Our Trade Plan Update For The Week Ahead

From year-end momentum to early-cycle discipline: structure, selectivity, and execution into 2026.

Market Update - Early January 2026

As we move into the first full trading stretch of 2026, this update reflects how price has evolved, not a shift in philosophy. The market has absorbed year-end flows, volatility has normalized, and leadership is becoming more selective. Some trends have extended cleanly. Others are pausing, compressing, or testing prior breakout levels.

This is no longer a market that rewards urgency. It rewards discipline, structure, and selectivity. Many setups have transitioned from clean pullback entries into momentum digestion or confirmation phases. The focus now is on identifying which moves are consolidating for continuation versus those that have already priced in near-term upside.

The objective remains unchanged: engage only where risk is defined and asymmetric, and step aside when price stops offering that edge. Not every strong chart deserves exposure. Not every dip is actionable.

Execution matters more than conviction at this stage. Let price confirm the next move.

How We’re Executing

We act only at predefined levels, where downside is already understood.

We avoid the middle.

We don’t chase strength.

We reduce or pause exposure when structure weakens.

Not every pullback is a buy.

Not every bounce deserves capital.

Cash is a position.

Waiting is part of the plan.

Risk Comes First

This phase continues to reward risk control over aggressiveness.

Position sizing matters.

Stops matter.

Doing nothing matters.

Protecting capital here preserves optionality for the next high-conviction phase.

What Comes Next

Below, we’ll update each stock and ETF individually with tight, 1-2 line trade plans, reflecting the latest technical structure. Some names remain actionable. Others move to hold-only or observation mode. A few will require fresh confirmation before capital is deployed.

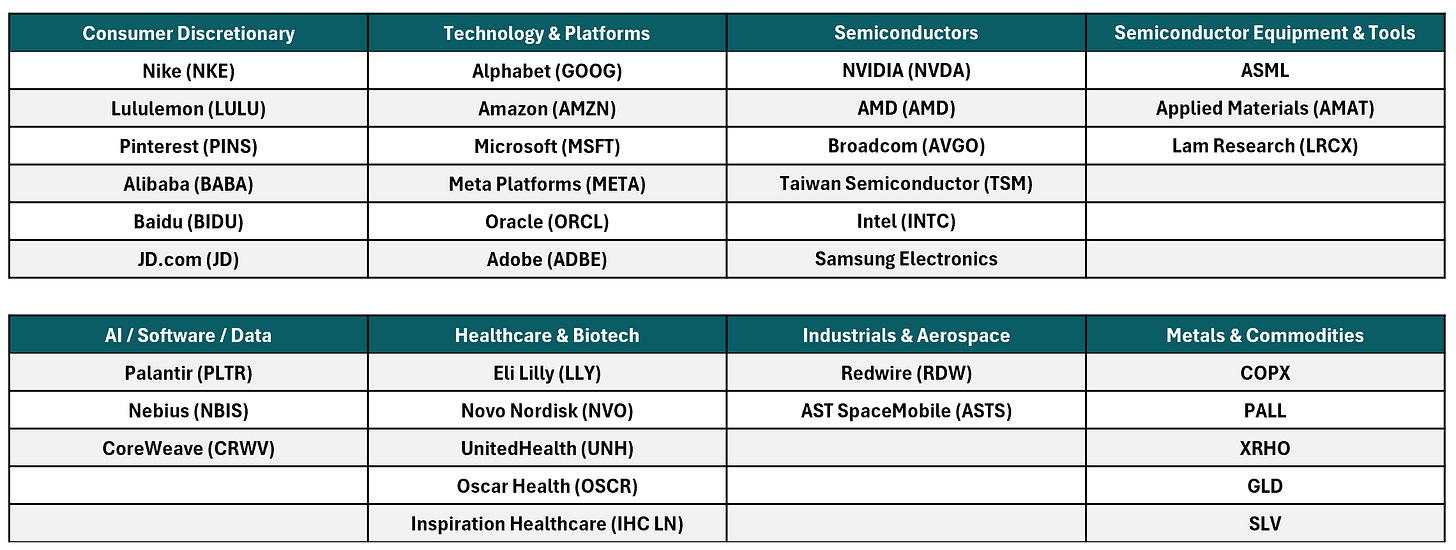

This trade plan update below covers all stocks and ETFs in the table that follows:

Technology - Mega Cap & Platforms

Alphabet GOOG 0.00%↑

GOOG is compressing above short-term EMAs; stay patient and only engage on a clean breakout and hold above 319–322. Until then, this remains a consolidation, with risk rising on a loss of 312.

