Positioning After the AI Reset: Where the AI Leaders Stand Now

How to think about risk, levels, and patience from here.

At the end of November, we framed NVIDIA NVDA 0.00%↑, AMD AMD 0.00%↑, and Broadcom AVGO 0.00%↑ as three different ways to express the same structural theme: AI-driven compute demand. Since then, price action has cooled, expectations have adjusted, and Broadcom has reported earnings.

This is not a new thesis. It is an update.

The market has moved from momentum to digestion. That shift changes how, and when, these stocks should be approached.

Key Takeaways

The long-term AI compute thesis remains intact across all 3 names.

NVDA is consolidating leadership, not losing it.

AMD offers higher asymmetry but still requires confirmation.

AVGO reset expectations after earnings, without breaking the business.

This is now a market for patience, levels, and discipline.

Pipeline, backlog, and what changed recently

Across all 3 companies, demand visibility remains strong, but the market has become more selective about how that demand translates into margins and cash flow.

NVIDIA continues to benefit from unmatched platform depth across hardware, software, and ecosystem adoption. Order visibility remains high, but incremental upside now depends more on execution than surprise demand.

AMD’s pipeline is improving, particularly in data center compute, but investor confidence is still being earned. The question is not demand existence, but how durable and repeatable that demand becomes across customers and cycles.

Broadcom’s latest earnings clarified something important. AI exposure is real, but revenue is increasingly bundled, customer concentration is high, and incremental growth is not as margin-accretive as earlier optimism suggested. Expectations adjusted accordingly.

Fundamental analysis

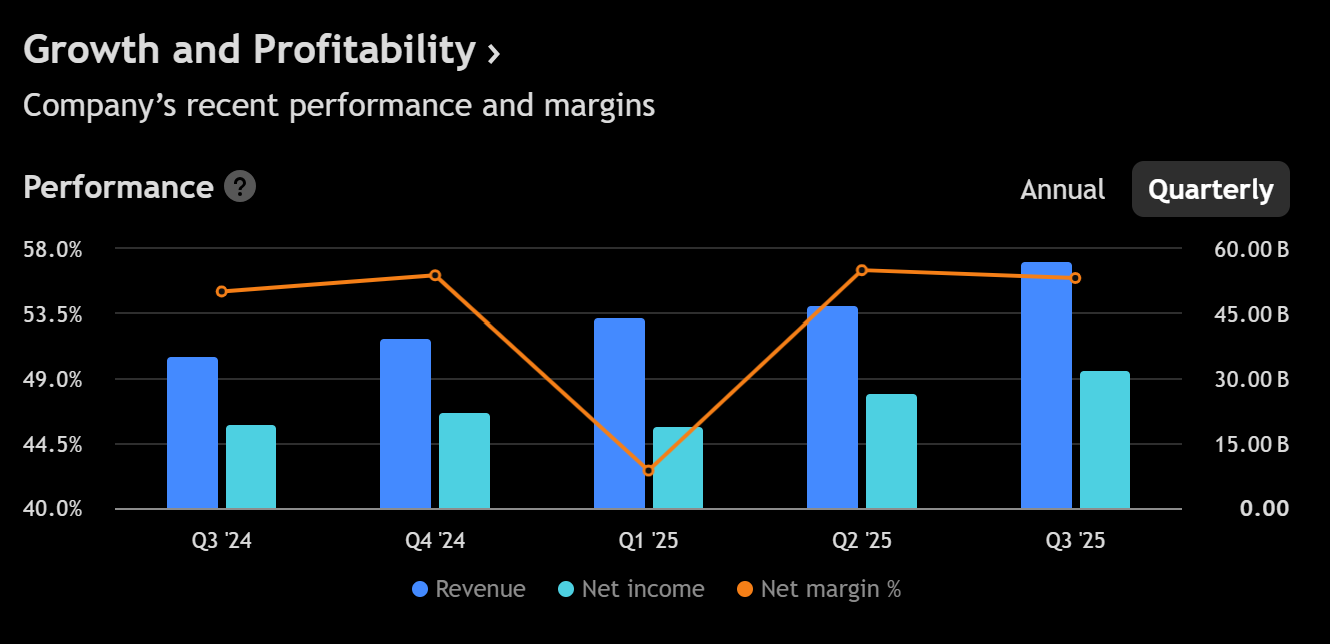

NVIDIA

Revenue growth remains exceptional, with data center driving the majority of incremental dollars.

