Why Money Problems Rarely Start With Money

Most financial stress is structural, not personal.

Most people assume financial trouble begins with a mistake. Overspending, poor judgment, a bad investment, or a lack of discipline are usually the first explanations offered. In reality, most money problems don’t begin with bad decisions at all. They begin with financial systems that function smoothly only under ideal conditions. When income, expenses, and obligations are tightly linked, even small disruptions can create outsized pressure.

That isn’t a failure of character. It’s a failure of structure. And understanding that difference matters, because it changes how resilience is built and how risk should be managed in everyday financial decisions.

Key Takeaways

Financial stress usually reflects structural fragility, not poor intent.

Tight coupling between income and obligations amplifies small shocks.

Cash flow timing matters as much as total income.

Optionality is the foundation of financial resilience.

Good financial plans are designed to function when conditions change.

The Hidden Source of Financial Stress

Most personal financial setups are built around an assumption of stability. Income is expected to arrive on schedule, expenses are assumed to remain predictable, and obligations are structured as if interruptions are unlikely. For a time, this works. But life rarely respects those assumptions. Income changes, costs rise, and timing shifts in ways that no spreadsheet can fully anticipate.

When a financial system depends on everything going according to plan, it becomes fragile by design. The problem isn’t that something went wrong. It’s that the system was never built to absorb variation. This is why two people with similar incomes can experience vastly different levels of financial stress. The difference is not effort or intelligence. It’s structure.

Cash Flow Is the First Constraint

Personal finance discussions often emphasize totals. Annual income, net worth, or long-term projections dominate the conversation. In practice, timing matters just as much. If income arrives monthly while expenses are fixed weekly, pressure builds. If income is variable but obligations are rigid, stress compounds. If emergency funds exist in theory but are inaccessible in reality, they fail when they are needed most.

These mismatches turn manageable situations into urgent ones. They force decisions under pressure rather than allowing choices over time. That pressure is often misread as poor money management, when in fact it is a cash flow problem created by timing, not behavior.

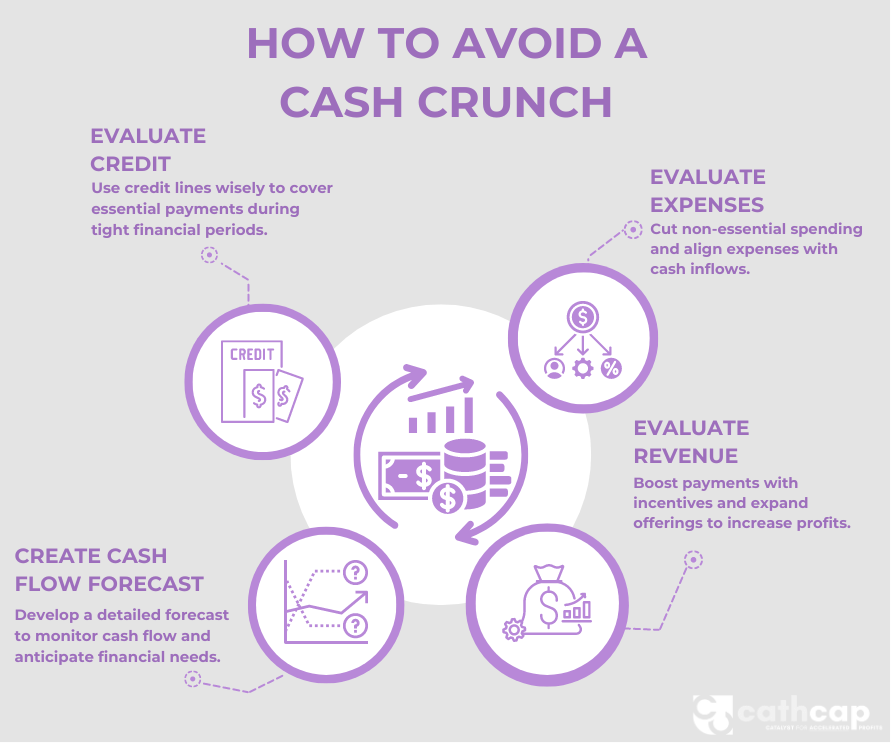

Managing Cash Flow to Avoid Financial Stress

Source: Cathcap. Illustrative cash flow management framework.

