Why BROADCOM’s pullback matters more than the headline reaction

A dominant AI infrastructure player works through a healthy reset

Broadcom rarely gives investors clean, easy entries. It is a company built on scale, pricing power, and execution, and the stock usually reflects that. When it pulls back, it tends to do so for a reason.

After the latest earnings, AVGO sold off sharply. Not because the business broke, but because expectations, positioning, and near-term margins needed air. This is the kind of moment that separates story-driven enthusiasm from disciplined investing.

Let’s walk through what actually changed, what didn’t, and how to think about AVGO from here.

Key Takeaways

Broadcom’s core business and long-term AI positioning remain intact.

The earnings reaction was driven by mix, margins, and concentration concerns, not demand collapse.

Backlog visibility is strong, but revenue quality matters more at this stage of the cycle.

Technically, AVGO is correcting from a stretched zone into clearly defined support.

This is a stock to engage selectively on pullbacks or strength, not chase emotionally.

Pipeline, Backlog, and the Latest Earnings

Broadcom’s earnings reinforced one central point: demand is not the issue.

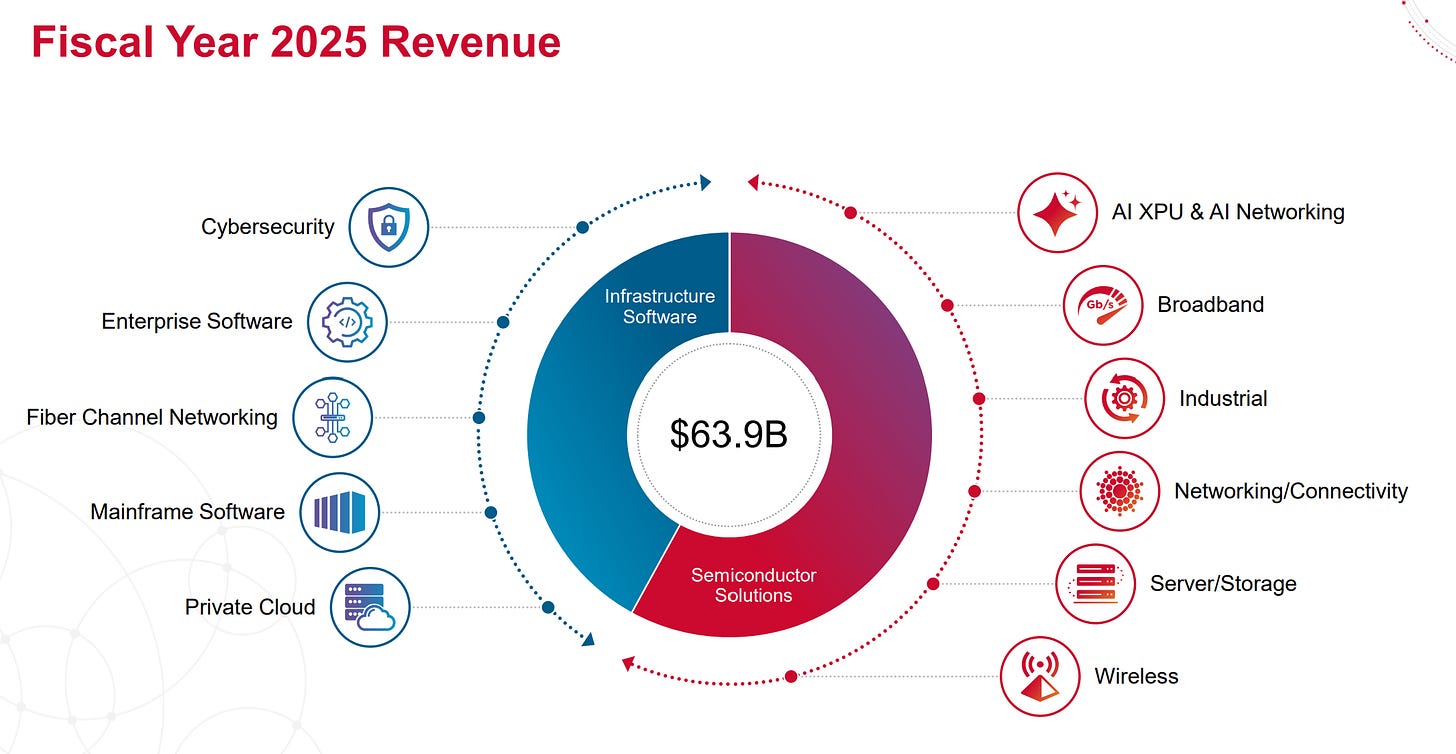

The company continues to see strong traction across AI networking, custom silicon, and infrastructure software. Its backlog remains elevated, supported by long-term hyperscaler commitments and multi-year design wins. That backlog provides visibility, but it also explains part of the market’s hesitation.

