Zeta Global ($ZETA): Beneath the Noise Lies a Platform Beast

Cash-rich, high-growth, misunderstood. $ZETA is compressing under macro pessimism. But the setup rewards patience.

Zeta Global isn’t a household name, but it should be. Behind the curtain is a first-party data platform quietly onboarding brands and compounding revenues faster than most of Big Tech. The problem? GAAP losses, stock-based comp, and a chart that’s been taking a beating since November 2024.

But that’s the opportunity.

This is a case where both the technical roadmap and the fundamental trajectory align: the near-term may get uglier, but the longer-term setup is a coiled spring. Let’s break down why.

In a Nutshell

Revenue +36% YoY, FCF positive, net debt neutral, yet stock trades near lows

Wave (c) corrective structure likely not finished

Institutional support rising, but public sentiment is muted

Once corrective C-leg ends, look at targets of $20+

Accumulate near $13.50–$12.00 with stop below $11.50

Fundamental Analysis

Zeta Global is a marketing technology company that provides an AI-powered marketing cloud. It focuses on helping businesses acquire, grow, and retain customers through data-driven, omnichannel marketing solutions. Essentially, Zeta Global offers a platform that combines data, intelligence, and activation to create better customer experiences and marketing results.

Financial Strength

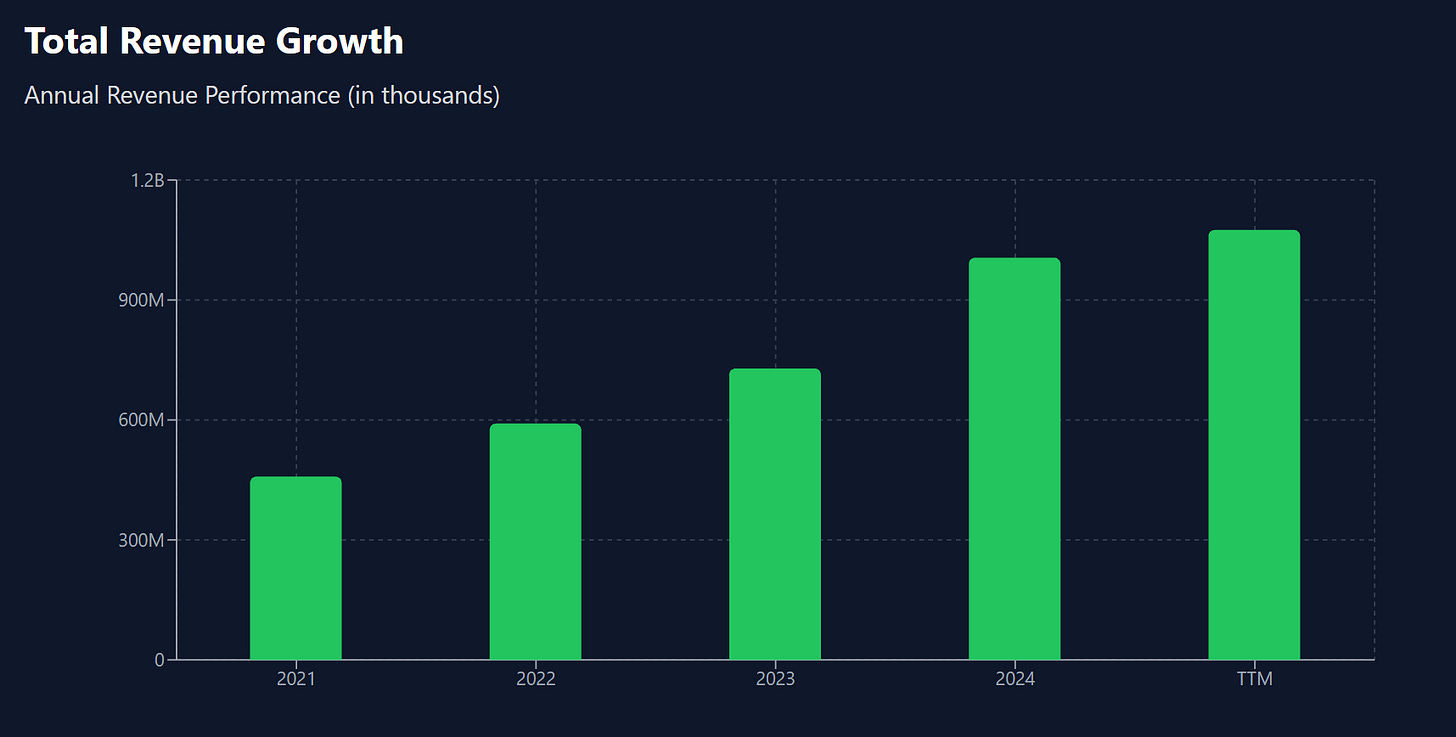

TTM Revenue: $1.075B (+30% YoY)

Gross Margin: ~60%

Free Cash Flow (TTM): $104.8M (positive 3 straight years)

Operating Cash Flow: $144M

Cash Position: $363M vs. $196M total debt

No net debt + growing working capital means liquidity is not a concern

Profitability Concerns

GAAP Net Loss (TTM): -$51.8M

EBITDA: Positive $9.1M

Normalized EBITDA: $20.5M

Diluted EPS: -$0.25, but improving from -$1.20 (2023) and -$2.95 (2021)

While still unprofitable on a GAAP basis, the trend is decisively upward. The key is scaling into operating leverage—and they’re almost there.

Valuation

Forward P/E: 23.98

Market Cap (@ $15): ~$3.55B

P/S (2025E): ~2.8x

For a 30% YoY grower with positive FCF, this is undervalued relative to SaaS peers

Analyst PTs: $25.33 avg, $44 high → potential 65–190% upside

Technical Analysis

Elliott Wave Structure

From the 2024 high ($38.20), Zeta is completing a textbook 5-wave down

