Warner Bros. Discovery: From Fallen Giant to Hollywood’s Hottest Buyout Bet

Stock surges on takeover rumors, colliding with a rare technical reversal.

Fresh off some major acquisition news, WBD 0.00%↑ is looking more and more interesting. After years of debt struggles and declining investor confidence, the stock has suddenly come alive, rallying around 30% in a day on reports that PSKY 0.00%↑ Paramount Skydance is preparing a takeover bid backed by ORCL 0.00%↑’s Larry Ellison. Add to that improving fundamentals, stabilizing free cash flow, and a technical breakout from a multi-year downtrend, and WBD 0.00%↑ has gone from value trap to a potentially exciting turnaround and merge play.

TL;DR

Merger buzz: Paramount Skydance PSKY 0.00%↑ is preparing a bid for WBD 0.00%↑, backed by Oracle’s Larry Ellison. Analysts at Needham see upside to $24.30/share if synergies are realized.

Fundamentals: After years in the red, WBD is finally posting positive net income ($765M TTM). Debt remains heavy ($34B net debt), but cash flow is stabilizing.

Technicals: Multi-year downtrend may be over. Breakout above $13–14 marks a regime shift, with short-term support at $14–15 and upside targets toward $20+.

Trade plan: Bias stays bullish while above $14. Retests of support are buying opportunities, and a confirmed deal could push valuation into the mid-$20s.

Merger Buzz: Paramount Skydance + WBD

Warner Bros. Discovery WBD 0.00%↑ has been struggling since the 2022 merger, onboarding and servicing massive debt, undergoing a costly restructuring, and losing cable revenue. Shares collapsed from the mid-$20s to single digits by 2023.

But 2025 seems different.

The Wall Street Journal reported that Paramount Skydance PSKY 0.00%↑ is preparing a bid for WBD, a move analyst Needham & Co. calls “strategically and economically logical.”

Key points:

Deal threshold: CEO David Zaslav’s contract requires a takeover premium above $16.80/share.

Upside math: With $3–4.5B in cost synergies, Needham estimates ~$30B in added value. If all of it accrues to WBD holders, that implies $24.30/share.

Strategic rationale: Combining two sub-scale studios would create a Hollywood heavyweight, with ~$18B in ad revenue, making it the 5th largest in the U.S.

Funding confidence: Backing from Oracle ORCL 0.00%↑ co-founder Larry Ellison adds financial credibility.

Market reaction: WBD 0.00%↑ stock surged ~30% in a single session on the news; PSKY 0.00%↑ jumped 16%.

While regulatory risks remain, this would be the biggest studio consolidation since DIS 0.00%↑ bought Fox in 2019.

Fundamental Analysis

WBD 0.00%↑’s TTM net income flipped positive ($765M) - with significant improvement in normalized NI, revenues stabilized around $38B, and operating cash flow is strong ($5B TTM). While leverage is still significant (net debt ~$34B), progress on free cash flow ($4B TTM) is easing fears.

Looking at WBD’s financials:

Revenue: ~$38B TTM, relatively stable vs. 2023 ($41B).

Profitability: Net income turned positive ($765M) vs. -$11B in 2024. EPS sits at $0.32.

Margins: EBITDA $23B TTM, showing strong cash earnings power.

Cash Flow: Free cash flow $4B, critical for debt reduction.

Debt: Net debt at $34B is heavy, but trending down from $45B in 2022.

Balance Sheet: Tangible book remains negative (-$38B), but cash on hand ($4.9B) provides short-term cushion.

Takeaway: Fundamentals are far from clean and reassuring, which could mean an acquisition bid comes at a strategic time. But WBD 0.00%↑ is moving in the right direction. Debt is the biggest overhang. A merger that unlocks $3 to 4.5 billion in synergies could accelerate deleveraging.