A few things stood out:

Growth is increasingly driven by large AI programs tied to a small group of hyperscale customers.

Revenue mix is shifting toward more system-level and bundled solutions, not just high-margin silicon.

Some revenue is effectively pass-through in nature, boosting the top line while diluting margins.

The market reaction was less about “what happened” and more about “how it’s happening.”

When revenue growth accelerates faster than margins, investors pause. When customer concentration rises, investors demand a wider margin of safety. None of this breaks the story. It simply resets expectations.

Fundamental Analysis: Strong Growth, but the Marginal Dollar Is Less Profitable

Broadcom’s latest earnings confirmed that growth is accelerating, but also clarified where that growth is coming from and at what cost.

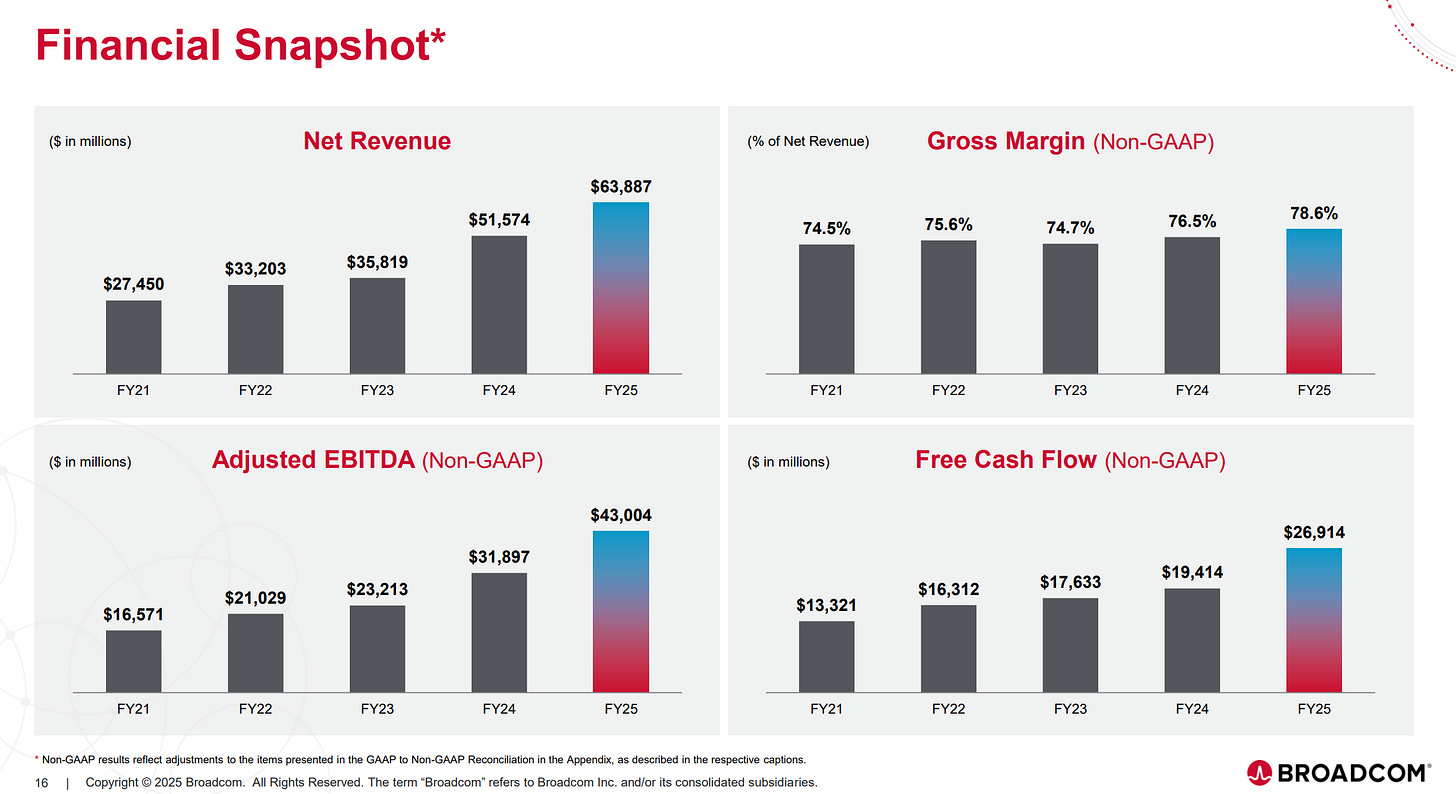

Revenue grew roughly high-20s % YoY, driven primarily by AI-related semiconductor demand and infrastructure software. Within semiconductors, AI revenue grew materially faster than the company average, with management guiding for AI-related sales to approach low double-digit billions annually, and to grow at a high double-digit % rate over the near term. That is real scale, not narrative.

The backlog reinforces this picture. Broadcom is now sitting on a very large multi-quarter AI order book, much of it tied to custom silicon, AI networking, and long-dated hyperscaler programs. This provides unusually strong visibility for a semiconductor business and meaningfully reduces demand risk over the next 12–18 months.

