (lower Bollinger Band) → 285 (May low); resistance 304 (20-day SMA) → 336 (50-day SMA). Daily Ichimoku and SMA converge at 304–307; a close above 307 would signal relief. Momentum tools (MACD, RSI, Stoch-RSI) suggest mild oversold relief.

Intraday (Short Term): Flat to slightly up, but trapped under the 50-hour SMA (~303). Watch 303–304 for a breakout and 300–293 for downside triggers. Low ADX (∼14) and ATR (∼2) indicate a stealthy build in volatility.

Our Trade Plan

Core Entry (Dip-Buy)

Zone: $300–303

Size: 50 % of intended allocation

Stop: $293

Secondary Entry (Confirmation)

Trigger: Daily close > $307

Size: Additional 30 %

Stop: Trail to $300

Aggressive Add (Trend Flip)

Trigger: Weekly close > $356

Size: Final 20 %

Stop: Trail to breakeven

Targets:

Short‐Term: $336 (50-day SMA)

Mid‐Term: $382 (50-week SMA)

Long‐Term: $430–450 (next major SMA cluster)

And Last

UnitedHealth’s fundamentals remain compelling, strong growth, high margins, and pristine cash flows, while its valuation has reset to a more attractive entry point. Technically, patience is warranted: deploy capital in stages around $300–303, amplify on a breakout above $307, and keep stops tight. This disciplined, phased approach balances the secular upside of a market leader against the backdrop of a still‐bearish chart.