Gross margins remain elevated above 70%, even after normalization.

Free cash flow generation continues to scale alongside revenue.

Valuation already prices in sustained dominance, not just leadership.

NVIDIA is still compounding at a rare scale, but the bar for upside surprises is high. This is a quality compounder, not a momentum trade.

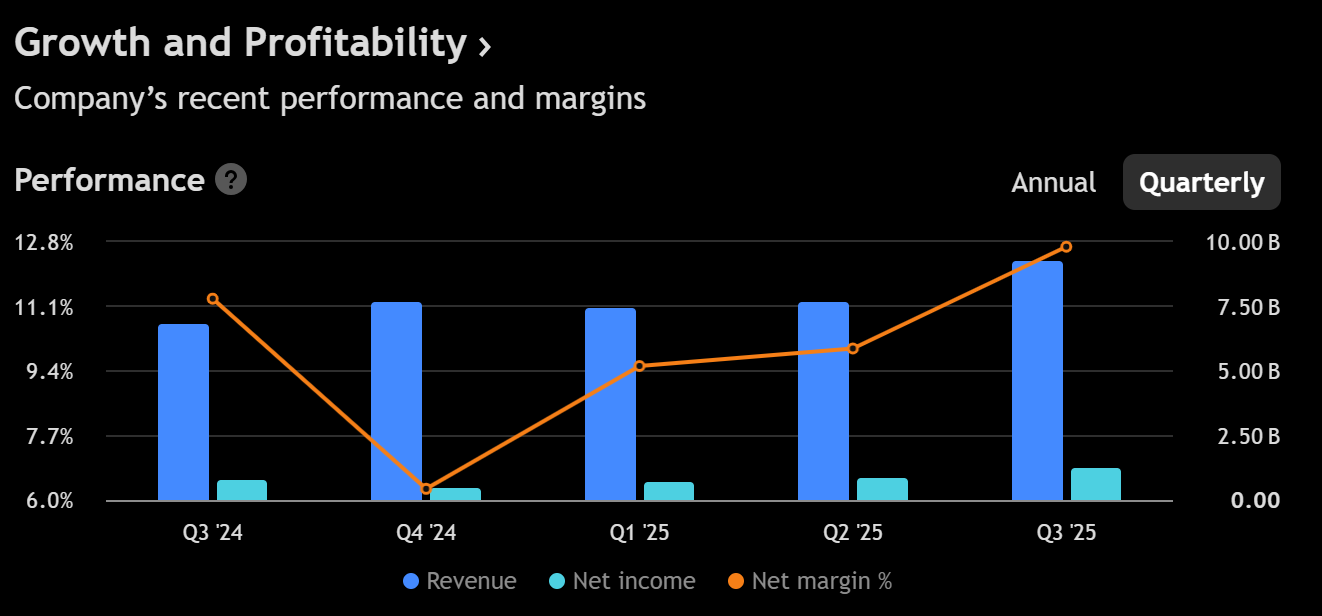

AMD

TTM revenue is roughly $32B, with latest quarterly growth above 35% YoY.

Gross margins have moved back into the mid-50% range.

Operating margins remain in the mid-teens, improving but still sensitive to mix.

Free cash flow is strong, supported by a capital-light model and net cash balance sheet.

AMD’s fundamentals are improving, but the market needs proof that data center growth can scale without margin volatility or policy disruptions.