Balance Sheet Fragility Is Not About Size

A strong balance sheet is not defined by how much someone owns. It is defined by how much flexibility remains after obligations are met. High fixed costs relative to income reduce adaptability. Debt structures that assume uninterrupted cash flow increase vulnerability. Assets that cannot be accessed without penalty limit response options.

None of these issues require reckless behavior to develop. They emerge quietly through normal life progression and incremental optimization. Over time, fragility builds not because people take excessive risk, but because they leave themselves no margin for error.

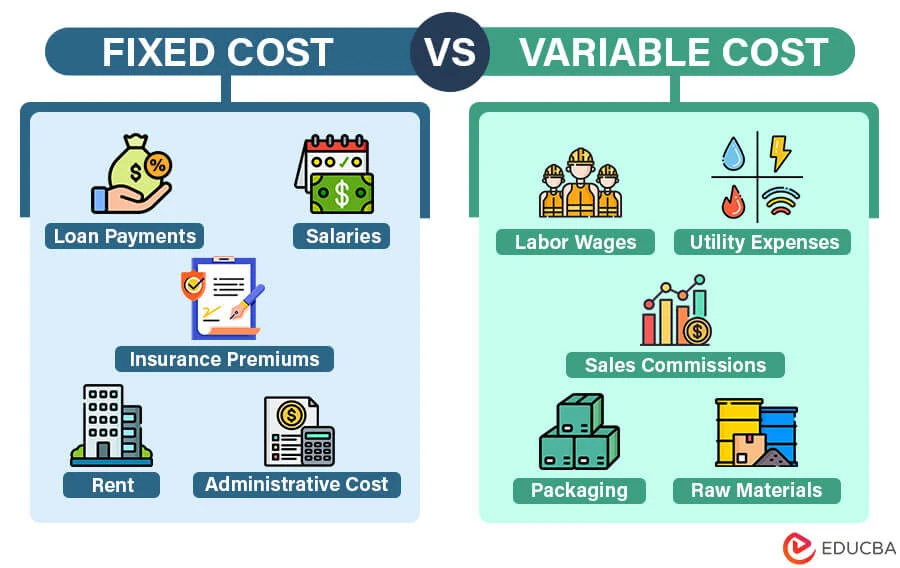

Why Fixed Costs Increase Financial Fragility

Source: EDU CBA. Illustrative cost structure framework.

Optionality Is the Missing Ingredient

The most underappreciated concept in personal finance is optionality. Optionality means having choices when conditions change. It means avoiding forced decisions and retaining the ability to adjust without breaking the system.

This does not require extreme conservatism. It requires intentional design. Maintaining some liquidity even when returns appear more attractive elsewhere, keeping fixed costs proportional to reliable income, and structuring debt so it remains serviceable under less favorable conditions all preserve optionality. This is not about predicting outcomes. It is about surviving variability.

Why This Is Often Misunderstood

When conditions are favorable, fragile systems appear efficient. Expenses are covered, debt is serviced, investments grow, and stress remains low. This creates the illusion of robustness. In reality, the system has simply not been tested.

When conditions change, the same setup reveals its weaknesses. The response is often self-blame or reactive adjustment rather than structural reassessment. The lesson is not to avoid risk entirely. It is to avoid configurations where a single disruption cascades into multiple problems.

Why Financial Plans Should Be Tested, Not Assumed

Source: The Finance Hub. Illustrative personal finance stress-testing framework.

What a Resilient Financial System Looks Like

Resilient personal finance is not built around perfection. It is built around tolerance. Income streams allow for variability, obligations can adjust, liquidity exists where it matters, and risk is sized so mistakes are survivable. Most importantly, decisions are not made under pressure.

This does not eliminate stress entirely, but it reduces the probability that stress becomes destabilizing. It allows financial decisions to remain deliberate rather than reactive, even when circumstances shift.

Bottom Line

Money problems rarely start with money. They start when financial systems assume nothing will change. Resilience comes from designing personal finances to function across a range of outcomes, not just the expected one. Cash flow timing, balance sheet flexibility, and optionality matter more than optimization or precision.

The goal is not to eliminate uncertainty. It is to ensure uncertainty does not force your hand. That is what durable personal finance looks like.