What changed with this earnings report is the quality of incremental growth:

Gross margin, while still high in absolute terms, is facing near-term pressure. Management explicitly guided to a sequential margin decline as AI-related systems and bundled solutions become a larger share of revenue.

Incremental revenue is increasingly tied to system-level and pass-through components, which lift reported sales but contribute less profit per dollar than Broadcom’s traditional high-margin silicon and software.

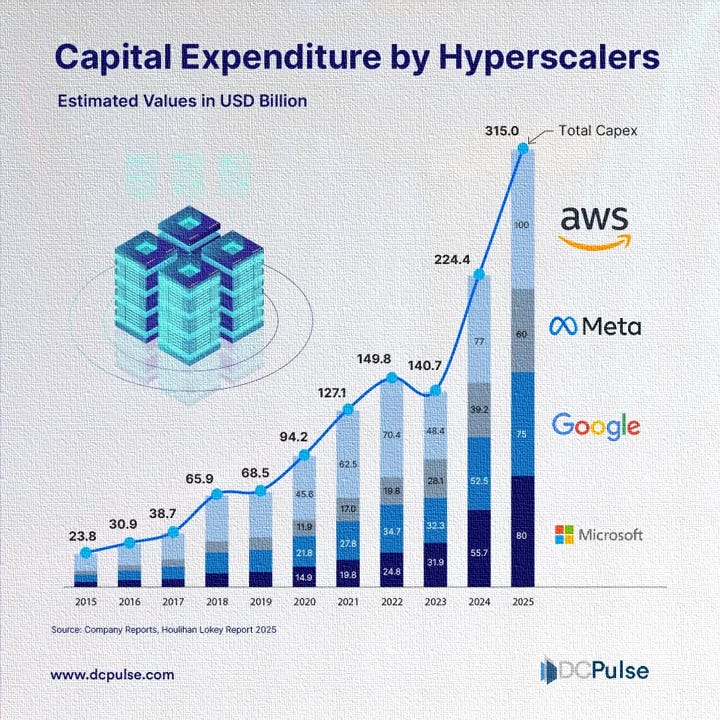

Customer concentration has increased, with a small number of hyperscalers accounting for a growing share of growth. This raises sensitivity to capex timing, even if long-term demand remains intact.

Free cash flow remains a key anchor. Broadcom continues to convert a large share of earnings into cash, supporting debt service, dividends, and strategic flexibility. This is not a balance-sheet or liquidity story.

The market’s reaction fits this setup. When revenue growth remains strong but incremental margins compress, valuation becomes harder to defend in the short term, especially after a powerful run.

Fundamental conclusion: Broadcom’s long-term earnings power and AI relevance remain intact. The earnings reset expectations by showing that the next phase of growth is durable, but less margin-accretive. That justifies consolidation in the stock, not a break in the business case.