Technical Analysis

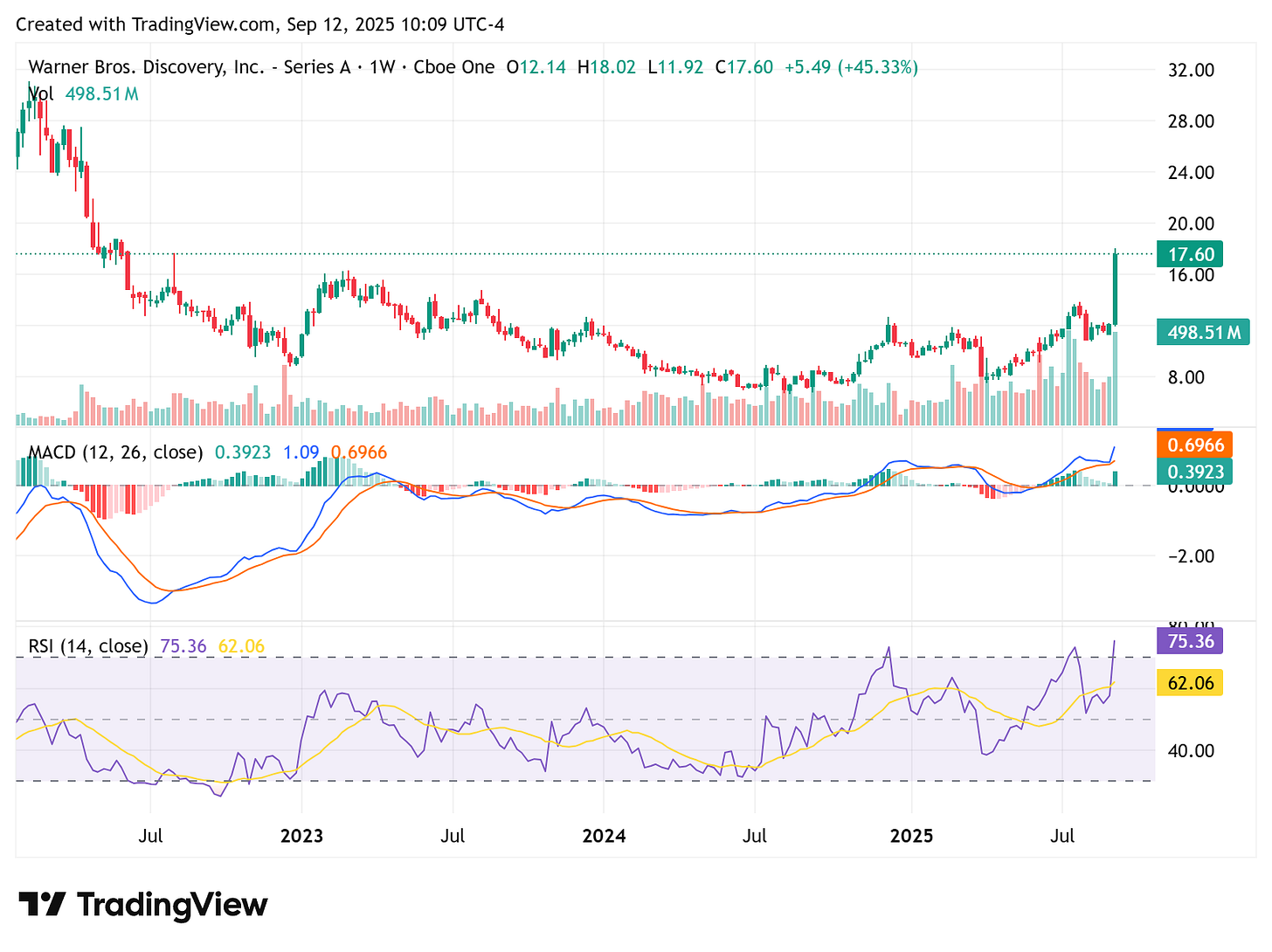

Weekly (Long-Term):

WBD has broken out of its multi-year downtrend, clearing the critical $13–14 zone.

RSI/MACD confirm momentum shift; volume surged to multi-year highs.

Resistance: $17.5–18 (near-term), $21.5 next major.

Support: $13.5, then $11.5.

Daily (Medium-Term):

Elliott count shows wave 3 completed, with a wave 4 retrace likely to $12.8–14.

A higher wave 5 push could target $20+.

Short-Term (2h/1h/30m):

Stock is extremely overbought (RSI > 90).

Pullback zones: $14.7, then $14.0, then $13.2.

As long as it holds above $14, setup remains bullish.

Summary: A long-term reversal is clearly in play, although short-term corrections are likely. The $14 to $15 zone seems to be the line in the sand, considering the technicals and merger dynamics. Should the acquisition not go through, things would change.

However, if the acquisition does go through with a minimum takeover premium of $16.80 per share, you can expect the pullback zones and resistance lines to shift upwards, and fair price of WBD 0.00%↑ would hover around $24.30.

Trade Plan

Bullish Bias: While above $14.

Buy Zones: $14–15 retrace = favorable risk/reward.

Targets: $17–18 near term, $20–22 on wave 5 extension. If PSKY 0.00%↑ deal proceeds, Needham’s $24+ becomes realistic.

Risk Management: A break below $13 invalidates the bullish wave count and reopens downside risk.

Conclusion

Warner Bros. Discovery has shifted from a value trap to a potentially strategic Hollywood prize with extreme upside. Fundamentals are stabilizing, technicals are turning bullish, and the Paramount Skydance merger chatter would be a game-changer.

Whether the deal materializes or not, the setup now has both technical momentum and takeover premium driving upside. WBD 0.00%↑ is no longer dead money, it’s back in play (for now).