Walmart (WMT) - The Retail Titan

Walmart is pulling back after a strong trend. The charts point to an ideal entry zone for the next leg higher. Here’s our roadmap for $WMT.

In a Nutshell:

Walmart WMT 0.00%↑ blends steady sales and stable margins (~25%) with long‑term earnings growth, trading at ~37× forward P/E.

Technically, it’s pulling back into a key zone ($97–$96.75), setting up for a potential rally towards $100–102.

Look to scale in around $97, add on a daily close above $97.15, and target $99.80–102, with a tight stop just under $95.94.

Walmart has evolved from pandemic beneficiary to a resilient consumer powerhouse. Its long‑term trend remains bullish, underpinned by strong cash flows, a dominant supply chain, and pricing leverage. Despite a short‑term pullback, the trend across higher timeframes is intact.

Technical Analysis

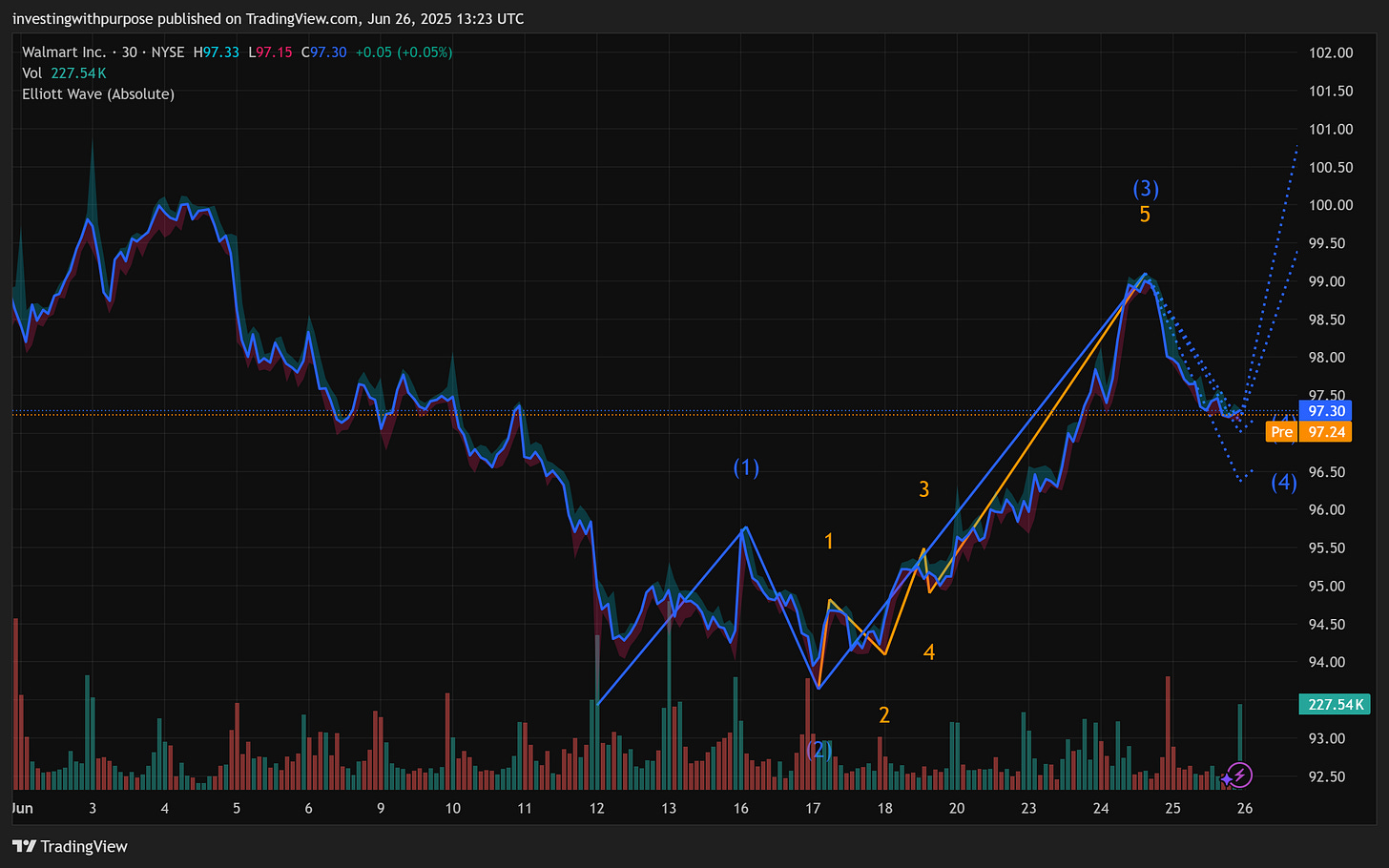

Walmart is at the tail end of its Wave 3 trend, having just completed the fifth leg of its sub-wave. As a result, the stock is retracing within Wave 4, presenting a potential entry before higher targets.