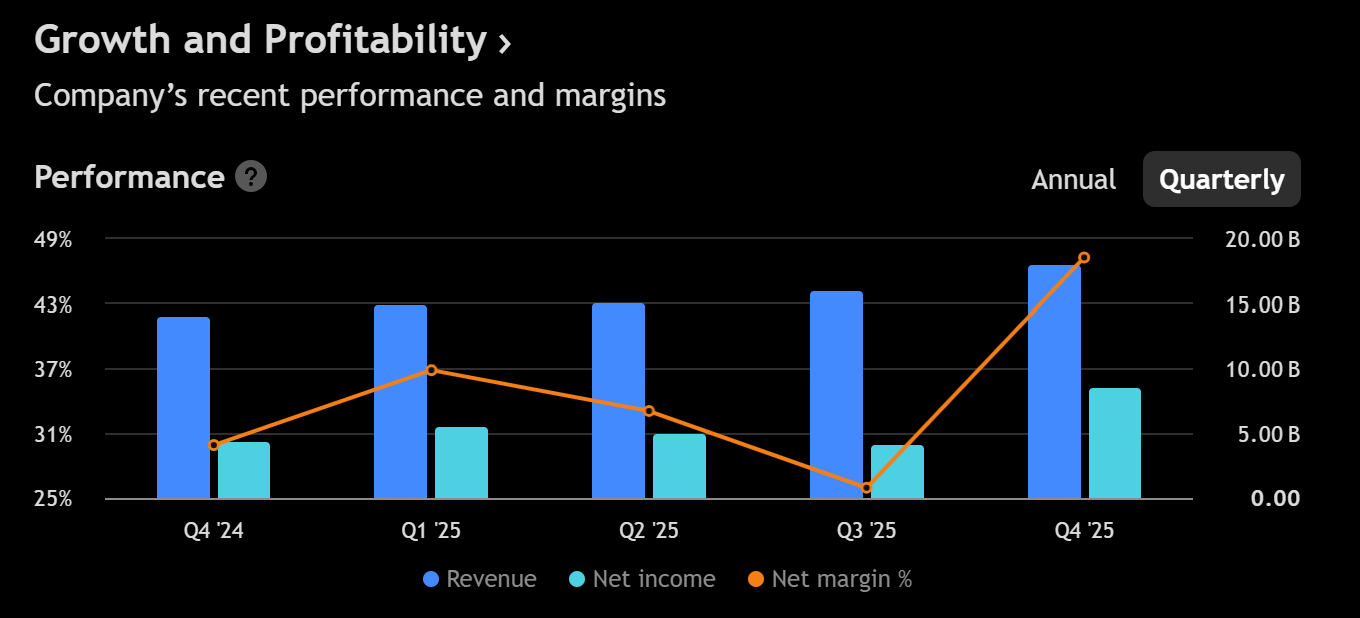

Broadcom

Revenue growth remains solid, but AI-driven growth is increasingly system-level.

Gross margins remain strong, but incremental margin expansion is moderating.

Free cash flow remains the anchor, supporting buybacks and capital returns.

Customer concentration and mix complexity are now fully priced in.

Broadcom is still a cash flow machine, but expectations have reset to match reality.

Our below post covers Broadcom’s latest earnings. For full read, just click.

Fundamental conclusion: None of these businesses broke. What changed was how much perfection the market was pricing in.

Technical analysis

What price, trend, and momentum are actually saying

NVIDIA

NVDA remains in a primary uptrend, but the stock is no longer in expansion mode. The market is digesting gains.

Price is holding above the rising long-term trend base, which keeps the structural trend intact.

The short-term EMA cluster has flattened, signaling momentum cooling, not reversal.

RSI has reset from overbought toward neutral, a healthy condition for trend continuation.

Volatility has compressed, suggesting the next move will be directional once key levels break.

Key levels:

172 to 175: Structural support where buyers previously defended trend continuation.

166 to 168: Higher-timeframe demand zone aligned with long-term trend support.

181 to 183: Momentum pivot. Acceptance above this level signals trend re-acceleration.

187 to 189: Upper resistance where rallies have stalled.

NVDA is consolidating strength. The trend remains valid unless long-term support fails.

AMD

AMD is in a corrective phase within a broader uptrend, with momentum still rebuilding.

Price is below short-term moving averages, indicating tactical weakness.

Medium-term trend support remains intact, keeping the larger structure constructive.

RSI is neutral to slightly weak, consistent with consolidation rather than breakdown.

Momentum needs confirmation through reclaim levels before upside conviction improves.

Key levels:

206 to 202: First retracement support where buyers must step in to sustain the structure.

194: Critical base. A loss here breaks the corrective thesis.

219 to 221: Momentum reclaim zone. Acceptance signals trend stabilization.