On the 1-month chart, Wave (b) seems to have completed on Friday, and corrective Wave (c) likely to commence

Multiple charts show confluence between $13.30 and $12.20 as critical retracement zones

Fib + EMA Confluence

Strong EMA compression on 1h, 2h, 4h as price coils post-earnings

Daily EMA 20/50/100 all turning up, but price slipping below 20 and 50 EMA = short-term pressure

Fib extension projects possible bottoming between $13.30–11.50

Momentum Signals

MACD on daily = bear cross just occurred

Although overbought in the short term, RSI falling from overbought (60s–70s) back to neutral (50s), confirming pause/consolidation

Weekly MACD turning up but still early; RSI recovering off 30s → base-building

Conclusion

Fundamentals:

ZETA 0.00%↑ is one of the rare growth names posting consistent revenue acceleration, expanding margins, positive cash flow, and no net debt—yet trades at a steep discount to fair value due to past GAAP losses and low investor awareness.

It’s still in the “show-me” phase—but showing it is.

Rating: Fundamentally bullish

Technicals:

Wave structure and Fib zones suggest a final C-leg may be in play, which could drag price to $13.30–$12.20 before launching higher. However, if current levels hold, Zeta could be in early stages of a rebound.

Either way, technicals say accumulate into weakness with patience.

Rating: Technically cautious near-term, bullish mid-term

Trade Plan

Entry Zones

Tier 1: $14.20–13.50

Tier 2: $13.30–12.20

Close below $11.50 (structural invalidation)

Target Zones (2025–2026)

Minimum: $20.50

Full extension: $27.00 → $30.00

Analyst High Target: $44.00

Risk Management

Stop: Below $11.50

Position sizing: scale in 1/3 size each tier, stop on full size below invalidation

To Conclude

Zeta Global is a misunderstood compounder with a rapidly improving balance sheet, strong FCF, and sticky SaaS-like revenue model. While price action looks weak short term, it's forming a base that could fuel a breakout once the corrective structure completes.

Accumulate weakness. Prepare for strength.

The information in this post is for educational and informational purposes only. It reflects the author’s personal research and analysis, which may be subject to error or omission. This is not financial, investment, or trading advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment or trading decisions.