Microsoft MSFT 0.00%↑

MSFT is stabilizing after a sharp breakdown, but structure is still repair-mode below the declining EMAs. No new exposure unless price reclaims 480–485; otherwise, this remains a hold-only / wait-for-confirmation setup.

Meta Platforms META 0.00%↑

META is basing after the impulse flush, with momentum slowly improving. Longs only make sense on a sustained reclaim above 655–660; failure to hold 645 keeps this range-bound and tactical.

Oracle ORCL 0.36%↑

ORCL has cleanly broken out and is accelerating with momentum expansion. Hold or add on shallow pullbacks while above 195–196, managing strength into extensions rather than chasing.

Adobe ADBE -5.25%↓

ADBE remains heavy below all key EMAs after the breakdown. This is still a wait-and-see name, but last week’s entry window has been hit. Keep a tight stop below 320 annd wait for price to reclaim 338–345 and stabilize above that zone.

Semiconductors & Hardware

NVIDIA NVDA 0.92%↑

NVDA is working through a controlled pullback after failing to sustain the push toward the low-190s, with price now sitting back on short-term trend support. Momentum has cooled materially, but structure is not broken. The 187–185 zone is the key area to watch, as it aligns with rising EMAs and prior consolidation; holding this area keeps the broader uptrend intact and opens the door for stabilization. A reclaim of 189–190 is needed to re-engage upside momentum toward 192–195, while a decisive loss of 185 would shift this into a deeper digestion or corrective phase and argue for patience.

Advanced Micro Devices AMD 4.85%↑

AMD has failed to hold its recent breakout and is now unwinding back into a trend-support and mean-reversion zone, with price slipping below short-term EMAs and momentum still correcting. This is no longer a momentum chase setup. Primary focus shifts to whether the 220–218 area can hold on a closing basis, as that zone aligns with the rising 200 EMA and prior structure. A sustained hold there keeps the broader uptrend intact and allows for stabilization, while reclaiming 223–224 would be needed to re-open upside momentum toward 226+. A decisive loss of 218–216 would signal deeper trend fatigue and warrants patience rather than early re-entry.

Broadcom AVGO -0.26%↓

AVGO has repaired structure and is grinding higher into a known resistance zone. Holding above 345 keeps the trend constructive, but upside into 355 is likely to encounter supply. New exposure is better sized on pullbacks rather than momentum entries at current levels.

Taiwan Semiconductor Manufacturing TSM 4.90%↑

TSM is digesting just below recent highs following a clean impulsive leg higher. The trend remains intact as long as price holds above 323–320, with continuation favored on a firm acceptance back through 330. Until then, this is a consolidation, not a breakout.

ASML Holding ASML 5.73%↑

ASML remains in strong trend continuation, with only shallow pauses following the recent breakout. Risk remains well-defined as long as price holds above 1,175-1,150, where the rising EMA structure sits. Strength above that zone favors continuation rather than mean reversion.

Applied Materials AMAT 2.97%↑

AMAT continues to trend higher, but momentum is beginning to cool near local highs. The cleaner setup remains a pullback entry toward 268–265, where prior demand and trend support align. Chasing strength here reduces asymmetry.

Lam Research LRCX 6.58%↑

LRCX is maintaining a clean higher-high, higher-low structure after its recent breakout. As long as price holds above 184-185, the trend favors continuation. Pullbacks into that zone remain the preferred way to manage exposure.

Intel INTC 8.46%↑

INTC has successfully repaired structure and pushed back into trend. Holding above 39.5-40 keeps the setup constructive, but upside is becoming increasingly momentum-dependent. Fresh exposure is better considered on pullbacks rather than extensions.

Samsung Electronics

Samsung remains extended after clearing all previously outlined targets and is now consolidating at elevated levels. This is no longer an add zone, but a digestion phase. The structure stays constructive, with better re-entry odds likely on a pullback into the rising trend base.

AI, Software & Emerging Tech

Palantir PLTR -4.36%↓

PLTR is stabilising after a sharp impulse selloff, with price now consolidating just above short-term EMAs. Momentum is improving, but this remains a repair phase, not a momentum breakout. New exposure only makes sense on a clean reclaim and hold above 175–177; failure to hold 172 would keep this choppy and range-bound.