226: Structural pivot. Clearing this level opens higher extension paths.

Interpretation: AMD offers asymmetry, but price must either hold support or reclaim momentum to justify exposure.

Broadcom

AVGO is consolidating after earnings within a well-defined range.

Primary trend: Still bullish on higher timeframes. Price has pulled back into the core trend zone but has not broken it.

Momentum: Short-term momentum is weak after earnings, with RSI in the mid-40s to low-50s area, consistent with a corrective phase, not a trend reversal.

Trend structure:

Key dynamic support sits in the $362–$367 zone. This is where healthy pullbacks tend to stabilize.

The deeper trend floor lies at $338–$339. A break below this level would materially weaken the structure.

Volatility: Elevated after earnings, which increases the odds of overshoots but also improves risk-reward for patient entries.

Overhead supply:

$385–$390 is the first major resistance band.

A clean reclaim of $403–$407 would signal trend repair and renewed upside momentum.

This is a pullback within an uptrend, not a confirmed breakdown. The setup favors patience and level-based execution rather than chasing rebounds.

Technical conclusion: All 3 stocks remain structurally intact, but none are in momentum expansion.

This is a market where levels, trend integrity, and momentum confirmation matter more than speed.

Our Trade plan

Simple, structured, and patient

NVIDIA

Pullback entries: 172 to 175, deeper at 166 to 168. These zones represent defended trend support.

Breakout entry: Acceptance above 183 confirms momentum rotation.

Invalidation: Below 163.5. A loss of the long-term floor breaks the thesis.

Targets:

Short term: 181 to 183.

Medium term: 187 to 189.

Long term: 195 to 205.

Rolling stop: Raise to breakeven after the first target, then trail under higher lows as structure confirms.

AMD

Pullback entries: 206 to 202, with higher conviction near 194.

Breakout entry: Acceptance above 219, stronger confirmation above 226.

Invalidation: Below 194. This breaks the corrective base.

Targets:

Short term: 213 to 219.

Medium term: 226 to 235.

Long term: 259.

Rolling stop: Raise stops only after support is reclaimed and held.

Broadcom

Preferred entry zones

$355–$365 (primary entry zone) This is the heart of the rising trend support. Price is already here. Buyers stepping in above this zone are defending the structure.

$338–$345 (secondary entry, deeper pullback) This aligns with the next major structural support. Better risk-reward, but not guaranteed to be reached.

Above $385 (momentum re-entry) A reclaim of this level signals that selling pressure has been absorbed and upside momentum is restarting.

Stop loss Below $328 This level marks a structural failure of the medium-term trend. A sustained move below it invalidates the bullish setup.

Targets

$376–$381 First rebound target. Mean reversion toward short-term trend levels.

$385–$390 Key resistance and supply zone. Expect hesitation or partial profit-taking.

$403–$407 Prior highs. A break and hold above this level confirms trend continuation.

$415–$425 Medium-term upside zone if momentum fully resets.

$460–$480 (longer-term extension) Trend extension area if the broader uptrend resumes.

Rolling stop logic

Above $381 → raise stop to $350–$355 Confirms higher low behavior.

Above $390 → raise stop to $365–$370 Signals trend repair.

Above $407 → trail stop below $376–$381 Locks in gains while allowing upside continuation.

Position sizing

Risk is defined by the distance between entry and invalidation. Wider stops require smaller size. Tighter, confirmed setups allow larger size within the same risk budget.

Bottom line

This is no longer a momentum market for AI leaders. It is a discipline market.

NVIDIA remains the highest-quality compounder, but patience is required.

AMD offers asymmetry, but only if support holds or strength is proven.

Broadcom remains attractive, but selectivity matters more than enthusiasm.

The most important rule now is simple: respect levels, not narratives.

This content is for educational purposes only and isn’t investment advice or a recommendation to buy or sell any security.

Excellent analysis! I appreciate the clear distinction between NVDA's entrenched position and AMD's 'requires confirmation' status. What if, despite AMD's improving pipeline, the network effects and established developer ecosystem around NVIDIA's CUDA prove to be an even stickier long-term moat than current expectations suggest, especialy in a market for patience?