Technical Analysis: From Extension to Consolidation, Explained

Broadcom’s technical picture shifted meaningfully after earnings, but the shift is from extension to consolidation, not from strength to weakness.

Trend structure first.

On higher timeframes, the primary trend remains intact. Price is still above the key long-term moving averages that define trend direction. This tells us the broader uptrend has not broken. When a stock remains above these longer-term trend anchors, corrections are usually about resetting momentum, not reversing direction.

Why the selloff started where it did.

Before earnings, AVGO had pushed into the 400 area, which coincided with multiple technical extremes lining up at once:

Price was extended well above medium-term trend support

Momentum readings were elevated, signaling late-stage buying pressure.The stock was trading near upper expansion zones where profit-taking historically increases

When price reaches those conditions, it does not take bad news to trigger a pullback. It only takes news that is “not better enough.”

How the current support levels were identified.

385–378: This zone is defined by prior price structure where buying previously stepped in, combined with a retracement of the most recent advance and proximity to intermediate trend support. When multiple reference points overlap, markets often pause there first. This is why it is the initial area to watch for stabilization.

371–366: This range marks a deeper retracement of the same advance and aligns with an earlier consolidation area. If price reaches this zone, it suggests the market is no longer doing a shallow pullback but is still correcting in an orderly way.

360–351: This is the final structural support band tied to the broader trend. It lines up with deeper retracement levels and longer-term trend support. A move into this area would feel uncomfortable, but technically it would still fit a healthy correction within an ongoing uptrend.

Where momentum indicators stand and what they imply.

Short-term momentum has rolled over. This reflects the sharp post-earnings move and explains why upside attempts may struggle initially. Rallies can still occur, but they are more likely to be tested.

Medium-term momentum is flattening rather than collapsing. This is a classic sign of consolidation, not distribution.

Longer-term momentum remains constructive, reinforcing that the dominant trend is still up.

This combination tells us the market is absorbing excess optimism rather than exiting the stock outright.

What needs to happen on the upside.

399–403: This area now represents the first real test for buyers. It is where the prior advance stalled and where sellers recently took control. Reclaiming and holding this zone would indicate that selling pressure has been absorbed and balance is returning.

Above 415: A sustained move above this level would signal that momentum has reaccelerated and that the correction phase is likely complete, reopening the path toward higher expansion zones.

Technical conclusion: AVGO is transitioning from a momentum-driven phase into a level-driven phase. The stock is no longer about chasing strength. It is about observing how price behaves at clearly defined support and resistance zones, and whether momentum rebuilds through higher lows and successful reclaim levels. As long as the deeper support bands hold, the technical structure remains constructive for medium- to long-term positioning.

A Simple, Clear Trade Plan

This is not a stock to rush. The plan should be clean and disciplined.

Pullback entries

385 to 378: Price is now inside this band, so this becomes the first near-term actionable entry zone. This zone integrates prior swing support, retracement support, and trend-aligned bounce potential.

371 to 366: If 378 breaks, this is a deeper technical support zone where buyers historically engage. This maintains good risk/reward and still fits within the broader trend.

360 to 351: Last high-quality demand zone before the correction becomes structurally concerning.

Breakout entries

Reclaim and hold above 399 Signals absorption of selling pressure and a return to the prior range.

Clean break and hold above 415 Confirms renewed upside momentum and continuation.

Stop | Invalidation below 348 on a closing basis

This level marks a break of the broader trend structure. Below it, the thesis changes. The choice of 348 reflects trend structure, not an arbitrary buffer.

Targets

Short term: 399, then 415 These are natural reaction and reclaim levels.

Medium term: 428, then 443 to 445 Prior expansion zones where profit-taking often appears.

Long term: 463 to 465, then 488 to 490 Higher-timeframe extension areas if the trend fully reasserts.

Levels were chosen based on prior price structure, trend behavior, and natural zones where markets historically pause or reverse.

Bottom Line

Broadcom did not disappoint. The market simply asked for a reset.

This is still a best-in-class AI infrastructure business with real earnings power and long-term relevance. But the stock had moved into a zone where expectations were tight and forgiveness was low.

From here, AVGO becomes interesting again only if price respects key support or proves its strength by reclaiming resistance. Anything else is noise.

Strong business. Cleaner setup ahead.

This content is for educational purposes only and isn’t investment advice or a recommendation to buy or sell any security.