Nebius NBIS 7.26%↑

NBIS continues to act constructively, holding above rising EMAs and pressing into prior resistance. The structure remains trend-positive, but near-term RSI is elevated, favouring patience over chasing. Preferred approach is buying controlled pullbacks toward 90–91, with trend risk increasing only on a loss of 88–89.

CoreWeave CRWV 11.58%↑

CRWV has failed to sustain its breakout and has rolled back below key short-term EMAs, shifting the structure from momentum continuation to corrective consolidation. Former support near 78–80 is now resistance, and any bounce should be treated as reactive unless price can reclaim and hold that zone on a closing basis. Until then, downside stabilization takes priority, with 75–76 acting as the next area to watch for demand and structure repair.

Industrials & Aerospace

Redwire RDW 15.91%↑

RDW remains in an intact uptrend, but price has begun to compress around the 20–50 short term EMA cluster, signaling short-term digestion rather than acceleration. Momentum has softened without breaking structure, keeping the trend constructive for existing holders. New exposure is best considered on continued consolidation or shallow pullbacks toward 9.80–10.00, not on short-term strength. Thesis is more intact than ever.

AST SpaceMobile ASTS 10.03%↑

ASTS saw a strong momentum expansion, followed by a controlled consolidation above key moving averages. The trend remains intact, but volatility suggests discipline is required. Pullbacks toward 79–80 are constructive, while sustained acceptance below 77 would weaken the structure and pause the bullish thesis.

Healthcare & Biotech

Eli Lilly LLY -0.37%↓

LLY continues to chop sideways after the recent volatility spike, with price compressing around the mid-EMAs. This is a stabilisation phase, not a breakout setup. Long exposure improves only on a decisive reclaim above 1,075–1,080, while failure to hold 1,065 keeps this a wait-and-see name.

Novo Nordisk NVO 3.52%↑

NVO remains one of the cleanest trends in the group, accelerating after resolving higher from consolidation. Momentum is strong, but RSI is stretched short term. Existing positions can be held, while new exposure is best approached on pullbacks toward 52–53, rather than chasing vertical extensions.

UnitedHealth Group UNH 1.27%↑

UNH has rebounded sharply but is now consolidating below recent highs, with momentum flattening. This is constructive digestion rather than distribution. Acceptance above 336–338 would re-open upside, while a loss of 332 would suggest further range trading before the next directional move.

Oscar Health OSCR 6.85%↑

OSCR remains in a constructive medium-term uptrend, but momentum has clearly cooled as price pulls back toward the 50–100 MA zone. This looks more like post-breakout digestion than structural damage, though upside acceleration has paused for now. The 16.30–16.50 area is key near-term support. A clean reclaim of 16.80–17.00 would be needed to re-engage upside momentum, while a sustained loss of 16.20 would open the door to a deeper consolidation phase. Short-term extensions argue for patience. Pullbacks toward 15.5–16 are preferred, with trend risk increasing only below 14.80.

Inspiration Healthcare (IHC LN)

IHC remains technically weak, trading below declining long-term averages with only early signs of basing. While downside momentum has slowed, this is still a recovery watch, not a confirmed reversal. A reclaim of 16.0–16.5 is needed to improve confidence; below that, risk remains elevated.

Retail & E-commerce

Nike NKE -1.03%↓

NKE has resolved higher from consolidation and is now breaking out above the upper range, reclaiming all short-term EMAs in the process. Momentum has picked up meaningfully, but RSI is stretched near term, so chasing strength carries risk. Existing positions can be held, while new exposure is best aligned on pullbacks toward 63.3–63.5, with the breakout thesis weakening on sustained acceptance back below 62.8.

Lululemon LULU 0.70%↑

LULU has triggered a clean breakout from a multi-day base, with price accelerating sharply above resistance and momentum confirming the move. This is a constructive trend shift, but the immediate extension argues for patience after the initial thrust. Pullbacks toward the 211–213 area are preferred for entries, while holding above 210 keeps the upside structure intact.

Amazon AMZN -1.69%↓

AMZN is recovering strongly after the sharp selloff, reclaiming key EMAs and pushing back toward prior resistance. Momentum has flipped positive, but the move is now testing a key decision zone rather than offering clean risk-reward. Acceptance above 233–234 would confirm a full breakout, while pullbacks toward 228–229 remain the more attractive way to express bullish exposure.