This is a healthy correction within an ongoing trend.

Monthly/Weekly: Strong trend across long‑term moving averages, RSI cooling from an overbought period.

Daily: RSI range suggesting neutral zone, with MACD lines compressing hinting at trend reset.

Elliott Wave: Clear Wave 3 top and Wave 4 retrace zone (~$97–$96.75), setting up Wave 5 target.

Invalidation Level: Below $96 (Wave 4 low, set stop-loss).

Fundamental Considerations

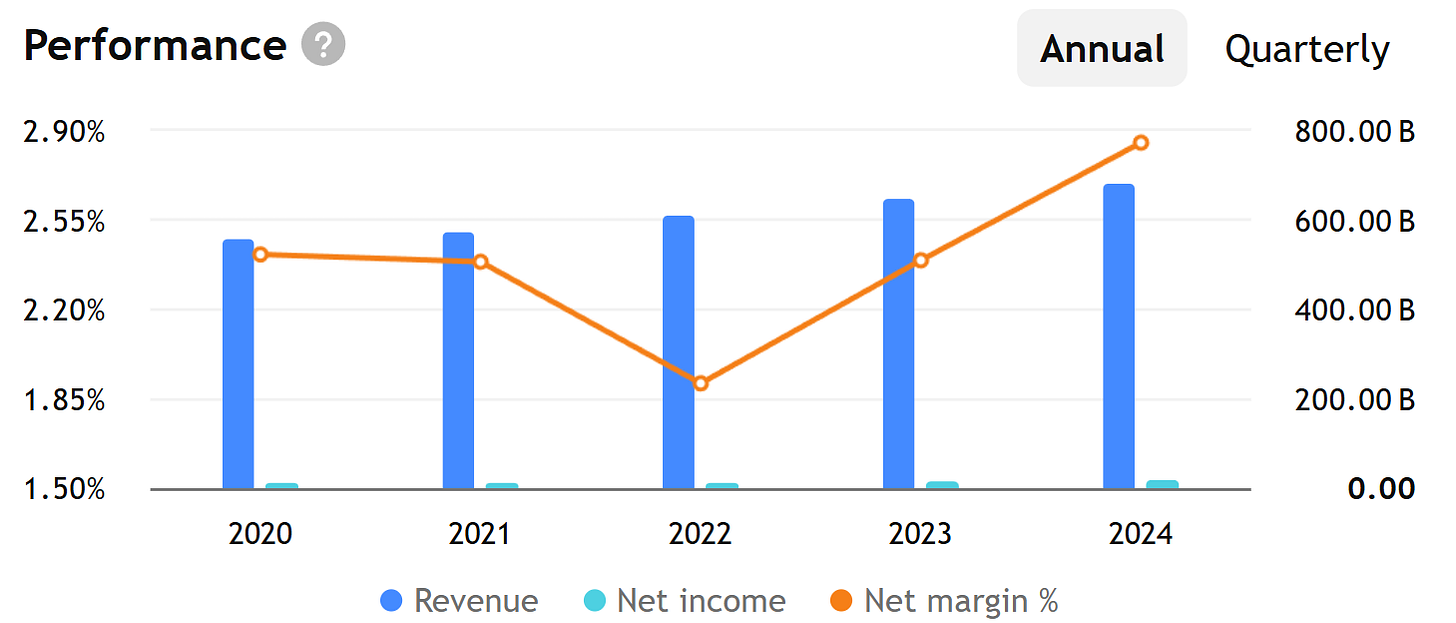

Earnings: Strong revenue beat, reaffirmed guidance.

Margins: Gross margin roughly stable (~25%), slight pressure offset by pricing.

Valuation: Forward P/E ~37x, aligning with long‑term trend and making retracements attractive.

Growth Outlook: ~5% Revenue growth projected, with EPS growth forecast around or even above 10% for the next year, making Walmart a stable long‑term compounder. Higher earnings this year would drive trailing P/E closer to forward.

Trade Plan Setup:

Buy Zone: $97.15–$96.75

Stop: Around or below $96

Targets:

Target 1: $99.84

Target 2: $101.49

Risk/Reward:

Risk: ~ $1.20–1.40

Reward: ~ $3–4.70

Final Thoughts

Walmart is acting like a textbook long‑term winner that’s pausing for breath. After a strong run, the stock is pulling back into a zone where buyers have reliably stepped in before. Its solid earnings growth, stable margins, and dominant market position make this a compelling spot for long‑term investors and swing traders alike. The risk is clearly defined, and the reward (a move towards $100–102) more than justifies getting involved here.

The information in this post is for educational and informational purposes only. It reflects the author’s personal research and analysis, which may be subject to error or omission. This is not financial, investment, or trading advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment or trading decisions.