Pinterest PINS 2.52%↑

PINS has broken higher and is consolidating above its prior range, with price holding above rising short-term averages. Momentum has cooled slightly, which is healthy after the recent push. Holding above 26.4–26.5 keeps the setup constructive, while a failure to hold 26.0 would suggest a return to range-bound trading rather than trend continuation. Upside building toward 29 first, then 32 on sustained acceptance. This remains a positioning phase, not a breakout.

Metals & Commodity ETFs

Global X Copper Miners ETF COPX 0.00%↑

COPX has resumed upside momentum after successfully holding the mid-70s support zone and reclaiming its short-term EMAs. The structure now favors continuation rather than mean reversion, but RSI is elevated, suggesting near-term digestion is likely. Pullbacks toward 73.5–74.0 remain the preferred entry, while a sustained hold above 75.5 keeps the path open toward the high-70s; loss of 71.5 would invalidate the breakout structure.

abrdn Physical Palladium Shares ETF PALL 0.00%↑

PALL continues to grind higher after reclaiming key moving averages, transitioning from repair into early trend continuation. Momentum is improving steadily rather than explosively, which favors controlled positioning. Pullbacks into the 150–152 zone remain attractive, while acceptance above 156–158 would confirm momentum continuation toward the mid-160s; structural risk only increases below 148.

Rhodium ETF $XRH0

XRHO remains one of the strongest commodity structures on the board, holding well above all major EMAs after a powerful impulse higher. Momentum is elevated, so this is no longer a chase setup. Best risk-reward sits on pullbacks toward 1,030–1,050, with secondary support near 870–900. As long as 810 holds, the broader trend remains firmly bullish with higher targets still valid.

SPDR Gold Trust GLD 0.00%↑

GLD continues to consolidate constructively after breaking out of its base, holding above rising EMAs and prior resistance. The structure favors continuation, but price is now in a decision zone rather than an entry chase. Pullbacks toward 403–405 remain buyable, while acceptance above 410–412 would reopen upside toward 420–425; a sustained break below 398–400 would force reassessment.

iShares Silver Trust SLV 0.00%↑

SLV has resumed its uptrend after a clean higher-low, with momentum rebuilding above short-term averages. This is constructive, but similar to gold, short-term extension argues for patience. Preferred exposure comes on pullbacks toward 67–68, while sustained strength above 70–71 keeps higher targets in play; a loss of 64 would signal a deeper corrective phase.

Crypto & Digital Asset ETFs

iShares Ethereum Trust ETHA 0.00%↑

ETHA has shifted decisively into a momentum regime, reclaiming all key EMAs and holding higher lows. While upside structure is intact, momentum has cooled slightly, which is healthy after the recent impulse. Pullbacks into 23.4–23.7 are preferred for new exposure, while acceptance above 24.0 keeps continuation in play; structural risk rises on a daily close below 22.9–23.0.

XRP ETF XRPI 0.00%↑

XRPI has broken out aggressively from its base, with price accelerating above resistance and momentum expanding rapidly. This is now a confirmed trend move, but near-term extension limits upside chasing. Pullbacks toward 12.5 offer the cleaner entry, while holding above 11.5 keeps the trend intact. Sustained period below 11.0 would mark a false breakout and warrant stepping aside.

Conclusion

The coming sessions are about follow-through and validation. Breakouts need to hold.

Strong structures should consolidate above former resistance, while weaker setups will reveal themselves quickly. Pullbacks into defined demand zones remain the cleanest opportunities, but only when support holds on a closing basis.

If momentum expands, we lean into strength selectively. If price stalls or fades, patience becomes the position. This is not a phase that rewards anticipation or forced exposure. The edge here comes from reacting well, not reacting fast.

Bottom Line

This remains a selective, execution-driven environment. The best opportunities are emerging where price respects structure and momentum confirms. Capital preservation matters just as much as participation, and in many cases, waiting is the highest-quality decision.

Respect the levels. Size risk deliberately. Let price do the work.

That’s how consistency compounds over time.

A final reminder: patience matters. This is not a market that rewards haste or overconfidence. Discipline in execution, position sizing, and diversification is what protects capital and compounds returns across cycles.

For deeper breakdowns, full technical context, and the complete trade plan, refer to the dedicated post for each respective stock.

This content is for educational purposes only and does not constitute investment advice or a recommendation or solicitation to buy or sell any security.

More from IWP: